The New Year is just around the corner. It’s a good time to review your financial matters. Let’s make some key resolutions for 2022 for a healthy financial life.

Understand the pandemic’s impact and take decisions

A good plan ideally starts off with a past review. “Spend 75 percent of your time in reviewing the pandemic years 2020 and 2021,” says Rishabh Parakh, a chartered accountant and founder of NRP Capitals.

Ask yourself: did your expenses shoot up, did you achieve your financial goals? Assess the impact of the COVID-19 pandemic on your income and expenses. This will help you set realistic financial resolutions that are achievable during the year.

Consolidate your portfolio

Many of us bought a lot of stocks and also cryptocurrencies in the past two years. There were several new fund offers (NFOs) and initial public offerings (IPOs) in 2021. Mrin Agarwal, Financial Educator, Money Mentor and Founder of Finsafe India suggests de-cluttering your portfolio. “Simplify your finances to review your portfolio periodically,” she says, nudging us to sell assets that we do not understand and may have just bought because everyone else around did. And bring down the number of holdings in your portfolio. “A simplified investment portfolio also eases the tax-filing process at the end-of-year,” she says.

“Make a resolution to consult your financial advisor before investing in new thematic offerings from AMCs or over-valued IPOs. Avoid following the herd blindly for quick gains as it’s risky,” says Paddy Raghavan, Co-founder of Multipl.

There are expectations that investing in cryptocurrencies would be regularised in the year 2022. “You should monitor this news development and invest only up to 5 per cent of your overall investment portfolio in cryptocurrencies,” says Parakh. He adds, retail investors should deploy only the amount that they can afford to lose. You must avoid gambling while investing in cryptocurrencies.

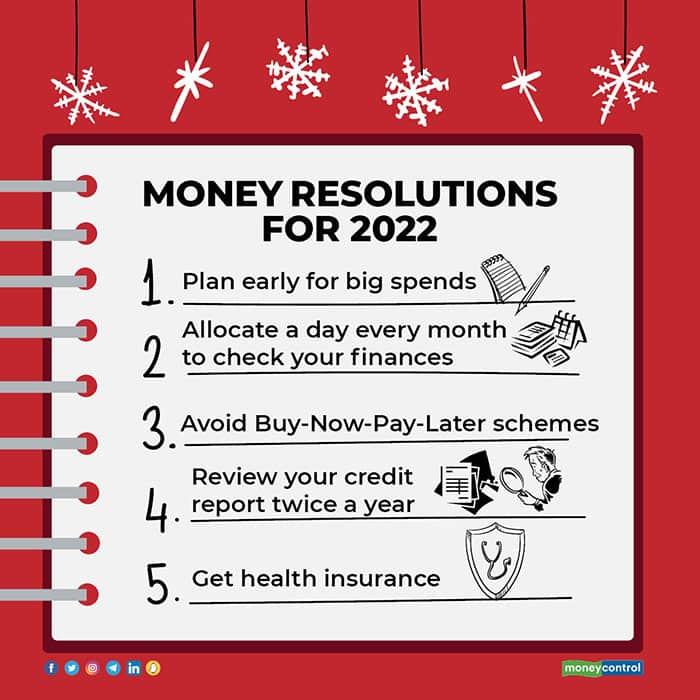

Buy health insurance

COVID-19 is still around us. “Most people have been relying only on the group insurance from their employer. They need to reassess whether existing their health insurance is currently sufficient for the family and dependents,” says Raj Khosla, founder and MD of MyMoneyMantra. Similarly, evaluate whether you have sufficient term insurance cover for uncertainty in this pandemic period.

You must have at least three months of cash reserve on hand as fixed deposits or liquid funds for an emergency.

Keep one day a month just for your finances

From monitoring your investments and deploying surplus amounts, to accounting for your expenses, checking your credit report, your money box requires your periodic attention. Keep a day aside from your schedule for your money box. “Jot down all the financial tasks in a diary / excel worksheet,” says Parakh. This way, you will have a focused approach and chances of your money box getting neglected goes down.

A close scrutiny helps uncover gaps. “Spend some time to understand your bank statement and credit card statement in a month. Analyse your expenses and bank charges. If something is not right then seek help from your bank,” says Aparna Ramachandra, Founder Director of rectifycredit.com. Become a more informed and financially agile person with such exercise.

Plan, save and then spend

Identify big ticket spends and make a resolution to save for it from January onwards. “Plan ahead and avoid impulsive decisions to buy them on credit,” says Raghavan.

For instance, spends like holidays, insurance premiums, school fees, gadgets, home interiors…all these high-ticket items should be planned ahead, “to avoid paying them by personal loans later,” adds Raghavan. Many shop using Buy Now, Pay Later (BNPL) schemes and travel using Holiday Now, Pay Later schemes. Make a resolution this year to avoid those.

If you had taken a loan moratorium in the year 2020 and now your cash-flow allows you to prepay part of this loan, then make a resolution to reduce this debt without affecting other financial goals.

Transfer the home loan account

There are several home loan borrowers paying home loan at old interest rates, which was around 10.5 per cent whereas now it’s available at less than 7 per cent interest rates. “Make a resolution that in the initial months of 2022, will negotiate with an existing lender for lower home loan interest rates or will switch the lender,” says Ramachandra.

“In the year 2021, the focus of the banks was to attract balance transfer customers, and it’s expected to continue in 2022. They are coming with offers to target customers with good credit profile of other banks into their own books,” says Atul Monga, Co-founder and CEO of BASIC Home Loan. For instance, Bajaj Housing Finance slashed home loan interest rates (including balance transfer) to 6.65 per cent p.a. as part of its new festive offer from December 28, 2021 to January 26, 2022.

If the new home loan offers are around 25-50 basis points cheaper than your current rate, there is no reason to delay home loan refinancing. “You should do your math and switch even if the difference is only 25-35 basis points,” says Vipul Patel, Founder of Mortgageworld, a loan consultancy firm. Anything above 25 basis points makes commercial sense with a long-term view. He adds, if your remaining loan tenor is 5-7 years, then it’s not beneficial to switch.

Improve your credit score and review annually

Make a resolution to monitor your credit report and credit score at least once in a year. “If anything is wrong in your credit report, then rectify it with the bank or lender,” says Ramachandra. If you have multiple loans with three to five months, instalments remaining, see if you can prepay and close the outstanding loan accounts, she adds. This will help to improve your credit score and you will be eligible for a higher loan at a competitive interest rate. Individuals having a score of 750 or more get the best credit terms.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.