Finance minister Nirmala Sitharaman has rejigged income tax slabs under the new tax regime and also raised the standard deduction under the new tax regime to Rs 75,000 from Rs 50,000, bringing cheer to salaried tax-payers as well as the pensioners.

The deduction, however, will remain unchanged at Rs 50,000 under the old tax regime. For family pensioners, the deduction will go up from Rs 15,000 to Rs 25,000 under the new regime.

This move will benefit four crore salaried individuals and pensioners, she said during her Budget 2024 speech. As a result, a salaried individual in the new tax regime stands to save Rs 17,500 in income tax," she said, adding that the government will have to forego revenue of Rs 29,000 crore in direct taxes.

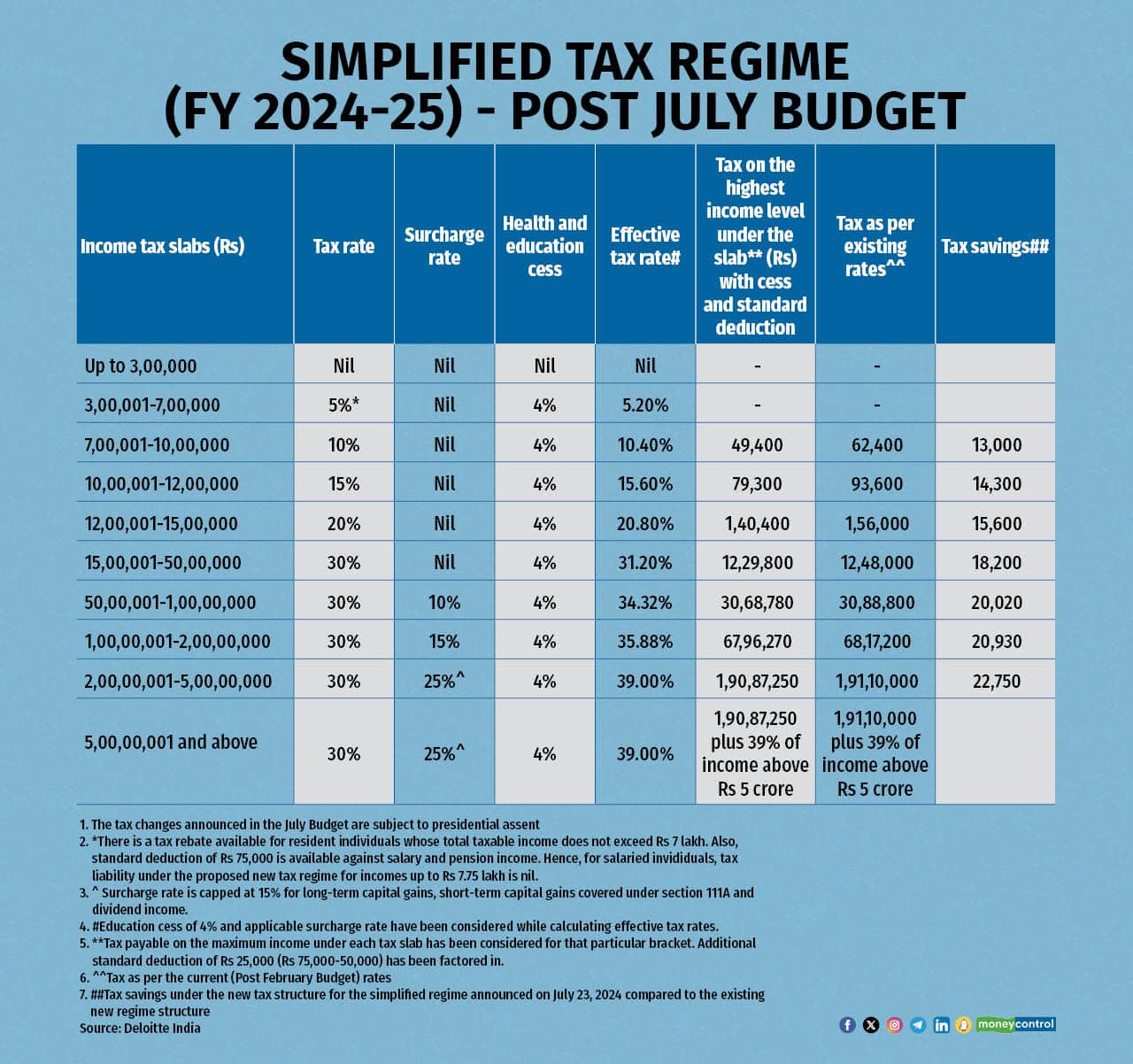

Here's how the new or simplified tax regime slabs and rates stack up post Budget 2024:

Simpler and sweeter: How individual, salaried tax-payers stand to benefit post Budget 2024

Simpler and sweeter: How individual, salaried tax-payers stand to benefit post Budget 2024

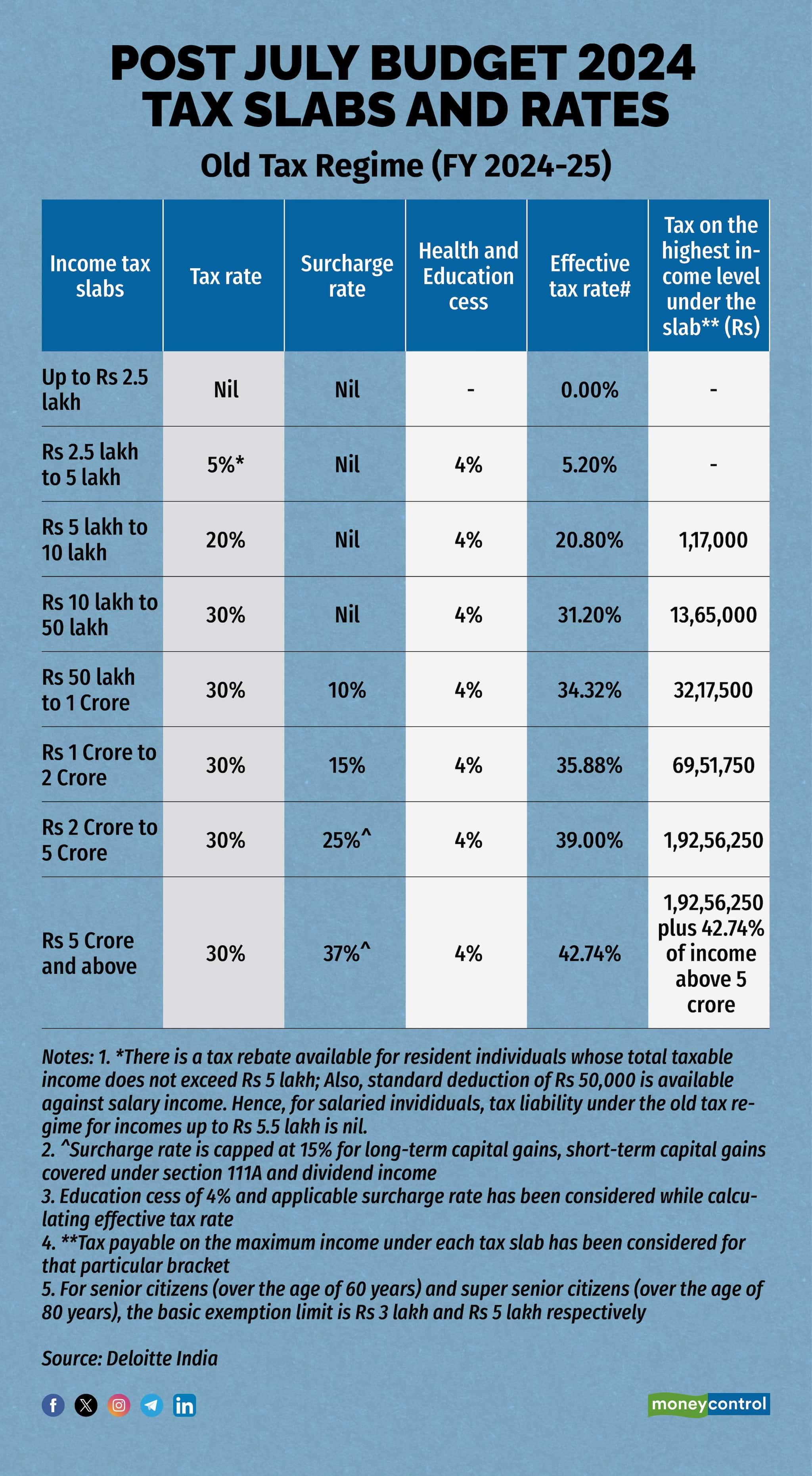

The tax rates and slabs under the old, with-exemptions tax regime will remains unchanged.

Status quo for the old tax regime: FM reiterates intention to look past the with-exemptions tax structure

Status quo for the old tax regime: FM reiterates intention to look past the with-exemptions tax structure

She also promised measures to simplify tax regime for individual income tax-payers, in line with measures taken over the years, especially introduction of the new, simplified tax regime.

Reiterating the government's focus on simplifying tax structures and rules, she said that more than two-third personal tax-payers have availed of the new tax regime in financial year 2023-24.

Nirmala Sitharaman said that the finance ministry will undertake a comprehensive review of the Income Tax Act to ensure that it is easy to understand, which will reduce the scope for disputes and litigations. The process is expected to be completed in six months.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.