Ever since an amendment to the Finance Bill, 2023 took away the favourable taxation that debt funds enjoyed, there has been much speculation that many investors are looking to move to other debt products such as fixed deposits and bonds.

Following the amendment, any capital gain (irrespective of the holding period) on debt fund investments made after March 31, 2023, will get taxed at an individual’s income tax slab rate, the same as how interest income from fixed deposits (FD) and bonds is taxed. This brings debt funds, FDs and bonds at par on taxation.

“Post these tweaks, all fixed-income products stand at a level-playing field. Retail and HNI investors will invest depending on liquidity, pre-tax returns and the associated time horizon of such investments,” says Ajay Manglunia, MD & Head, Investment Grade Group, JM Financial.

With debt fund sops gone, Vikram Dalal, Founder and Managing Director, Synergee Capital Services, sees a shift to bonds. He has seen a steady rise in inquiries by investors on investing directly in bonds as debt funds and MLDs (market-linked debentures) no longer have any capital gain advantage from April 1, 2023.

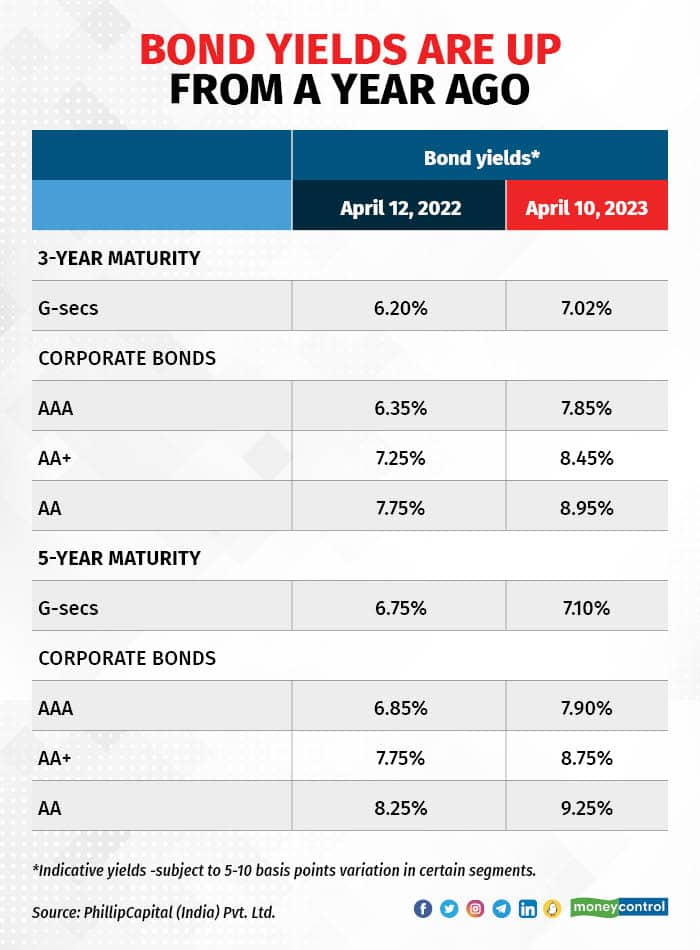

The rise in yields the past year along with tepid equity returns have only added to the appeal of bonds as an investment avenue.

According to Sameer Kaul, MD & CEO, TrustPlutus, it is still early days to comment, and people have already rushed and invested in debt funds before April 1. “Many investors may also shift to hybrid funds,” adds Kaul. So, it’s wait and watch for now.

Also see: List of top funds - MC30That said, here are a few points to note.

While debt funds and FDs are easy to invest in and liquidate (FDs are subject to a penalty on premature withdrawal), the same is not true of bonds to the same extent. Apart from that, unlike direct bonds, debt funds can provide you with a diversified portfolio for a much smaller investment. Also, with debt funds, you can defer your tax liability – pay it only when you redeem your investment and not periodically as with interest income from bonds.

Also read: Fixed deposits or debt mutual funds: Which one is better for you?Easy information and accessWith many online bond platforms springing up in recent years, getting information on bonds and investing in them has become easier than ever before.

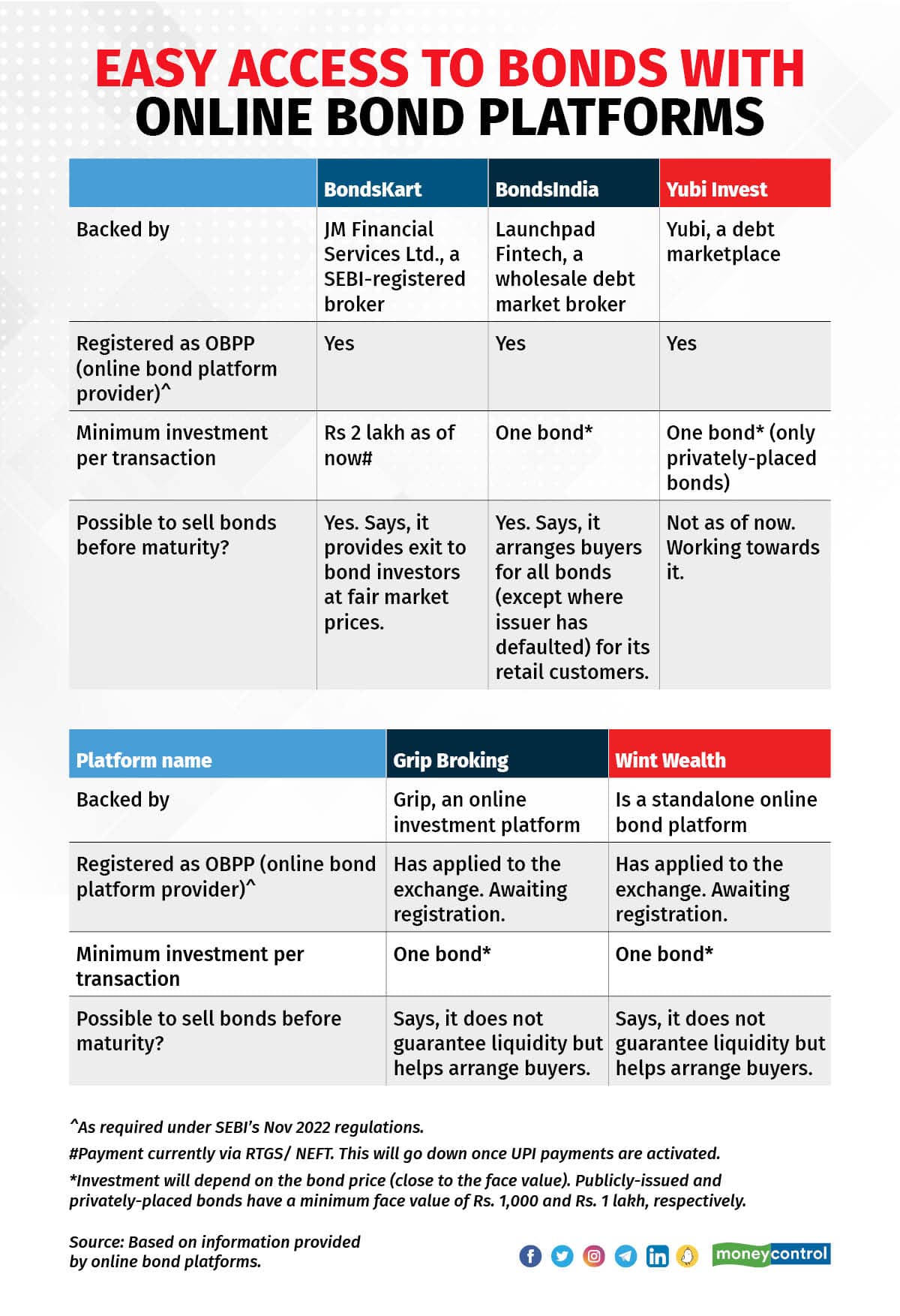

Regulatory concerns relating to online bond platforms too have been laid to rest. Following SEBI’s November 2022 regulations, all such platforms must register as a debt broker, and on meeting certain criteria, also as an online bond platform provider (OBPP) with the exchanges. This brings them under SEBI’s purview and offers comfort to investors. The regulations also require OBPPs to offer only listed bonds on their platform, another positive for investors.

Elaborating on the SEBI regulations, Ankit Gupta, Founder Director, BondsIndia, an OBPP says, “Any platform selling listed bonds must have an OBPP licence. Not only that, if you are selling listed bonds on an online platform, then you cannot offer any other investment product on the same platform.” Launchpad Fintech Private Ltd, the company backing the BondsIndia platform has been functioning as a debt broker since 2020, and now, holds an OBPP licence too.

All the existing bond platforms that applied for an OBPP licence (before the March 2023 deadline) but are yet to receive it can continue to operate in the meanwhile. But they can sell only listed bonds.

The only drawback that remains is liquidity – something not unique to the OBPPs but true for the bond market in general. Having bought bonds, you may not always be able to sell them before maturity and at their fair value. So be prepared to hold them until maturity. Though, some of the bond platforms we spoke with said they provide an exit option to investors.

In this context, Nikhil Aggarwal, Founder & CEO, Grip, an online platform that offers alternative investments including bonds, emphasises that it’s important to understand that while one may get liquidity (get buyers for the bonds you hold) in bonds, this may come at a price that may be below their purchase price. This could be on account of limited liquidity or a change in interest rates. Grip Broking has applied for an OBPP licence. According to Aggarwal, Grip tries to get buyers on a best effort basis for its users but does not guarantee liquidity to those wanting to sell their bonds prematurely.

While you can also invest in bonds through a trading account with many stock brokers, the range of bonds and the extent of information on them may not match what the online bond platforms are providing.

Commenting on the ease of selling bonds before maturity, Deepak Jasani, Head of Retail Research, HDFC Securities, says that while it is possible to sell bonds through your trading account, all the bonds may not get sold at the same price (as with equity shares). If there are no buyers at the price at which you have placed a sell order, you must be willing to sell them at a lower price.

As regards RBI Retail Direct, the central banks’ platform for investing in government bonds, experts point to the lack of awareness among retail investors as an impediment. On the ease of premature exit for these bonds, experts seem to have differing views.

Avenues to invest inNotwithstanding the concerns around premature exit, as a retail investor, here are a few options you have.

One, is to apply for public bond issuances (primary market) as and when they happen. However, given that a vast majority of bond issues are privately placed, this route may not offer ample opportunities. Oversubscription may also imply you don’t get to invest your intended amount.

Alternatively, you can invest in bonds that are trading in the secondary market. For this, you can choose to invest via one of the online bond platforms that have registered as an OBPP (see table for details). These bond platforms offer a wide range of corporate bonds from different issuers covering a range of credit ratings and maturity profiles. Certain platforms may, though, focus only on bonds of certain credit ratings.

You will need to sign up for a platform by providing your basic personal details and/or supporting documents before you begin transacting. Most of the platforms we spoke with do not have any minimum investment limit except for BondsKart. The only requirement – you need to buy at least one bond. Publicly issued bonds come with a minimum face value of Rs 1,000 and privately placed bonds with that of Rs 1 lakh. Given this, investors must be prepared to invest a similar sum (the exact amount will depend on the price that the bond is trading at).

For BondsKart, as of now, one must transact for at least Rs 2 lakh (via RTGS/ NEFT). However, this will go down to the minimum face value of bonds once the UPI payment gateway gets activated.

While online bond platforms do not levy any transaction charges, as with any bond transaction, you get charged a certain spread in the form of a higher bond price (or lower yield). Ajinkya Kulkarni, Co-Founder, Wint Wealth, says this spread can range from 10 basis points to up to 150 basis points. “So, you can’t say mutual funds charge an expense ratio and that there’s no expense with bonds,” he says.

As a high net-worth investor, if you are willing to invest in multiples of Rs 10 lakh then your broker or wealth firm, too, can provide you bonds to invest in. Dalal from Synergee Capital Services says large investors such as brokers and wealth firms apply for private bond issuances, and then sell these bonds to their clients. “SEBI has reduced the face value of bonds in private placement from Rs 10 lakh to Rs 1 lakh. This has led to more traction in the market. But, with only limited application forms allowed in any private placement, bonds are available only at a premium as demand far exceeds supply,” says Dalal.

Also read: Here is how you should invest after the RBI rate-hike pause Ease of exit: The Abhimanyu complexOn ease of exit, there are variations across different platforms. According to Gupta, BondsIndia arranges buyers for all bonds (except in cases of default) for all its retail customers. The JM Financial Services-backed BondsKart says it provides exits at fair prices to its customers. However, many other platforms say they do not guarantee liquidity but help their customers get buyers if they want to sell off their bonds.

In response to a question on how many investors so far have been able to sell their bonds before maturity, Grip Broking said they have got a very insignificant number of such requests. BondsIndia and Wint Wealth said bonds worth Rs 7.5 crore and Rs 2 crore, respectively, have been bought back by them. BondsKart and Yubi Invest said they would be unable to share this data.

What do experts suggest?“I would recommend retail investors to look at mutual funds rather than bonds as they are easier to buy and sell, and they give you a diversified portfolio,” says Kaul. Jasani concurs. “The expense ratio is a small fee to pay for the fund manager’s expertise but with direct bonds, an investor has to manage everything on his own,” he says.

Joydeep Sen, a corporate trainer (debt markets), says, “While HNI investors can have a relationship with wealth firms and bond houses for bond transactions, retail investors are better off with mutual funds as they provide better liquidity and diversification.” At the same time, he stresses the importance of not getting carried away by high yields only. “On online platforms, investors tend to simply go by the yields. But they must also understand the risk as reflected in the credit ratings.”

Also read: Will SEBI push revive interest in ESG funds?Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.