The COVID-19 pandemic has transformed consumer behaviour and spending patterns. Consumers, especially the millennials and Gen Z, are increasingly looking for simplified micro-credit solutions to manage their recurring and occasional purchases. This has led to a massive rise in the popularity of Buy Now, Pay Later (BNPL) schemes in India over the last few years. A Global Payments Report by Worldpay from FIS has projected BNPL to be the fastest growing e-commerce payment method in India – its market share in the e-commerce space is expected to grow from 3 percent in 2020 to 9 percent by 2024.

According to a report titled ‘BNPL: A lending game-changer’ from BankBazaar, the country has over 30 focused start-ups, a few e-commerce giants and even leading banks and NBFCs that are making rapid progress in onboarding customers in this space. These include Amazon Pay Later, Flipkart Pay Later, HDFC Bank FlexiPay, ICICI Bank Paylater, Lazypay Pay Later and ZestMoney.

How does the BNPL scheme work?

A BNPL scheme operates like any other payment option on e-commerce websites such as Flipkart, and Bigbasket, on food delivery apps such as Zomato and Swiggy, and even on trip-booking portals such as Goibibo and Cleartrip. In this scheme, all the purchases during a billing-cycle get added up, and you can pay later. A consumer can make small-value transactions using this scheme.

On selecting BNPL option while making payment, you can obtain short-term micro-loans starting at Rs 400 and going up to Rs 1 lakh in credit limit based on your credit profile. The repayment cycles are in the range of 14 days to 30 days or EMI-based repayment tenure of 3-12 months. These options vary depending on the vendor, product and value of the transaction. “While most BNPL schemes provide an interest-free time of 14 to 45 days to make the repayments, the EMI options come with an added interest in certain cases,” says Pankaj Bansal, CBO at Bankbazaar.com.

Also read: Why 'holiday now pay later' schemes may be loan traps

BNPL Vs Credit card: Which is better?

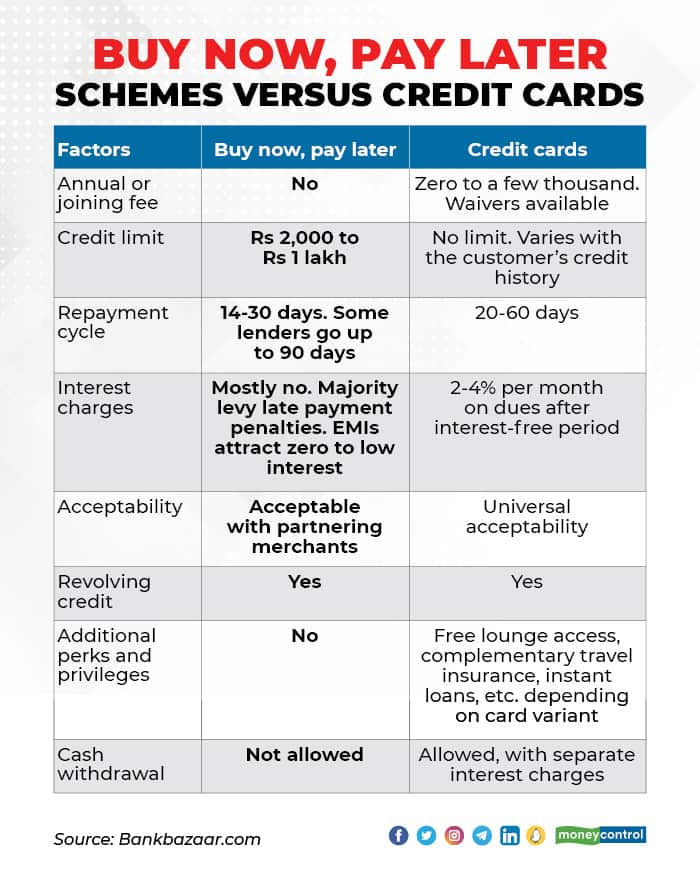

Credit cards are universally accepted, while the usage of BNPL is limited to partnering merchants, though the service providers are regularly increasing the number of partners. “Credit cards provide you with a much wider range of rewards, such as cashback, air miles, reward points and facilities such as special discounts, airport lounge accesses, etc. BNPL is limited to shopping online,” says Bansal.

Credit cards also allow you to shop offline, while BNPL is primarily popular in the online space. Credit cards may also offer higher limits compared to BNPL. On the flipside, BNPL schemes don't have annual, processing, or renewal fees, which credit cards do (see graphic for the key differentiating factors).

“If you are looking for a single payment solution that’s both flexible and rewarding, then credit cards may be the way to go. However, if you are looking for an alternative payment option that allows you to defer payments or allows easy EMI options, then BNPL may be the way to go,” says Bansal.

Eligibility criteria

In the case of credit cards, banks primarily link your eligibility with your annual income and credit score. You can apply for a credit card only if you have an income above a certain threshold limit set by the bank. It may also be difficult for you to get a card if you do not have a credit score or if your credit score is low. However, BNPLs are micro-loans for customers who do not want to use credit card for small transactions or are ineligible for a credit card. “The path to accessing BNPLs is often easier compared to getting non-pre-approved credit cards,” says Bansal.

BNPL vs credit card charges

Again, it varies as per the bank and issuer. HDFC Bank charges interest on the FlexiPay- Buy Now Pay Later scheme. It gives you a tenure options to repay in 30, 60 or 90 days and charges Rs 70 per month as interest cost on purchase of Rs 3,000 and above. That is, 2.33 percent per month and an annual interest rate at 28 percent. Fintech firms such as Cashe and Kissht charge up to 30 percent as annual interest rate for longer tenure loans. Aparna Ramachandra, Founder Director of rectifycredit.com feels that personal loan from banks are much cheaper compared to buy-now, pay later schemes. “Banks charge between 9 and 12 percent annually to consumers with credit histories,” she says.

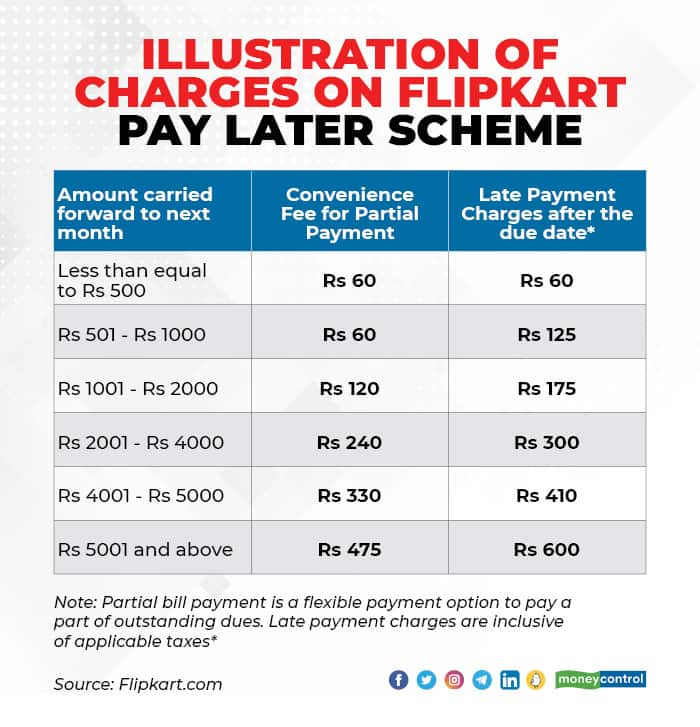

Apart from interest charges on converting the outstanding amount into EMIs, there are late-payment charges levied for payments beyond the due dates and a convenience fee charged for partial payment from outstanding dues (refer to graphic).

“With BNPL scheme, fintech firms and leading banks are creating a sort of virtual facility similar to credit card transaction and payment processes. They are targeting millennials who don’t have a credit card,” says Parijat Garg, a digital lending consultant.

The interest rates on credit card are the highest among all debt categories. To revolve the credit, you end up paying 1.99-3.75 percent monthly, which is 24-45 percent on an annual basis. For instance, the monthly interest on HDFC Bank Infinia credit card is 1.99 percent, SBI Elite is 3.50 percent and, Citi Cashback levies an interest rate of 3.75 percent. Besides interest rates, there are annual membership fees on these credit cards starting from Rs 500 to Rs 10,000, depending on the card variant.

What should you do?

You need to decide which credit instrument to choose depending on the purchase, repayment options, and the discounts and rewards. You should be careful while using any credit facilities. Be ready with the money before the repayment due date, once the bill gets generated. No matter what you opt for, you have to repay what you have spent, on time and in full, or else there would be penalties.

“Reckless usage and late payments with any of these facilities can jeopardise your credit score, hurting your chances of getting the best offers when you apply for other loans in the future,” warns Bansal. You must learn to manage your finances within your monthly income instead of depending on such easy credit schemes. An informed usage and utmost financial discipline is key to maximising the value of the instrument you choose.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.