When markets started going down, I came across several investors who were worried and asking whether it made sense to stop their mutual fund SIPs.

Their concern is valid, no doubt. After all, who likes seeing their investments go down.

But it is somewhat strange that they are more concerned about whether to start or stop their SIPs and less about what they have already accumulated. In almost all cases, the latter would be a much bigger amount.

Worrying about the next SIP installment is fine for small investors or who have just started investing recently. But for those who have been investing for years, it makes sense to pay proper attention to risk management of their existing portfolios.

If you aren’t sure why this is necessary, then let’s take a small hypothetical example.

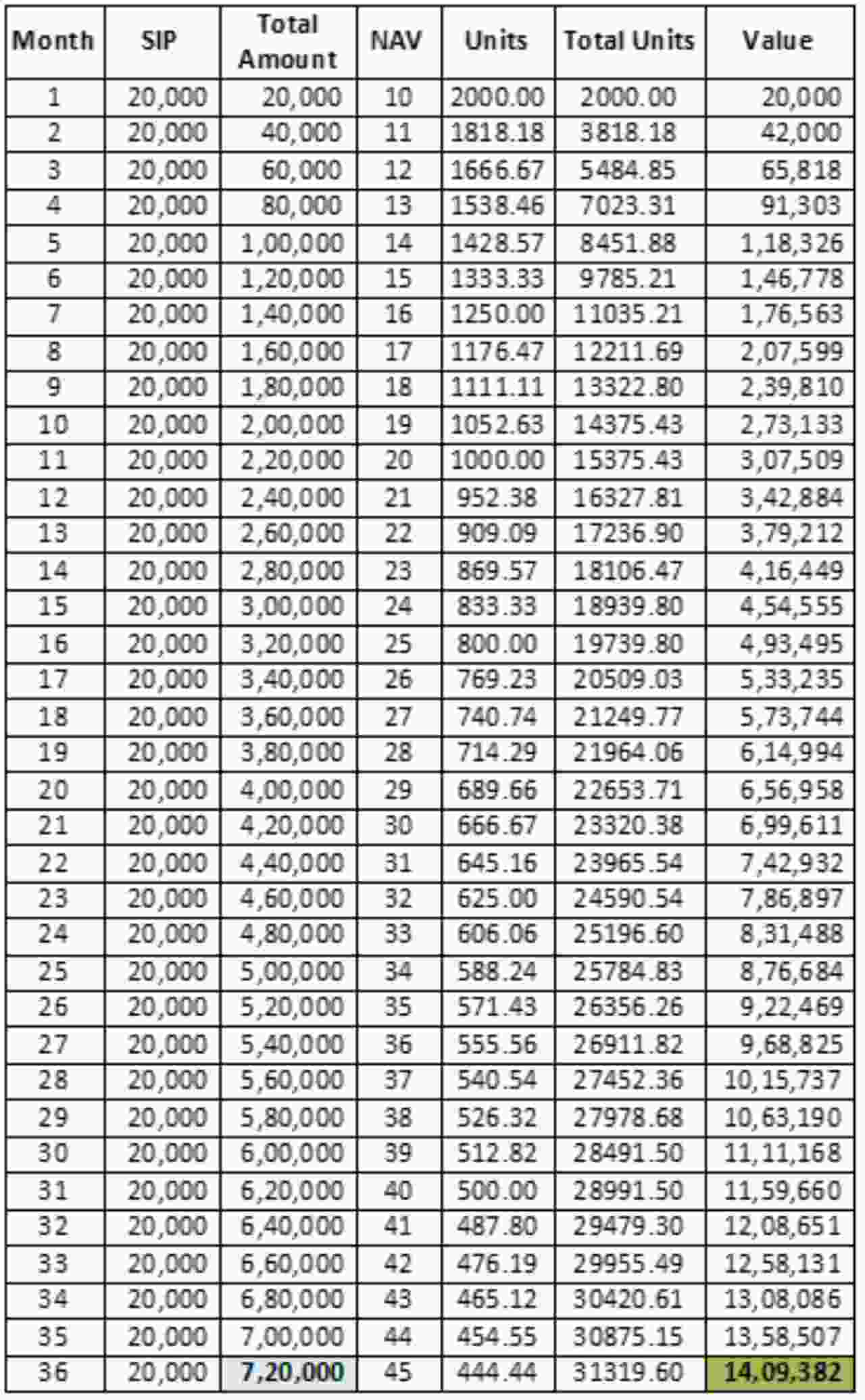

Suppose you plan to invest Rs 20,000 monthly via SIP in equity mutual funds for the long term. If you do this, you will be investing Rs 2.4 lakh (12 months X Rs 20,000) every year.

Now markets do well for 3 consecutive years after you begin investing.

In these 3 years that follow, you would have invested Rs 7.2 lakh (36 months x Rs 20,000 per month). And the value of your investments would have become Rs 14.1 lakh as shown in the table below:

That’s a good run of 3 years for your investments. Rs 7.2 lakh turning into Rs 14.1 lakh - almost double in 3 years!

But markets don’t go up in a straight line for very long (remember this is a hypothetical example).

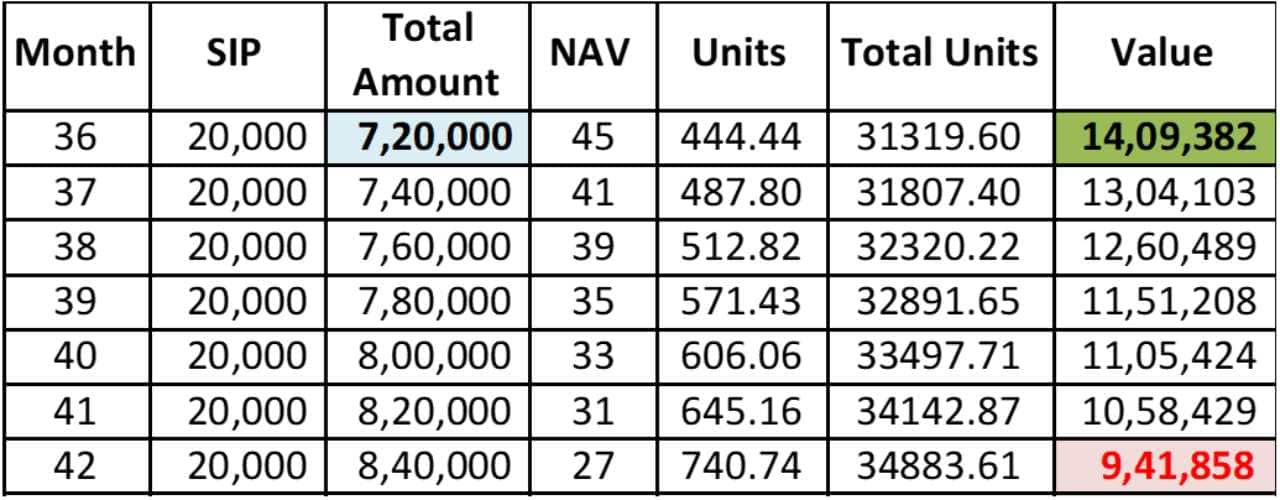

So in the next 6 months, markets hit a rough patch and start going down.

As a result, the NAV of the fund you are investing in, also goes down:

Between month 36 and 42 of the investment journey, chances are that like many others you would be worried whether to stop your SIP or not as the market is not doing well.

But did you notice something else?

The value of your investment has gone down from a peak of Rs 14.1 lakh to Rs 9.4 lakh.

This drop in the value of existing corpus is more worrisome than worrying about whether to invest the next ‘Rs 20,000’ or not (i.e. to stop the SIP or not).

And this is important to realize here.

Once invested, the full corpus is exposed to the market’s volatility and not just the SIPs. It is for this very reason why managing (risk of) existing corpus is more important than just worrying about what to do next.

Note - How one protects the existing corpus is another matter where one deals with asset allocation, portfolio rebalancing, de-risking tactics, diversification, etc. It requires a detailed writeup in itself.

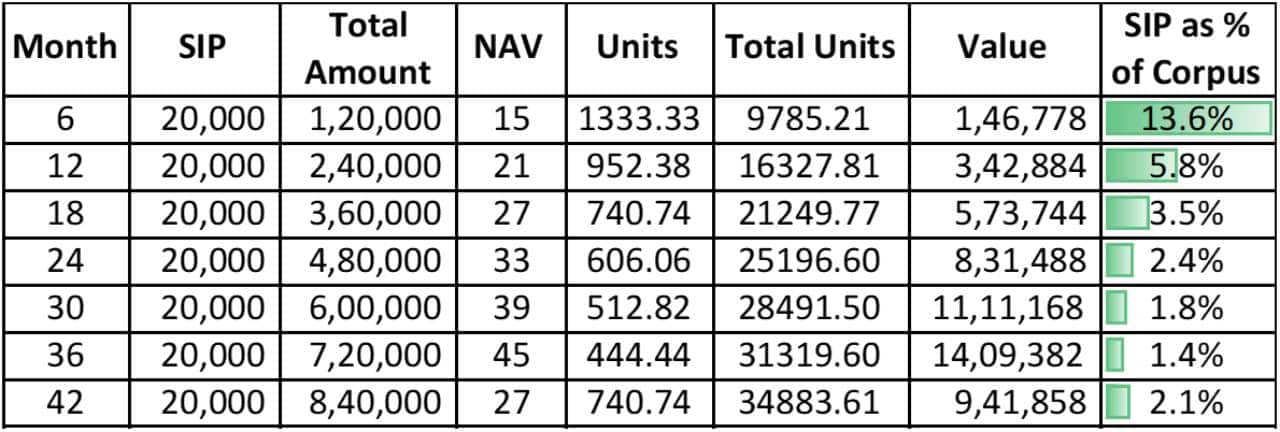

With each passing SIP month, the percentage of the SIP amount compared to the existing corpus keeps on reducing. If you look at the last column of the table below table (showing portfolio at each 6-monthly interval), it clearly shows that the impact of each monthly SIP goes on reducing with passing time:

And this is an analysis of only 3-4 years.

Imagine the ‘negligible impact of one month SIP’ on a corpus that is being saved up for 15-20 years.

Unfortunately, most investors focus only on fresh investments like the ‘next SIP’.

But as you must have realized by now, it is equally important to manage existing corpus as well and not to ignore it. And more so if the corpus is large - to not be impacted by SIP amount itself (meaning SIP being a small percentage of the overall corpus).

To summarize, it’s not enough to just keep doing your SIPs (or worry about whether to start or stop or increase it) in a well-chosen mutual fund portfolio. It is also important to monitor and review your existing portfolio as it grows in size. And if need be, rebalance it with an eye on asset allocation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.