Indian health insurance companies are bracing themselves for yet another surge in COVID-19 claims, with cashless hospitalisation claims seeing an uptick. The country, particularly Mumbai and Delhi, are in the throes of a third wave that health experts say is likely to be driven by the Omicron variant. India recorded 2,82,970 daily COVID cases and 441 deaths on January 19, and the active tally rose to 18,31,000.

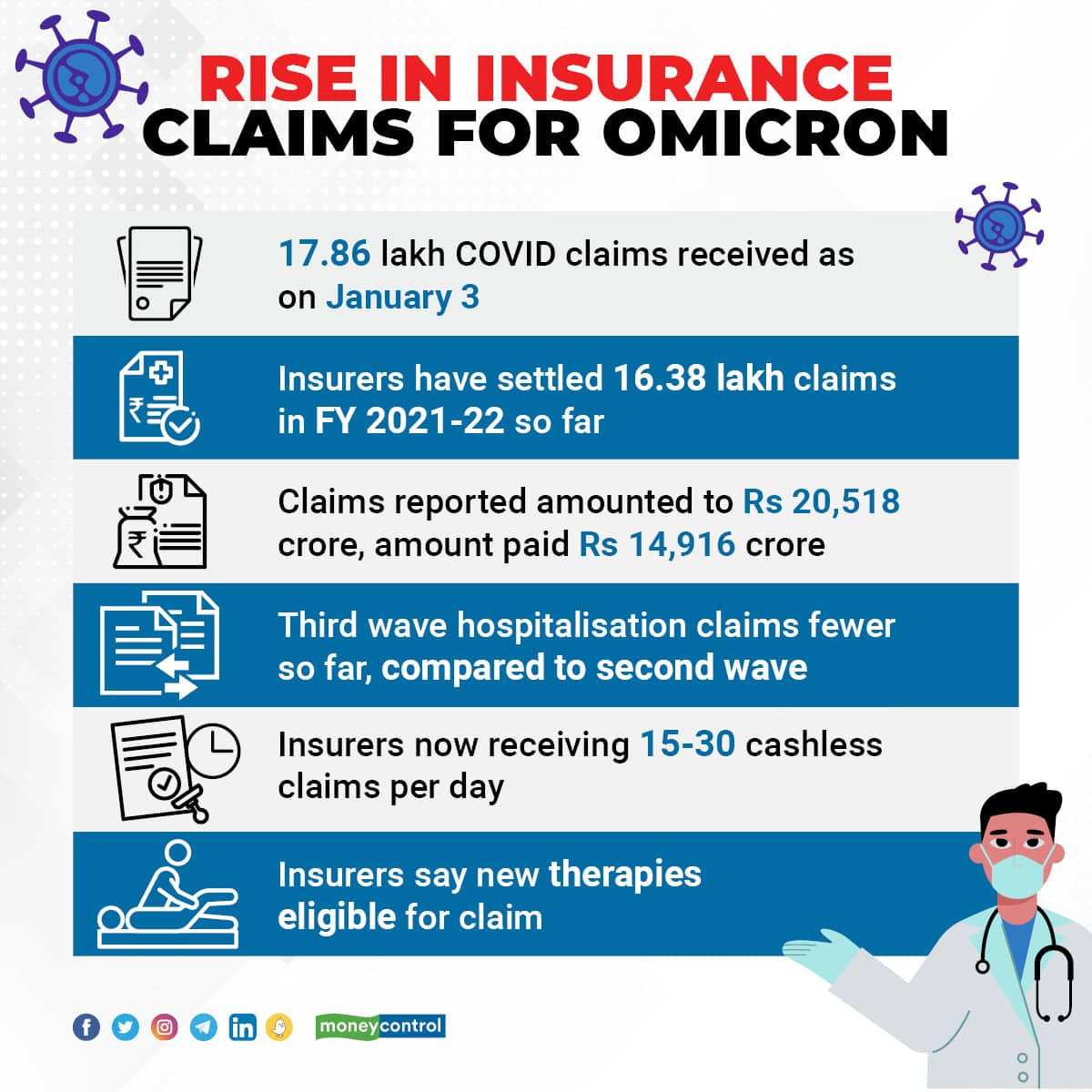

As on January 3, the general insurance industry had received 17.86 lakh COVID-19 claims in financial year 2021-22 and the claim amount crossed Rs 20,000 crore . This was over 80 percent higher compared to financial year 2020-21, when the industry received 9.86 lakh. During financial year 2021-22, health insurers settled 16.38 lakh COVID claims amounting to Rs 14,916 crore.

Spike in cases, not as many hospitalisation claims

Hospitalisation claims have shot up in the last ten days, but are still fewer than what insurers had witnessed during the second wave in March-May 2021. “From 3-5 cashless claims on December 28, we are now seeing close to 30 daily cashless claims on an average now. The number of cases has galloped in the last two weeks. Though hospitalisation rate so far is lower compared to the delta wave, these are early days and hence, we are guarded,” says Bhabatosh Mishra, Director, Underwriting, Products and Claims, Niva Bupa Health Insurance. Standalone health insurer Manipal Cigna is now receiving 15 hospitalisation claims per day.

Home care treatment claims have also seen a rise. “Number of hospitalisation claims has increased, but it’s too early to read the trends. Home treatment claims have picked up and we expect a further increase as more people are likely to recoup at home than get admitted to hospitals,” says Sanjay Datta, Chief, Underwriting, Claims and Reinsurance, ICICI Lombard General Insurance.

Also read: Taking treatment for COVID-19 at home? Here’s how must file your health insurance claim

Insurers get access to data on cashless claims immediately as they receive intimation on admission and directly settle the bills with the hospitals. Data on reimbursement claims – where the patients pay the bills and claim reimbursement from insurers later – comes with a lag. “We will know only in the next one week whether those who tested positive in the last few days will need hospitalisation. If the active caseload goes up, hospitalisation numbers, too, will increase. Even if the hospitalisation rate, as a percentage of total cases, is lower than second wave, the number of claims in absolute terms could be much higher,” says Mishra, striking a note of caution.

Mild cases, but insurers wary

For now, most claims received are mild, in line with trends in South Africa, where Omicron was first identified, say industry officials. “The mortality rate is lower as compared to last wave. Most of the claims pertain to patients who are experiencing mild to moderate symptoms such as mild fever, cough, and body ache. The requirement of ICU beds, oxygen and ventilators is low as of now,” says Priya Deshmukh-Gilbile, Chief Operating Officer, Manipal Cigna Health Insurance.

But the rapid growth in cases has put the industry in the wait-and-watch mode. “In the last 3-4 days, we have seen an increase in hospitalisation claim intimation. But it is too early for patterns and trends to emerge,” says Amit Chhabra, Business Head, Health Insurance, Policybazaar.com.

For Manipal Cigna, most claims have poured in from Hyderabad, Mumbai and Mumbai Metropolitan Region (MMR) Pune and Chennai and Delhi. “The claims that we are seeing in our data base are predominantly of younger working population (25-45 years), largely due to infection contracted during external exposure. The impact on children and geriatric population is yet to be seen and the trends may change,” says Gilbile-Deshmukh.

New therapies eligible for claim

US pharma major Merck’s anti-COVID pill Molnupiravir hit the Indian markets this week, but also came with its set of controversies. The drug is approved by Drug Controller General of India (DCGI), but Indian Council of Medical Research (ICMR) Dr Balram Bhargava recently raised concerns around its safety profile.

However, insurers will not treat it as experimental treatment for which insurers usually do not pay. “Insurers look at two aspects – approval from designated authorities and prescription by treating doctors. As long as appropriate protocols are followed while prescribing treatment and medicines, we will pay the claims,” says Mishra.

Similarly, Monoclonal antibody cocktail, which comes at a price tag of close to Rs 60,000 for each patient dose, too, is payable. A pack, which can treat two patients, can cost close to Rs 1.2 lakh. While it is administered through the intravenous (IV) route, your insurer may not insist on hospitalisation. “Administration of this cocktail, if indicated as per existing FDA and other relevant treatment protocols is payable under day care and patient need not be hospitalised for this,” says Mishra.

However, insurers and intermediaries seem to be divided on this issue. Another senior official at a private insurance company told Moneycontrol that such claims won’t be paid under day care as it is not a ‘named’ procedure. “Neither is it listed as day care treatment in policy documents nor is it a procedure that involves administration of anaesthesia or some intervention. The insurer, however, can make an exception and pay the claim even if patient is not hospitalised. Or, the IRDAI has to come out with a specific guideline,” says Hari Radhakrishnan, Regional Director, First Policy Insurance Brokers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!