Banks and other lenders often rely on your credit score – going by your past repayment record – to decide if your loan application should be accepted or rejected. But what if you have never borrowed or have no credit card till date? Now, if you apply for a loan, how would banks decide if you are a worthy borrower?

TransUnion CIBIL recently launched a new algorithm to assess first-time creditors, or new to credit (NTC) borrowers as they are known in banking parlance. Called CreditVision NTC Score, this will help assess a NTC consumer’s eligibility. “TransUnion CIBIL is a late entrant to this space,” says Kunal Varma, CBO and Co-Founder of MoneyTap. Experian Credit Services, another credit bureau in India, has been offering NTC score for over four years now and financial institutions using their services get an NTC score of the new-to-credit consumer if she is a first-time borrower. Even digital lenders have in-built algorithms to evaluate an NTC consumer’s loan inquiries.

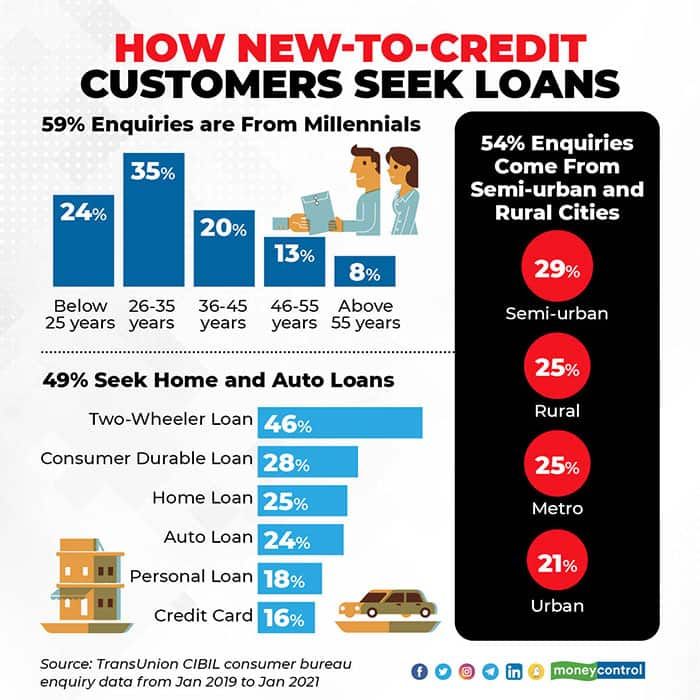

The firm’s thrust comes on the back of the large number of loan inquiries made by NTC customers.

“Overall, nearly 35 percent of loan applications made by NTC customers are approved. However, the approval rates differ based on the loan product asked for,” says Neeraj Dhawan, Managing Director of Experian India. For instance, lower-ticket products such as personal loans, consumer durable loans and two-wheeler loans have higher approval rates in the range of 40-45 percent, according to Experian India.

Where do financial institutions start looking for data if you’ve never taken any credit before? Parijat Garg, a digital lending consultant says that checking your employment details, a physical verification of your residence, as well as your social media activities can provide vital clues to your behaviour.

The CreditVision NTC Score developed by TransUnion CIBIL gives a score of 101-200; a higher value indicate lower credit risk and reduced probability of the borrower defaulting.

Similarly, the Experian NTC score is also built on the performance of a look-alike consumer on the bureau data base and gives the score ranging from 1-10, with 1 implying high credit risk and 10 indicating low credit risk. These scores given by credit bureaus are provided only to financial institutions for credit risk assessment of NTC consumers.

Some experts say that relying on just these scores for NTC customers is just a start. “These scores won’t solve the problem. There are several other risks involved,” says Prithvi Chandrasekhar, President-risk and Analytics at InCred, an NBFC.

NTC consumers lack the experience to handle credit. Some NTC consumers may even over-borrow after they get sanctioned the first loan, use multiple credit cards and revolve outstanding credit, miss on loan instalments, and so on, experts say.

“For NTC customers sourced in 2019, we observed that the default rate was in the range of 5-7 percent as of 2020, where they account for customers who did not pay their loan instalments for more than 90 days after they were due,” says Dhawan of Experian India.

Banks looking at better tools to assess fresh borrowersBanks have increasingly looked at credit firms for better cues to assess new to credit customers. “The credit bureaus have a larger footprint about customer behaviour information and such NTC scorecards developed by bureaus will help financial institutions take credit decisions comfortably,” says Rajanish Prabhu, Country Head - Credit Cards & Merchant Acquisition of Yes Bank.

The NTC market is big. For instance, Kotak Mahindra Bank is expanding in this segment and allowing the bank to serve first-time borrowers such as millennials. “We have developed advanced scorecards that help us understand this segment better. TransUnion’s NTC score is an added scorecard that we will make use of to evaluate consumers,” says Ambuj Chandna, President – Consumer Assets, Kotak Mahindra Bank.

“Our analysis clearly shows that if provided credit opportunities, NTC consumers can prove to be good borrowers and form a profitable customer base for credit institutions,” says Rajesh Kumar, Managing Director and CEO of TransUnion CIBIL.

New to credit? Borrow sensiblyIf you are new to credit, your bank or the credit scoring firm will scrutinise other aspects of your life to get to know you better. This is for your own good, as if you start defaulting at an early age itself, getting a loan later for genuine purposes such as buying a home, would be tougher. Here’s how you can be a disciplined borrower:

Avoid loans, as far as possible. A two-wheeler or a personal loan are best avoided. If you can afford the two-wheeler from your own earnings, it would be good to do so. A personal loan is expensive.

Having a credit card is one of the simplest ways to building a good credit profile. “Build a credit history over a period, and then apply for a home or auto loan,” says Gaurav Gupta, Founder, Myloancare.in. He says that large lenders charge higher interest rates from NTC consumers even for home loans.

Have a plan to avoid debt traps in the beginning of your career itself. The loan you repay every month shouldn’t be more than 40 percent of your take-home salary. “If you are not in a position to repay multiple loans and end up defaulting even in one loan segment, it will affect your credit score,” says VN Kulkarni, Former Banker and financial counsellor.

“You must inform the financial institution proactively in case of financial stress due to the pandemic,” says Anil Pinapala, Founder and CEO of Vivifi India Finance. This will give an option for restructuring of loan instalments instead of defaulting.

Stick to large banks, if you must take a loan. As RBI recently highlighted, it is best to avoid spurious fintech digital lenders.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.