Ganesh Chaturthi, a festival celebrated across India, symbolises new beginnings, wisdom and prosperity. Ganesha, revered as the remover of obstacles and the deity of intellect, provides us with timeless lessons that can be applied to various aspects of life, including financial planning for retirement.

Here are five smart pieces of wisdom inspired by Ganesh Chaturthi for a secure retirement.

Start early and stay disciplined: The power of consistency

Much like the meticulous preparations for Ganesh Chaturthi that begin well in advance, your retirement planning should start early. Time is your greatest ally in accumulating wealth, and consistency is key. By regularly investing a portion of your income and staying committed to your financial goals, you harness the power of compounding, allowing your money to grow exponentially over time.

See here: Retirement planning: The 555 formula could help you retire rich

Discipline in financial planning means adhering to your investment strategy, regardless of market fluctuations or short-term temptations. Avoid the pitfalls of greed and the allure of high-risk investments that promise quick returns. Instead, focus on building a diversified portfolio that aligns with your long-term objectives. Just as devotees faithfully worship Ganesha year after year, your commitment to disciplined investing will pave the way for a prosperous and independent retirement.

Let it go: The art of avoiding past-performance traps

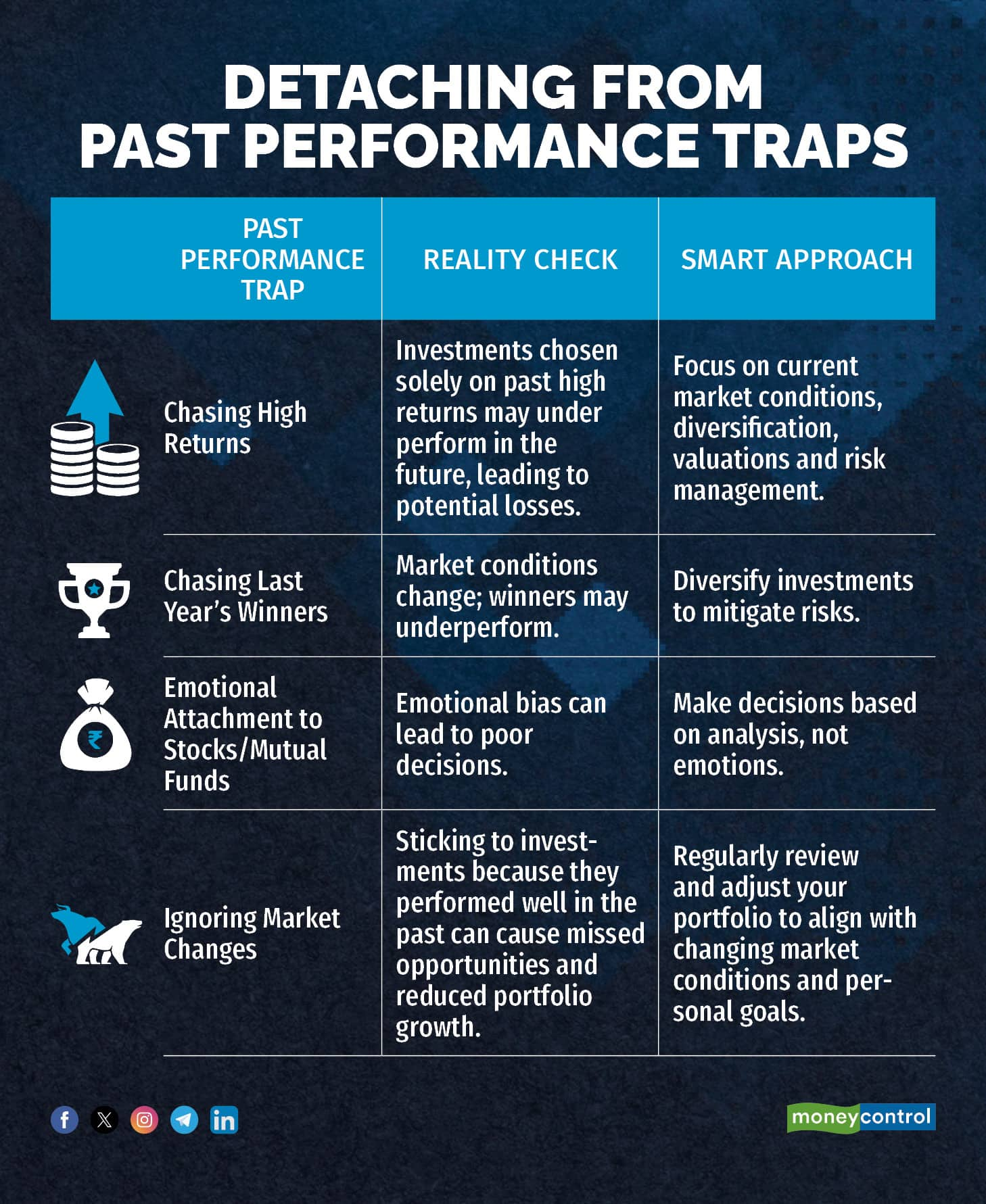

Ganesha’s iconic elephant head represents the ability to overcome obstacles and the wisdom to let go of things that no longer serve us. In the realm of financial planning, this translates to not taking the bait of past performance, or in other words, the track record of an investment product or manager. Many investors fall into the trap of chasing investments based on their historical returns, only to realise that past performance does not guarantee future success.

See here: How much money do you need for your retirement? Simply Save

Instead of dwelling on what worked in the past, focus on the present and future. Analyse current market conditions, reassess your financial goals and make informed decisions that align with your retirement objectives. Let go of emotional biases and past regrets and embrace a forward-thinking approach. By doing so, you can avoid costly mistakes and stay on the path to a peaceful retirement.

Seek guidance: Use financial planners

Just as devotees seek Ganesha's blessings and guidance to navigate life’s challenges, it’s crucial to seek the wisdom of an experienced financial expert when planning for retirement. An expert can provide valuable insights, help avoid common pitfalls and keep you accountable to your financial goals.

Relying solely on trial and error with your hard-earned money can lead to unnecessary risks and setbacks. A seasoned financial mentor can guide you in making informed decisions, ensuring that your investments are aligned with your risk tolerance and retirement objectives. They can also help you stay disciplined and avoid emotional decisions that could derail your financial plans. Remember, the path to financial independence is best travelled with the guidance of someone who has the experience and knowledge to help you succeed.

Cultivate patience and avoid greed: The elephant’s steady gait

The elephant, symbolised by Ganesha, moves with a steady and deliberate gait, teaching us the importance of patience and avoiding greed in financial matters. Retirement planning is a long-term journey that requires a balanced and measured approach. The temptation to chase after quick gains or get-rich-quick schemes can entail disastrous results.

Also see: UPS vs NPS: Which is better for you?

Patience is key to allowing your investments to grow over time. Resist the urge to make hasty decisions based on short-term market movements or FOMO, the fear of missing out. A well-thought-out investment strategy, executed with patience and discipline, will yield better results in the long run. Greed, on the other hand, can cloud your judgement and lead to poor financial choices. By cultivating patience and maintaining a steady course, you can achieve a secure and independent retirement.

Prepare for the unexpected: Be financially resilient

Ganesh Chaturthi is also a time to reflect on the importance of expecting the unexpected. Life is full of uncertainties, and retirement is no exception. Whether it’s health issues, economic downturns or unforeseen expenses, having a financial cushion is essential for a peaceful retirement.

Building an emergency fund, diversifying your investments and having adequate insurance coverage are critical components of a resilient retirement plan. This financial safety net will protect you from unforeseen challenges and ensure that your retirement years are spent in comfort and peace. Just as devotees prepare for all aspects of the Ganesh Chaturthi celebrations, you should be prepared for any financial surprises that may come your way.

Conclusion

Ganesh Chaturthi is a time of celebration, reflection and renewal. By embracing the wisdom derived from Ganesha, you can set the foundation for an independent and peaceful retirement. Start early, stay disciplined, seek expert directions, cultivate patience and prepare for the unexpected. By doing so, you ensure that your money works for you in retirement, allowing you to enjoy your golden years without financial worries and without being dependent on your children.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.