According to a recent study by global TransUnion titled ‘Empowering Credit Inclusion: A Deeper Perspective on Credit Underserved and Unserved Consumers’, over 160 million consumers were considered being credit underserved in India and about 50 percent of India’s population is credit unserved at the end of 2021. Let’s interpret what it means for credit borrowers and financial institutions offering credit to consumers.

Who are credit underserved and unserved consumers?The underserved consumers are those who have some level of current or past borrowing activity on their credit file — they have varying credit history, experience, usage and participation. These consumers have accessed traditional credit products but aren’t using them to the same extent as more credit active counterparts.

The credit unserved consumers do not have any credit history, meaning no credit accounts were ever opened. They are, by definition credit invisible, with no credit data available to analyse by the lenders on the credit bureau.

“Our study helps the market participants better understand how many people are truly underserved from a credit perspective, while also determining paths for them to gain more credit opportunities,” says Rajesh Kumar, MD & CEO of TransUnion CIBIL.

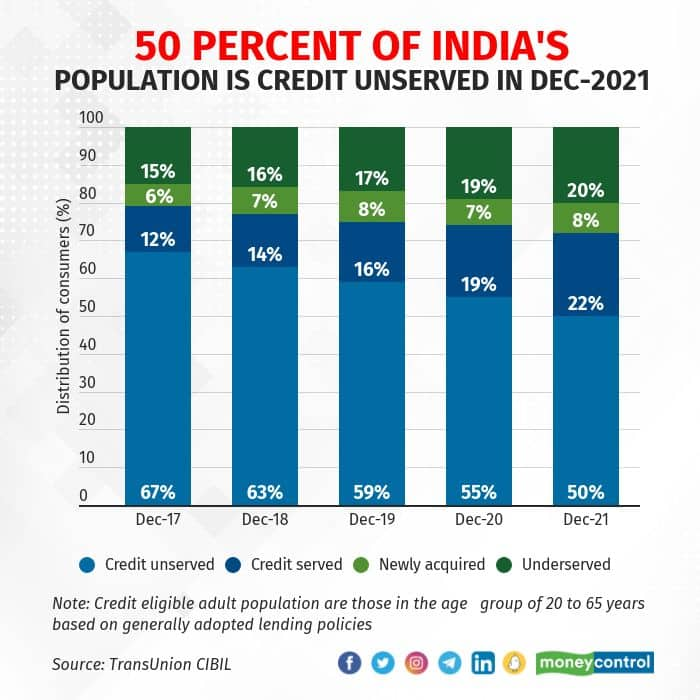

Increased credit inclusion over a four-year periodThe TransUnion CIBIL research showed that there has been a significant increase in credit served consumers, from 91 million in 2017 to 179 million in 2021, raising the estimated credit served levels from 12 percent to 22 percent of the adult population (refer to graphic).

The credit unserved has fallen from 67 percent in December 2017 to 50 percent in December 2021. But, it is still a major element in the overall matrix. The lack of credit score and credit history for unserved consumers is an impediment for getting credit opportunities, as many lenders are hesitant to extend credit to consumers with no credit history or score. These traditionally unscorable consumers face a challenge to get that first credit product because they lack credit history.

“Although India has made great strides in increasing the levels of credit inclusion across the country in recent years, the current reality highlights the importance of incorporating enriched credit data into the lending ecosystem, so that fewer consumers find themselves to be credit unserved,” says Kumar. Once these consumers can be evaluated by financial institutions, lenders can better determine where there might be new opportunities for growth and how they can expand credit inclusion further, he added.

If you are new to credit (NTC), your bank or the credit scoring firm will scrutinise other aspects such as employment history, monthly income, bank account statement, social media accounts, etc. to get to know you better.

Avoid loans, as far as possible. Two-wheeler or personal loans are best avoided. If you can afford the two-wheeler from your own earnings, it would be good to do so. A personal loan is expensive.

Having a credit card is one of the simplest ways to building a good credit profile. Some banks allow you to apply for a credit card against your fixed deposits. “Build a credit history over a period, and then apply for a home or auto loan,” says Gaurav Gupta, Founder, Myloancare.in. He says that large lenders charge higher interest rates on loan products from NTC consumers. So, it’s important to build credit history and have a good credit score.

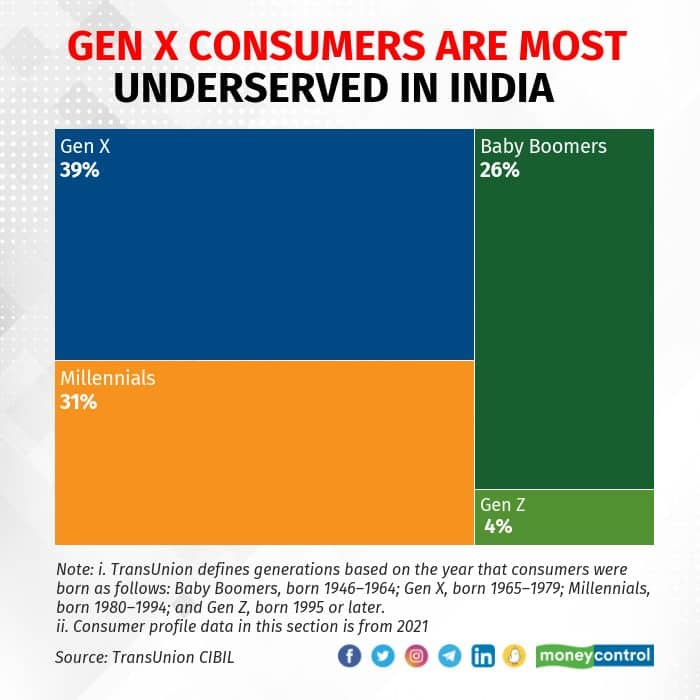

The underserved, beyond the numbersAccording to the study, the underserved consumers seem to be younger consumers, based on the higher percentage of millennials (refer to graphic). The credit cards and instalment-based credit schemes such as Buy-now, Pay-later (BNPL) are the most commonly used.

Financial institutions traditionally offer high-interest-rate loan products to higher-risk consumers and it’s the most common reason the underserved is refused a credit offer. For these consumers, education around credit products and offers may not be the reason for their lack of participation in the credit marketplace — but the reason would be the structure and pricing of the products they’re offered. This implies an opportunity for lenders to better target creditworthy underserved consumers through strategies such as bifurcated pricing, lower interest rates or leveraging alternative credit data sources to better assess their risk.

“The high-risk profile of these underserved consumers requires greater due diligence in properly balancing growth and risk, as traditional credit scoring models have limitations in identifying potentially good-performing, underserved consumers because of their limited credit data,” says a retail banker requesting anonymity.

Do not end up borrowing recklesslyThere are fintech lenders increasingly targeting millennials, low-income, digitally-savvy customers who have small-ticket and short-term credit needs, and no or limited credit history. The underserved and unserved borrowers should not borrow recklessly from such fintech lenders.

With multiple personal loans and limited income growth, millennials end up in a debt trap. Personal loans are expensive. If you fail to pay even a single EMI on time, your credit score gets impacted. And this affects your credit history for any future borrowing. “Until the defaulting or delinquent borrower settles the overdue amount, it will be difficult to get new credit from formal financial institutions. And even if one secures another loan, it’ll be quite costly because of a poor existing credit score,” says Parijat Garg, personal finance expert.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.