Dev Ashish

People set themselves different financial goals. And financial goals have their own risk profiles that are based on the type of the target, its time horizon and the risk profile of the investor himself.

So how should you as an investor go about deciding the equity exposure for different goals?

In other words, what should the asset allocation for your goal-based investments be?

Timelines and importance of goals

The very first step is to identify the goal’s time horizon. People divide goals as being short-, medium- and long-term in nature. But to make the assessment more precise, it’s better to have a few more classifications. For example:

Now try to plot your goal in the grid below using the points mentioned above.

Segregate your goals

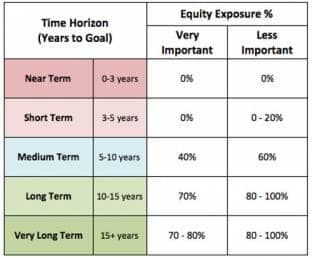

Now, depending on where a goal is placed in the above grid, you need to decide the equity exposure for the goal.

Here is a sample equity exposure for a ‘balanced to moderately aggressive’ Investor.

Longer the horizon, higher the equity exposure

There is no perfect formula to decide on the right equity exposure for different goals. But it’s better to avoid equities for short-term financial targets. Also, embrace equity for long-term goals. Medium- and intermediate-term goals can be dealt with by taking a balanced approach.

Also, an investor himself may have a conservative or balanced or aggressive risk appetite. So this profile too will have an impact on what proportion of equity exposure should be chosen for his goals.

For example:

Re-balance portfolio constantly

Merely deciding on the percentage of equity exposure for your goals is not enough.

As the years pass by, you have to ensure that the proportion of equity in your portfolio is relevant for the period remaining to achieve your goal.

A goal that began as a long term financial target will (after a few years) become a medium-term goal and, eventually, a short term goal. So, the investments need to be re-balanced to reflect the risk that is more suitable for the shorter remaining periods.

For example: Let’s say you start with saving for your child’s education due after 17 years. And you start with equity funds alone. After 4-5 years of equity accumulation and when about 12 years are left, gradual rebalancing of the existing corpus should begin and be done every year. Now, when only a few years are left (i.e. in the 12-13th year), you need to start reducing the proportion of equity gradually or tactically, so that by the end of the 15th or 16th year, you have a minimal or no equity component at all. You need to de-risk the goal portfolio progressively.

This is the reason why a regular review should be done once you start saving for your goals.

You can create separate portfolios for different goals as it helps in easy monitoring. Or if the number of goals is high, then similar goals (having similar risk profile or timelines) can be clubbed and handled accordingly.

(The writer is the founder of StableInvestor.com)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!