Momentum investing has its fans, many of whom are quite vocal on social media. But the ground reality is that the idea still has a very small following compared to the overall investing landscape in India.

Nonetheless, their popularity is rising and even AMCs are bitten by the momentum bug.

Till last year, only UTI had a momentum offering. Now, Aditya Birla Sunlife, Motilal Oswal, IDFC, and ICICI have all come up with their momentum products. Unsurprisingly, all are passive funds and based on Nifty200 Momentum 30 index.

On August 19, IDFC Asset Management launched its momentum fund called the IDFC Nifty200 Momentum 30 index fund. Its new fund offer (NFO) ends on August 26.

Fund houses have their reasons for launching schemes — raising funds, being present in a new space, and so on. But do momentum funds make sense for the regular retail investor?

What is momentum investing?

Unlike the prevailing buy-low-sell-high canon, momentum investing takes the opposite approach. It is based on the premise that stocks doing well have momentum and hence, will continue to do well in the near term. So, momentum investing tries to ride this wave (or momentum) of stocks that are doing well and then, jump on to the next wave before the first one slows down.

This sounds good and to many, like the holy grail of investing.

But does it work?

Momentum has caught the attention of investors in recent years. Many momentum strategies have generated returns higher than broader indices. And at times, the outperformance has been significant.

If we look at the Nifty 200 Momentum 30 Index, on which all the Indian momentum funds are based, then the index has outperformed the Nifty 200 since its inception.

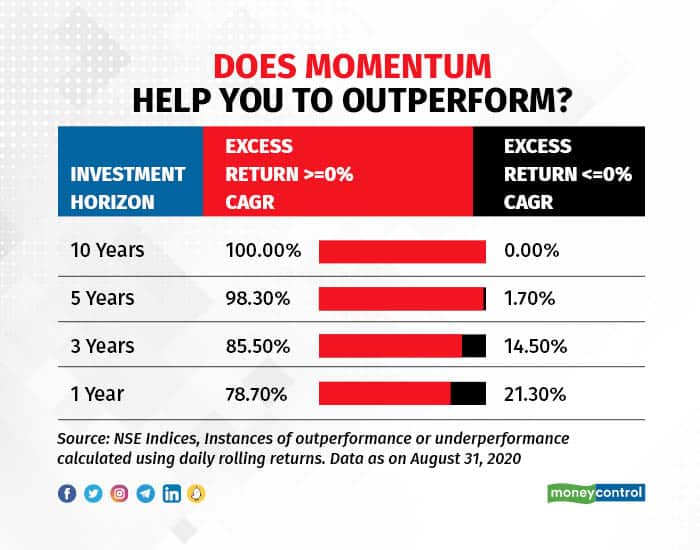

Though a bit dated (and there is still no update on their website), this is what NSE had to say (in 2020) about the index’s outperformance: “The Nifty200 Momentum 30 index has consistently outperformed the Nifty 200 index on a daily rolling return basis over long and short horizons.’’

But before you accept this as the new best strategy to follow, please remember that most of this is back-tested data. And back-testing and reality can be different. So, what we have is more in theory than in practice.

In fact, the oldest mutual fund in the space is just one year old.

And that is something that should be remembered before betting big on this, and on any strategy.

Look under the hood

Let us look under the hood of the momentum index for a bit. The Nifty 200 momentum 30 Index chooses only 30 companies from the top 200 listed on the NSE (a mix of 100 large-cap and 100 mid-cap stocks).

Thus, the index aims for exposure to high-momentum stocks across large and mid-cap stocks from the top 200 companies. From these, it picks 30 with the highest normalised momentum scores.

This exercise is repeated half yearly, and hence, the index goes through a six-monthly rebalancing and churn.

A small sidenote here: a bit of number crunching suggests that a rebalancing frequency of six months is too long for momentum strategies. A weekly or monthly frequency would be more suitable. But to be fair, that will substantially increase the expenses and hence, may not be feasible.

Now, given that the index is generally a mix of large and mid cap stocks, which are churned semi-annually, it will not be wrong to say that the momentum index can often come up with quite a different portfolio compared to those in the regular Nifty 50, Next 50 or Nifty 200 indices.

This can add some tactical diversification to an investor’s existing portfolio comprising common index funds, large-cap funds, flexi-cap funds, etc.

Also given the structural nature and rebalancing, this fund can be quite volatile in the short term. Therefore, it is best for investors willing to accept high volatility on the downside (and not just on the ride up). Also, it is more suitable for those with a long-term horizon of five years or more.

This should not be a substitute for your pure large-cap allocation. You should not try to replace your active large-cap funds, index funds, flexi-cap funds with these new momentum funds.

At best, it may be combined with other regular categories.

How much to Invest?

A few points to help you decide.

• The idea of riding the momentum towards higher profits is indeed promising, but these funds are still new and unproven.

• If you are a conservative saver with a small equity allocation or new to equity, give this category a miss. Keep your investments limited to large-caps, index funds, and flexi-cap funds.

• If you have some appetite for volatility and identify as a sufficiently aggressive investor, then you can combine momentum funds with other categories like active or passive large-cap funds, flexi-caps, mid-caps, etc. This will definitely give you some style and strategy diversification. But limit your overall exposure in momentum funds to 10-20 percent maximum.

• Exposure below 5 percent will anyways not move the needle much. So, even though momentum funds are best as a satellite equity portfolio, there still needs to be meaningful exposure. Otherwise, it just adds to portfolio clutter.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.