With many states in India facing an acute shortage of beds, many COVID-19 patients are forced to seek treatment at home, at least until they get access to institutional facilities.

As was the case during the first wave of the pandemic, some hospitals, doctors and healthcare companies offer tele-medical consultation for mild COVID-19 cases. The services on offer include online doctor’s consultation, nurse visits, delivery of required medicines and also thermometers and oximeters. In fact, some companies also offer complete home ICU set-ups, with charges of over Rs 15,000 per day.

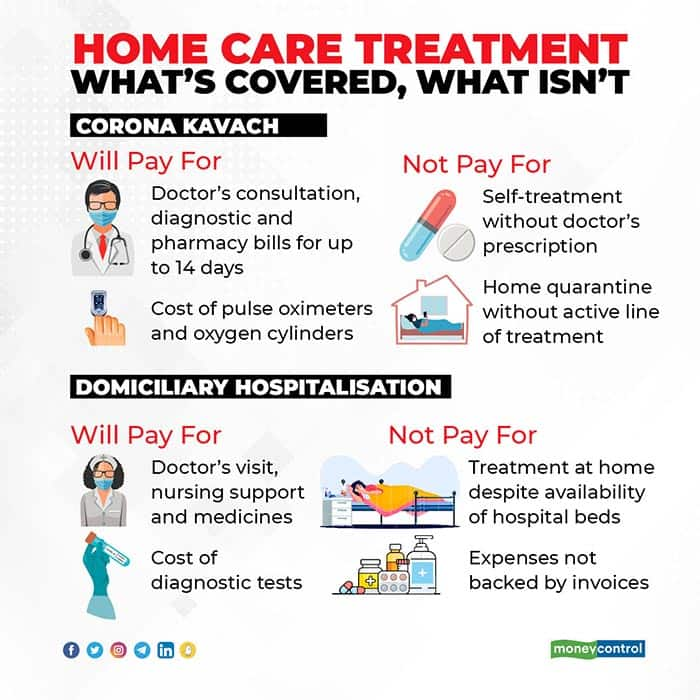

Now, generally, regular health insurance policies do not cover treatment at home. They pay only for 24-hour hospitalisation and day-care procedures – unless they come with an OPD (out-patient department) component. Corona Kavach policies, however, cover the cost of treatment at home.

Here are the ways in which you can claim a reimbursement for your home-care treatment.

Home care treatment under regular policies

Your first recourse is the basic health insurance that you have. The problem is that most health insurance policies do not cover treatment taken at home. But, the likes of ICICI Lombard have started offering this cover as part of their regular policies. “Even if the condition is mild and does not require hospitalisation, but the doctor advises treatment at home, you can file a claim under this facility,” says Anuj Jindal, Co-founder and CEO, Sureclaim.

However, you will have to be mindful of the conditions and exclusions while making a claim. “If the policy has coverage for home healthcare, the policyholder should seek prior authorisation (from the insurance company) before readying a set-up, to ensure smooth payment of claims. As long as oxygen usage is towards a line of active treatment under a medical supervision, it can be claimed. However, the capital cost of the cylinder which is essentially a medical equipment, is not payable,” says Datta. This means, the cylinder cost will not be reimbursed – only the cost of oxygen and refilling will be. ICICI Lombard has observed policyholders with mild COVID-19 taking home treatment, while moderate and critical cases have had to be admitted to hospitals. “Mild cases usually have an average claim size of Rs 14,000 over a period of 10-14 days, as they primarily need medical supervision twice a day along with medications,” says Datta.

However, costs incurred for, say, bed-rest post recovery will not be covered. “Nursing costs incurred on rest and rehabilitation, expenses relating to dietary supplements, vitamins and minerals as also charges incurred on unproven or experimental treatments will not be covered,” says Mahyavanshi.

Look out for the words “home care” or something equivalent in your health insurance policy.

Covers for ‘home hospitalisation’

However, many regular health insurance policies come with a ‘domiciliary hospitalisation’ clause. This is different from a plain-vanilla home care. It means that hospitalisation is recommended, but you cannot find a hospital bed and are therefore stuck at home and getting the COVID-19 treatment.

“The intent of domiciliary cover is to provide sophisticated medical management at home. This is provided when no beds are available or the patient is not in a position to be moved to a hospital. So, home ICU set-ups – including doctor visits, nursing and IV (intravenous injections) support - will be covered under this facility,” explains Nikhil Apte, Chief Product Officer, Health Insurance, Royal Sundaram General Insurance.

However, if you are covered under such a regular policy, take note of the conditions. For one, it is important to have the necessary documentation in place. Insurers could insist on GST-registered organised companies (those that offer professional home care treatment) for providing detailed invoices. “The original bills have to be in place and you need to inform the insurer in advance. This is the biggest challenge in home care, as there are very few organised vendors providing such services with proper bills. Fixed benefit COVID-19 policies that pay out a pre-agreed sum when you test positive, are a better bet,” says Apte. However, Corona Rakshak, which itself is a fixed-benefit policy, insists on at least three days of hospitalization.

Also, ascertain if your product imposes sub-limits. For example, your policy could specify that treatment at home will be covered only up to 10 per cent of the sum insured. “There is usually a cap of a minimum of three days of treatment necessary. So, if the duration of the home treatment is less than three days, it would not be covered,” adds Dhirendra Mahyavanshi, Co-founder, Turtlemint, an insurtech company. Given that COVID-19 treatment lasts longer than this period, it is unlikely to be a hindrance in most cases.

Corona Kavach pays for treatment at home

Your last resort is the Corona Kavach policy, which offers coverage of up to Rs 5 lakh. If you have a Corona Kavach policy – the standard, IRDAI-mandated COVID-19 policy offered by insurers since last year – you can get your bills reimbursed even if you are treated at home.

“Home care treatment means undergoing the treatment for COVID-19, on the advice of a medical practitioner, at your home,” says Sanjay Datta, Chief, Underwriting and Claims, ICICI Lombard. The expenses will be covered for up to 14 days. “It is extended to those who test positive for COVID-19 and are recommended an active line of treatment. Cost of pulse oximeters and oxygen cylinders will also be covered, which is not the case in most indemnity (hospital reimbursement) policies,” says Abhishek Bondia, Co-founder, Securenow.in.

“Minor treatment under home quarantine isn’t covered. But the costs incurred in setting up a home ICU and the cost of COVID-19 treatment would be covered without any limits up to the sum insured,” says Mahyavanshi. To make the claim, you will need a doctor’s prescription advising treatment at home. You will also need to submit the doctor’s original prescriptions, diagnostic reports and medicine bills.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!