After a volatile week, gold prices in India continued to fall on Thursday, October 23, following one of the sharpest single-day declines in recent years. The correction comes as investors booked profits amid easing US-China trade tensions and ahead of the US Federal Reserve’s rate-cut decision expected later this week.

According to GoodReturns, the price of 24-carat gold in India slipped to Rs 1,25,890 per 10 grams, while 22-carat gold fell to Rs 1,15,400 per 10 grams. The 18-carat gold variant was priced at Rs 94,420 per 10 grams.

The latest dip follows months of steady gains driven by geopolitical risks, trade uncertainty, and strong safe-haven buying. Over the past ten months, especially in the last two, gold has rallied sharply, touching record highs before the current pullback.

Silver prices also cool offThe silver rate in India also declined on Wednesday and remained soft into Thursday’s early trade. Silver stood at Rs 160 per gram or Rs 1,60,000 per kilogram, reflecting profit-booking and lower global cues.

Despite the latest dip, silver has delivered an exceptional 70 percent rally in 2025, fuelled by strong industrial demand, particularly from electric-vehicle and solar-panel manufacturers, and a tightening global supply.

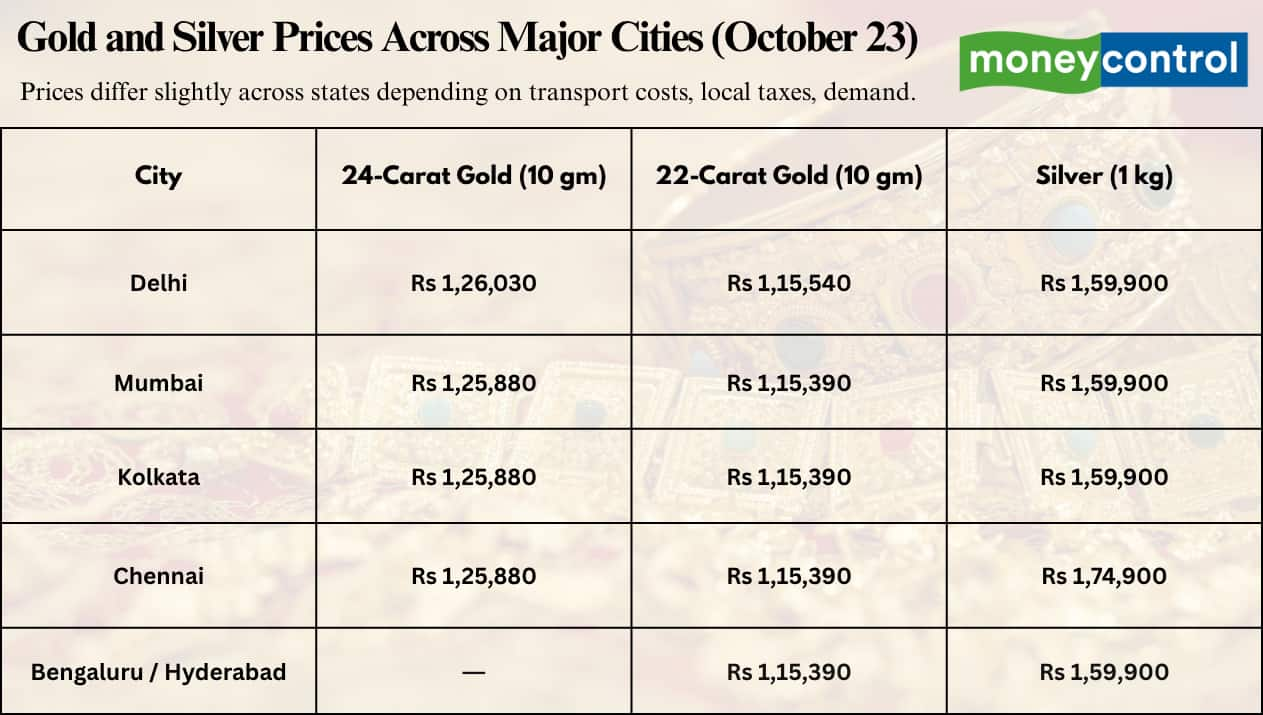

City-wise gold and silver ratesThe price of precious metals continues to vary slightly across regions due to logistics, local taxes, and demand differences.

Gold (per 10 grams)Delhi: 24-carat - Rs 1,26,030 and 22-carat - Rs 1,15,540

Mumbai/Kolkata/ Chennai: 24-carat - Rs 1,25,880 and 22-carat - Rs 1,15,390

Bengaluru/Hyderabad: 22-carat - Rs 1,15,390

Silver (per kilogram)Delhi/ Mumbai/Kolkata: Rs 1,59,900

Chennai: Rs 1,74,900

Global cues: Gold slides, silver steadies

Global cues: Gold slides, silver steadies

Globally, gold prices declined as investors locked in profits after a record-breaking rally. Spot gold fell 0.53 percent to $4,102.09 an ounce, while US gold futures for December delivery inched up 0.4 percent to $4,124.10 per ounce.

The yellow metal remains on track for its strongest year since 1979, up over 50 percent so far in 2025, buoyed by geopolitical tensions and expectations of more US Federal Reserve rate cuts.

Silver showed mixed cues, spot silver edged 0.1 percent higher to $48.82 per ounce, while MCX December futures traded lower at Rs 1,45,751 per kilogram.

What’s driving the declineAnalysts cited by Goodreturns and Reuters attribute the price correction to:

Despite the correction, ETF holdings of gold remain near a three-year high, reflecting persistent investor confidence in the metal as a long-term store of value.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.