The gilt funds category is at the bottom of the one-year returns list. According to Value Research, gilt schemes with 10-year constant maturity portfolios have given only 1.12 percent returns over the one year ended January 6, 2022. The category did well in the previous two years. Here is a take on what caused the poor performance and whether you should still bet on them.

What is a constant maturity fund?

A constant maturity scheme with 10-year maturity is a passive way of investing in government securities. The fund manager buys government bonds in such a manner that the portfolio has an average maturity of 10 years. While a few schemes buy one government security, others invest in a mix of government securities to make sure the scheme’s average maturity is 10 years. The scheme’s portfolio is not actively managed. The five schemes in this category put together manage Rs 1,421 crore.

This approach works well when interest rates move sideways or downwards. Since the long-term bonds (typically maturing in more than seven years) deliver better yields than their short term counterparts, in a sideways markets these schemes post better returns as the interest receipts are higher. When the interest rates fall these bonds see price appreciation, as more investors flock to them for better yields. Interest rate risk is high for long tenured bonds, and when the interest rates in the economy are cut, the long term bonds do well. For example, 10 year constant maturity schemes gave 12.64 percent and 12.79 percent returns in years 2019 and 2020?. However, things have changed over a period of time.

“Reserve Bank of India had cut interest rates to infuse liquidity in the financial markets in a bid to counter the slowdown caused by lockdowns announced in CY2020. But after the arrival of vaccines and effective vaccination programmes the economy has opened up and the RBI is planning to withdraw liquidity,” says Marzban Irani, Chief Investment Officer, LIC Mutual Fund. The interest rates have bottomed out and they are on the way up, he adds.

The same is getting reflected in the yield movements in the bond market. Since the beginning of CY2021, the yield on 10 year benchmark bond yield has gone up to 6.52 percent from 5.89 percent. And that leads in pulling down of performance of long term bond funds including 10 year constant maturity funds. “When the interest rates go up, unlike other actively managed funds, the constant maturity scheme cannot reduce the average maturity of the portfolio. That leads to marked to market losses and the scheme’s returns come down,” explains Rajeev Radhakrishnan, CIO-Fixed Income, SBI Mutual Fund.

The scheme is best positioned to benefit when interest rates fall or in a softer rate scenario, he adds.

A rocky path ahead, when rates go up

For time being we are looking at a possible increase in interest rates. “RBI will first reduce the excess liquidity in the financial markets and is unlikely to move the repo term in the near term. We expect repo rate hikes to be on the table only in the second half of CY2022,” says Radhakrishnan. He expects the 10 year benchmark g-sec to trade above 6.75 percent by end of the year.

Though the quantum of upward movement in yields is dependent on various factors, most experts are of the opinion that the yields are going to inch upward. Joydeep Sen, Corporate Trainer-Debt, expects 10 year benchmark G-sec yield to move up by 50 basis points in 2022.

If the current yield is 6.5 percent and the scheme has an expense ratio of 50 basis points, then the net yield is 6 percent. If the modified duration of the portfolio is 6.5 years, then a 50 basis points upward movement in yields will give a loss of 3.25 percent (a one percentage point hike in the interest rates leads to a fall of 6.5 percent in the scheme’s net asset value). When we deduct this 3.25 percent from the net yield of 6 percent, we will be left with 2.75 percent returns, one year from now.

This is just a hypothetical exercise and do not offer any guarantee of returns. Exact quantum of yield movement and the time frame in which it happens will also have a bearing on the returns.

Should you sell and invest elsewhere?

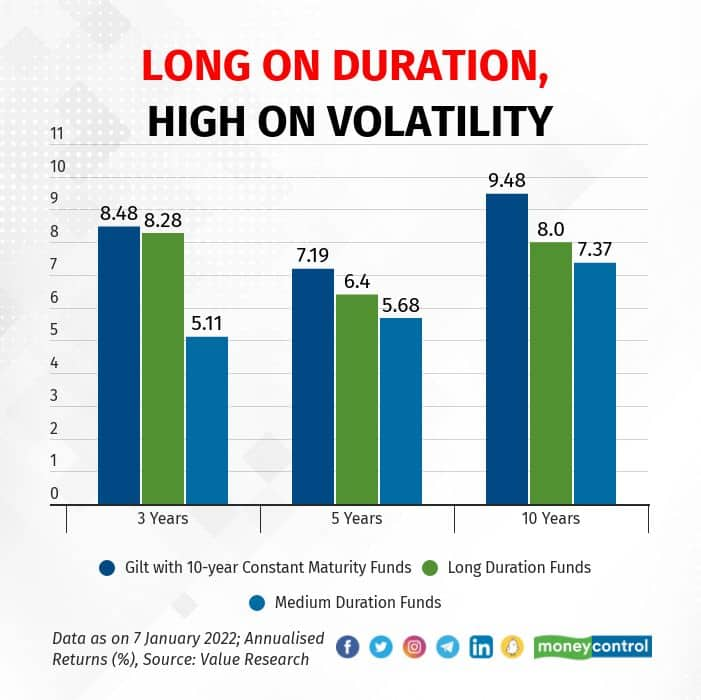

“These schemes will be volatile over the next six to twelve months as the yields go up. If you are a short term investor, you are better off avoiding these,” says Sen. You should consider investment in these schemes if you have a long enough time frame, he adds.

In a rising interest rate regime, these constant maturity schemes are best avoided by conservative investors as they may not have the stomach for the increased volatility. “Most conservative fixed income investors are better off investing in short duration funds with a two to three year view,” says Irani.

Vinod Jain, Founder and Chief Financial Planner of Jain Investment Planners, however, finds long-term government securities attractive. “Though the yields are expected to go up, long-term government securities, including the 10-year g-sec offer attractive risk-adjusted returns for long-term investors,” he says. He points out that as opposed to a 10-year fixed deposit, a 10-year g-sec maturity fund offers better tax-adjusted return; long-term gains tax with indexation benefits.

But investors must sit through the entire interest rate cycle.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.