In the last eight years, the number of credit cards has more than tripled to about 62 million, according to data from the RBI. However, monthly transactions have risen 4.7 times in the same period.

Clearly, the number of users and the amounts spent have increased substantially.

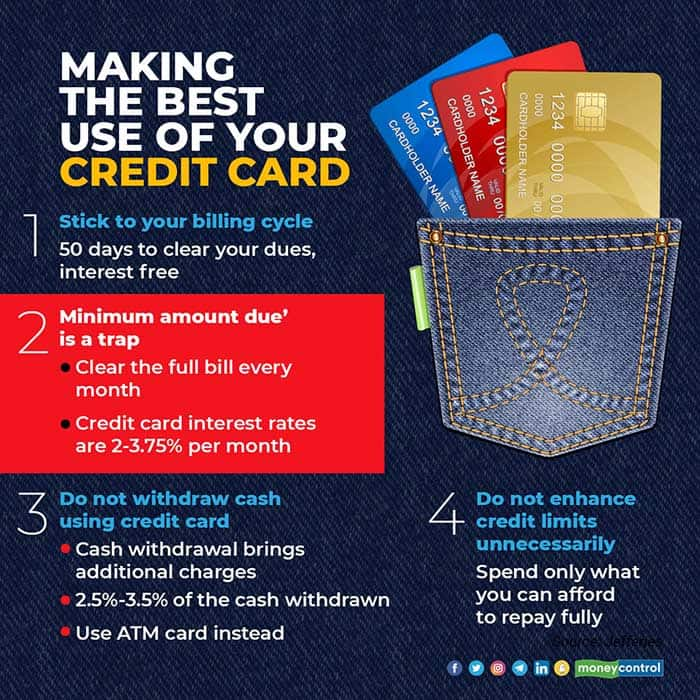

Credits cards are helpful only if you use them with care. Here’s a simple guide for getting the best out of your credit card.

Stick to your billing cycleEvery credit card comes with a 50-day cycle billing cycle. If you spend on day one of your cycle, you effectively have 50 days before which you need to pay and if you spend on the 30th day you get 20 days to repay. These 20-50 days are the interest-free period.

Say, your billing cycle begins on the 10th of every month. You will have until the 9th of the next month to spend in this cycle. Then, a new spending cycle begins. However, you get time till the 29th of the next month (month number two) to clear the credit card dues.

What happens if you don’t pay on the 29th and wait for, say, another week? You will have to pay interest daily, till the entire amount outstanding is repaid. Not just that, the interest-free period for the next spending cycle gets over-looked until you repay the outstanding. This means you will be charged interest even on new purchases in the next cycle, if you fail to clear dues by the deadline.

Do not withdraw cashEvery credit card offers a proportion of the credit limit withdrawable as cash. It’s good to know this limit. In case of emergency, you may even use it. However, under ordinary circumstances, avoid withdrawing cash as it is subject to interest charges. The charges for cash withdrawal from your credit card are applicable as soon as you make a withdrawal and are 2.5-3.5 percent of the value. It’s best avoided. Use your debit-cum-ATM card to withdraw cash, instead.

Credit card bills cleverly come with this figure of minimum amount due. If you pay just this minimum amount, you cannot escape the interest charges.

You will be charged daily interest on the remaining amount and on any new purchases made with the card. Monthly interest charges on credit cards range from 2-3.75 percent. This translates to an annual interest of 28-45 percent!

Be aware of the charges payableThis is the real killer. Interest rates payable on your credit card’s outstanding dues are not displayed upfront on bank websites. Even your own credit card statement will have this figure buried in a corner.

Some premium cards carry a low interest rate but require you to spend a lot in a year to retain membership. For example, HDFC Infinia Credit Card has an interest rate of 2 percent a month as compared to HDFC Regalia Credit Card which comes with 3.5 percent monthly interest rate. But Regalia requires you to spend at least Rs 3 lakh a year to get a waiver of the Rs 2,500 annual membership fee. Infinia requires you to spend at least Rs 8 lakh a year to get a waiver on the Rs 10,000 annual membership fee.

Hence, the lower interest rate is simply an incentive to spend more. But that is not the only charge. Each time you swipe your credit card abroad or even buy goods in foreign currency online from India, a foreign currency markup charge is applicable.

Credit enhancement is a baitYour bank would love you to enhance your card limit. Every credit card comes with a limit on how much you can spend. Often, this limit is beyond your monthly affordability.

Let’s say you get your first credit card around the same time as your first job. The card could have a credit limit of Rs 50,000-Rs 1,00,000 a month. However, spending Rs 1,00,000 a month on your credit card is not advisable at the start of your career.

If you do exceed your credit limit, there is a penalty (over-limit charges of around 2.5 percent on the excess drawn).

Reward point benefits, stretching your money, concierge services, access to lounges and restaurant discounts, gift vouchers and insurance covers may tempt you into signing up for a credit card membership. However, there are no free lunches.

Follow the credit card ‘hygiene’ as mentioned above, to enjoy the benefits of a stress-free credit life.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.