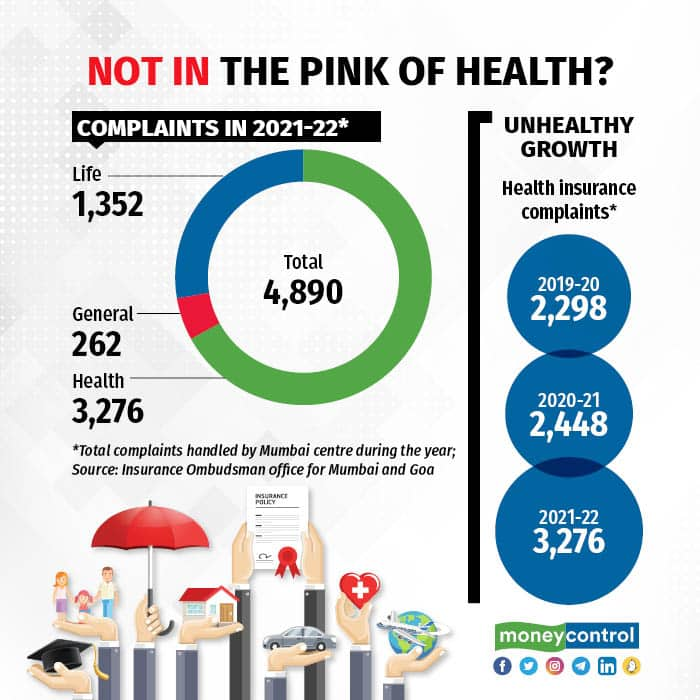

Health insurance complaints from policyholders jumped nearly 34 percent in 2021-22 compared to the previous year, according to data released by the Insurance Ombudsman office in Mumbai.

The centre had handled 2,298 health insurance complaints in 2019-20 and 2,448 in 2020-21, but the figure shot up to 3,276 in 2021-22, according to its annual report for 2021-22. Though it does not segregate COVID-19 and non-COVID-19 claims, the spike in complaints corresponds with the period when Mumbai and the country witnessed peaks of the Delta and Omicron COVID-19 waves.

“Most COVID-19-specific complaints pertain to partial settlement of hospitalisation claims. Then there are cases where claims were entirely rejected on the grounds that the patient's condition did not require hospitalisation,” Bharatkumar Pandya, Insurance Ombudsman for Mumbai and Goa said at a media conference held recently.

Moneycontrol has chronicled several such policyholder grievances against non-life insurance companies during the harshest COVID-19 phases.

Also read: One year of COVID-19: Health insurance claim settlement hinges on IRDAI nudge

Policy contract, not government tariffs, matters the mostOne of the reasons for partial reimbursement of COVID-19 hospitalisation claims was that many insurers chose to go by the treatment tariffs prescribed by state governments and the General Insurance Council.

“We pass awards after examining each case individually. In general, however, the insurer has to go by the policy terms and conditions and these tariffs did not form part of the policy documents. In some cases, the government-prescribed rate cards were not applicable to the insured patients,” explains Pandya.

Hospitals’ view that the government-imposed COVID-19 tariff was meant only for uninsured patients had resulted in a deadlock between hospitals and insurers, leaving patient-policyholders in a lurch. The reference rates published by the GI Council, too, were indicative and not binding on insurers.

Most insurance complaints received by the Mumbai Insurance Ombudsman office were linked to health insurance.

Out of the 4,890 complaints handled by the centre in 2021-22, an overwhelming majority of 67 percent (3,276) complaints were related to health insurance. “The topmost reason for complaints was claim rejection on the grounds of suppression of pre-existing diseases,” says Vijay Shankar Tiwary, Secretary, Mumbai Insurance Ombudsman.

Also read: Missed declaring your health condition while buying an insurance policy? Here’s what you can do

The other common cause of disputes between policyholders and insurers is claims made during the waiting period. For instance, most health policies do not cover expenses incurred on treatment of cataract or hernia in the first policy year.

The Mumbai centre’s report also flags the reasonability clause in health insurance contracts, due to which the reimbursement amount gets reduced, as a key cause of disputes.

“The invoking of customary and reasonability clause with regard to treatment at a network hospital is both unfair and counter-intuitive. Why would the insurer not take up the issue of ‘over-charging’ with the hospital and why would it rather make the insured pay?” the report asks.

An insurance company rejecting your claims is not the end of the road. You can file a complaint with the IRDAI and insurance ombudsman offices in your city. The ombudsman offices can handle complaints entailing claims of up to Rs 30 lakh.

“However, you must write to the insurance company and wait for 30 days before escalating the matter. The ombudsman has to dispose of the case within 90 days of having received it,” says Pandya. You can approach the ombudsman if the insurance company has rejected your complaint, you are dissatisfied with the resolution, or it has simply not responded to your grievance for 30 days.

The insurance ombudsman will, after examining arguments on both sides, pass an order. If you are not satisfied with the verdict, you are free to approach consumer courts. However, the order is binding on insurance companies.

Penalties for not adhering to the verdictThe insurance company has to comply with the ombudsman’s order within 30 days. If it fails to do so, you must bring it to the notice of the ombudsman. Insurers have to shell out penal interest (two percentage points over the prevailing bank rate), per the Protection of Policyholders Regulations, 2017. “However, most insurers largely comply with our orders in time,” says Pandya.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.