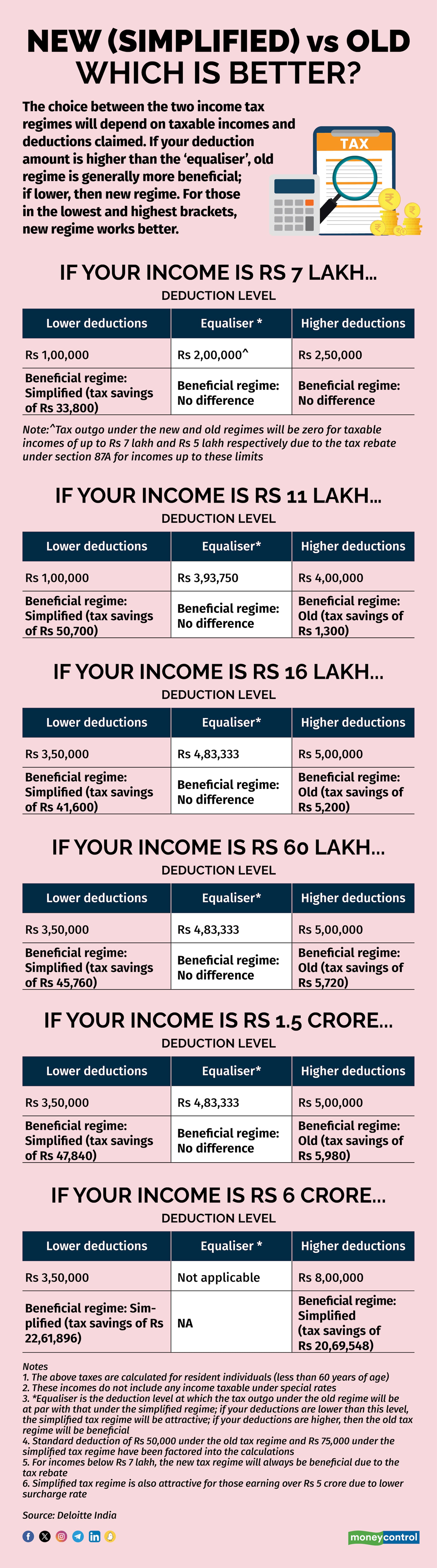

Budget 2024 has ensured that the new, simplified income-tax regime is now better than before.

Tax-payers now have more incentives to switch to the new, simplified regime, only those who avail of significantly higher deductions will find the old tax regime attractive.

Finance Minister Nirmala Sitharaman liberalised income tax slabs under the simplified regime further, besides hiking the standard deduction from Rs 50,000 to Rs 75,000.

Essentially, salaried employees would be better off switching to the new, simplified tax regime unless they are claiming deductions of up to Rs 2 lakh on home loan interest or are eligible for hefty house rent allowance (HRA). Without either of the two, the old tax regime doesn't make much sense.

Also read: Simpler and sweeter? How Budget 2024 will reduce taxes under the new, minimal exemptions tax regime

Old regime for higher, multiple deductions

For instance, if a salaried employee with an income of Rs 11 lakh claims deductions worth more than Rs 3,93,750, her tax outgo will be lower in the old tax regime. Now, it is debatable whether it is practically possible for someone with an income of Rs 11 lakh to claim this level of deductions. However, a couple with double income may be able to afford higher deductions as sharing of household expenses would leave more money in their hands to save.

An individual with income of Rs 60 lakh, too, will find the old regime suitable if she claims deductions worth more than Rs 3,93,750.

New regime suitable for low-earners, HNIs

For those who earn less than Rs 7 lakh, the simplified regime offers a rebate, bringing down their tax outgo to zero. In fact, salaried employees earning up to Rs 7.75 lakh will not have to pay any tax under the new regime, thanks to the higher standard deduction of Rs 75,000. In contrast, the tax rebate limit under the old tax regime is lower at Rs 5 lakh and standard deduction unchanged at Rs 50,000.

Also read: Deduction for employers' contribution to employees' NPS raised from 10% to 14% in Budget 2024

For high income earners, for instance, someone earning Rs 6 crore, again, the tax payable will be lower under the simplified regime as the effective tax rate surcharge rate is lower at 25 percent (effective tax rate of 39 percent). Under the old tax regime, the surcharge rate for those who earn over Rs 5 crore is much higher at 37 percent (effective tax rate of 42.74 percent).

Also read: How your SIPs would be taxed after Budget 2024's capital gains tax rate changes

Even tax-payers who wish to avoid the paperwork and compliance burden under the old tax regime are bound to favour the new tax regime.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!