Tomorrow, we will look at whether the recent regulatory changes would make claims settlement any easier.

When the Insurance Regulatory and Development Authority of India (IRDAI) came up with norms for standardised COVID-19 specific policies in July 2020, many rushed to buy them. With stories of disputes between hospitals and insurers gaining prominence, they assumed that dedicated policies would cause fewer hassles. So, they sought the Corona Rakshak fixed benefit policy.

Thiruvananthapuram-based Ajmal T, a medical representative, was one of them. When he contracted COVID-19 in December last year, he was confident that the Corona Rakshak policy he had purchased from a private insurer would come to his aid. “My hospitalisation expenses amounted to Rs 60,000, but the insurer refused to pay the claim on the grounds that my hospitalisation was not justified. This, despite producing doctor’s certificate advising hospitalisation, hospital case papers and all other documents that it asked for,” says Ajmal. He has escalated the case to the Insurance Regulatory and Development Authority of India (IRDAI) and is expecting a final resolution soon.

Also read: Standardised Corona Kavach and Rakshak policies on the anvil

“The policy conditions only require 72-hour hospitalisation and COVID-positive status. Whether the patient should be hospitalised or not is to be decided by the treating doctor. Will the insurance company take responsibility if the condition deteriorates rapidly, as has happened in COVID-19 cases?” asks Hari Radhakrishnan, Regional Director, Amicus Insurance Broking services. He has handled three other such cases since December and the insurers finally paid the claims after disputes were raised.

“One of the reasons cited was the absence of an active line of treatment. But COVID Rakshak policy doesn't link the payout to the severity of infection or intensity of care provided,” points out Anuj Jindal, Co-founder, Sureclaim.in. Insurers, on their part, have been stung by adverse claim rations due to COVID-19.

COVID-19 cases have risen once again in many states across India. “We are seeing nearly 150 daily claims from Maharashtra since February,” says S Prakash, Joint Managing Director, Star Health and Allied Insurance.

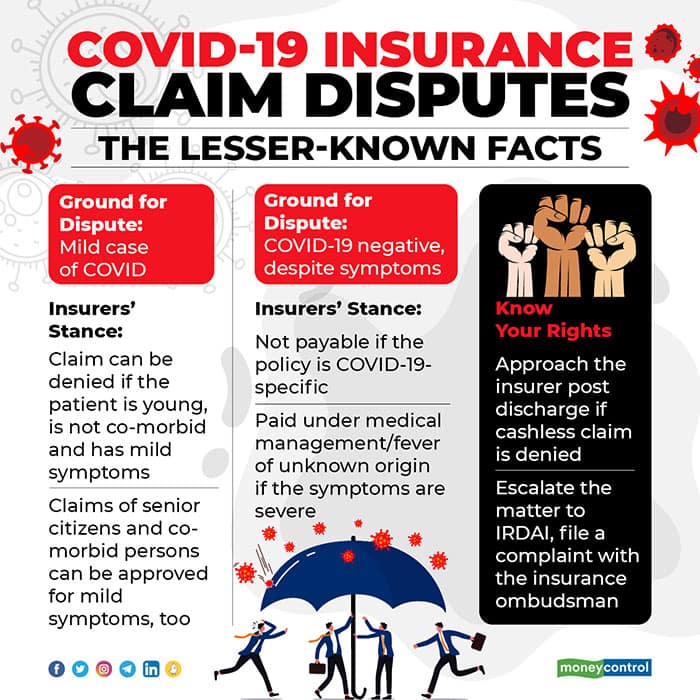

Partial claim payout has been a source of dispute since the start of the pandemic outbreak in India. Such regular claim hassles apart, being aware of unusual claims or disputes that have tormented policyholders will help you deal with such situations better in the days to come.

Mild COVID-19 cases in a muddleAjmal’s is not an isolated case. “We are following established ICMR and WHO guidelines. Wherever government guidelines said a patient (with mild symptoms) can be quarantined and treated at home, we had to say no to hospitalisation. In a pandemic situation, every patient need not be admitted – it could result in denial of beds to patients with severe conditions,” points out Bhabatosh Mishra, Director, Underwriting, Claims and Products, Max Bupa Health Insurance.

Some insurers and their third-party administrators have taken the stand that hospitalisation for mild COVID is not always justified. “When presenting symptoms were very marginal – for example, if a young policyholder without co-morbidities just had mild throat infection, hospital admission requests were not approved. In our view, such patients were better off taking treatment at home as hospitals are high risk zones. However, these constituted less than 2 percent of cases. In the remaining 98 percent of cases, hospitalisation expenses were paid for,” says Girish Rao, Chairman and Managing Director, Vidal Health TPA. Senior citizens or those with co-morbidities might are unlikely to face resistance to insured hospitalisation, even if their symptoms are mild.

Others say they have honoured all genuine hospitalisation claims, even the milder ones. “We have decided to pay all COVID-19 hospitalisation claims, though some of our peers in the industry differ on this aspect,” says a senior official at a private general insurer, who did not wish to be identified.

Testing ‘negative’ is bad news for someSixty-five-year-old Nirali Shah (name changed) was hospitalised in Mumbai with acute breathlessness, lung damage and high fever late last year. Though she tested negative, the treating doctor took the call to admit her to the isolation ward and administer Remdesivir, a drug that had received emergency approval for treating COVID-19. “My oxygen levels had dropped to 90. I was covered under a group mediclaim policy, but the insurer rejected the claim, citing incorrect line of treatment followed by the hospital,” she says. She is now locked in a dispute with the insurer and intends to approach the insurance ombudsman if the former fails to resolve her complaint.

Again, insurers’ approach to such cases are varied. “Diagnosis, prevention and treatment are all uncertain in the case of COVID-19. The test can be negative, but it is not fool proof as RT-PCR tests demonstrate 70 percent sensitivity. We also take the patient’s clinical symptoms and biochemical markers into account – C-reactive protein levels, Serum Ferritin and oxygen saturation, among others. Depending on these markers, they could be treated as COVID-19 positive patients (even though test results are negative),” says S Prakash.

Aatur Thakkar, Co-founder and Director, Alliance Insurance Brokers explains that at times cashless claims get rejected because policyholders are hospitalised despite testing negative for COVID-19, at least initially. This holds true especially for COVID-19 specific policies. But if any subsequent report turns out a ‘positive’ result – for instance, at the time of cashless pre-authorisation – policyholders can pay the hospital bill from their own pockets and later claim a reimbursement. Regular health policies, however, have a greater chance of clearing your claim as, despite a negative report, other complications merit a claim.

Here again, “the conditions must warrant hospitalisation: high fever, breathlessness, nausea, dehydration and so on. These parameters were arrived at by a group consisting of GI Council members, TPAs and hospitals,” says Rao.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.