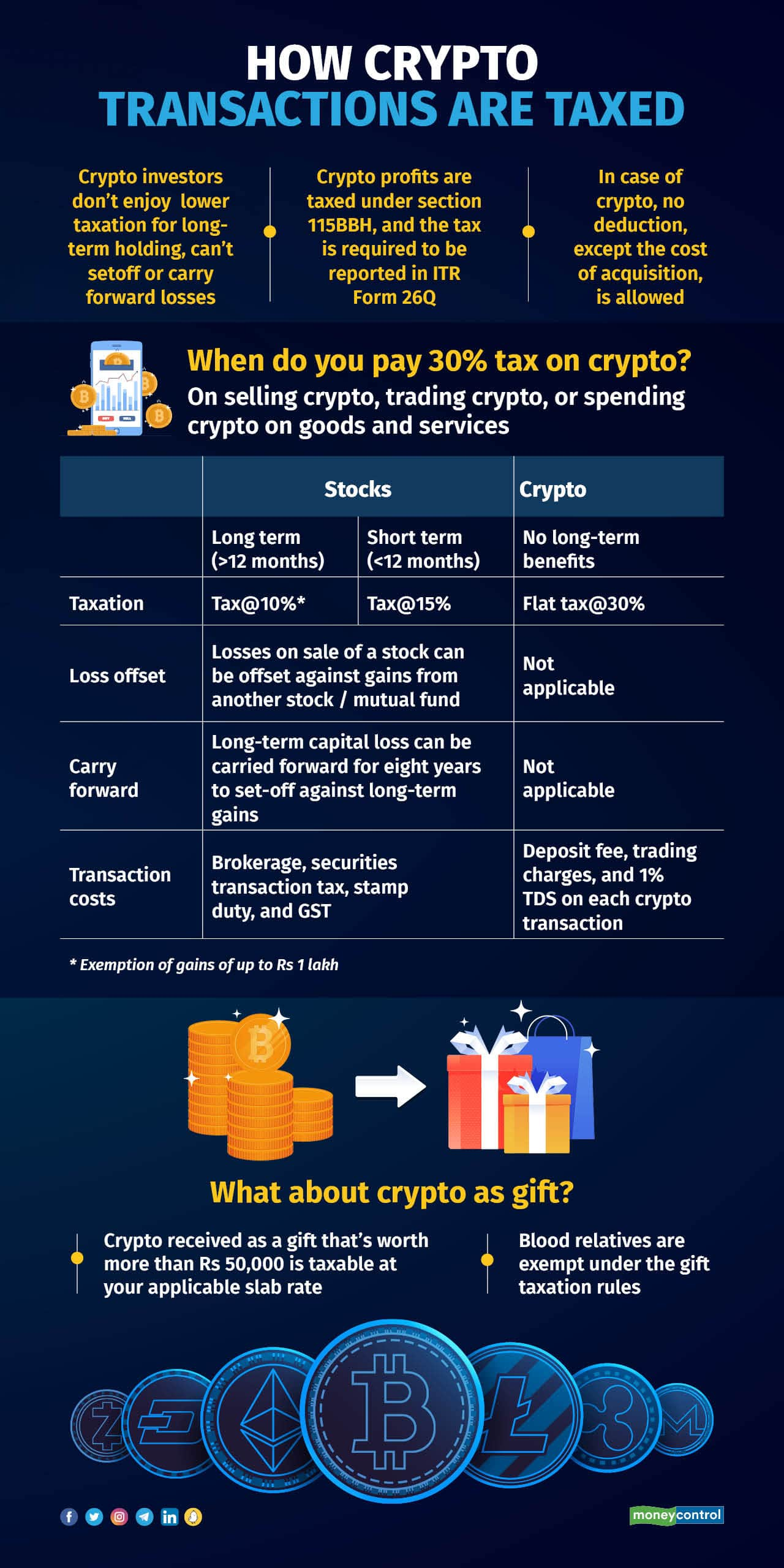

Budget 2022 dealt a body blow to the booming cryptocurrency market in India, imposing a 30 percent tax on income or gains arising from such transactions. In addition, it also directed cryptocurrency exchanges to withhold 1 percent TDS (tax deducted at source) on such transactions.

Taxpayers’ compliance hassles shot up, as a result. If you have dabbled in crypto transactions, not only will you have to report the gains or income therefrom during the financial year 2022-23 in your income tax returns, a detailed disclosure of all your trades will have to be made under a separate VDA (virtual digital assets) schedule. “This includes not only cryptocurrencies, but also non-fungible tokens (NFTs),” says Avinash Polepally, Senior Director, CryptoTax Business Head, Cleartax.

Also read: Moneycontrol's definitive ITR filing guide for FY 2022-23

Budget 2022’s impact on crypto transactions

Finance Minister Nirmala Sitharaman’s budget announcements on February 1, 2022, dulled the lustre of cryptocurrencies in India. “Globally, crypto exchanges have recorded a drop in trading volumes as the markets have turned bearish since mid-2022. In India, however, the drop has been more pronounced due to the TDS that came into effect on July 1, 2022,” says Vimal Sagar Tiwari, Co-founder and Chief Operating Officer, CoinSwitch.

“We saw a steady decline in trading volumes (~90 percent, on-year). Most users have hedged their investments with stablecoins (that are backed by fiat currency, gold, etc), and adopted a wait-and-act approach commonly seen among retail investors,” says Shivam Thakral, CEO of BuyUcoin, a digital asset exchange.

Yet, greater scrutiny and compliance requirements have had a positive impact too. “This shift has paved the way for increased institutional involvement, as clearer taxation guidelines have instilled confidence and attracted mainstream players to the crypto market,” he adds.

Also read: Will BlackRock’s spot Bitcoin ETF breathe life into the comatose crypto market?

ITR-2 or 3?

If you are a salaried employee with income less than Rs 50 lakh, you will have to file returns using ITR-2, not ITR-1. That is, if you choose to treat crypto gains as capital gains. “The taxpayer will have to decide whether she wants to treat this as capital gains, or income. If you decide to treat the crypto earnings as income, then ITR-3 is the form for you, even if you have no other business income,” says Mayank Mohanka, Partner, SM Mohanka and Associates.

Reporting capital gains on crypto transactions is fairly simple — the difference between your sale price and cost of acquisition will count as capital gains, and be taxed at 30 percent.

If you have made losses, you cannot set them off against gains made from the sale of any other capital asset, like mutual funds or even VDAs. “Investors cannot set off losses on one VDA against gains from another. For example, if a person makes a profit from his Bitcoin holdings but makes losses on Ethereum, he will have to pay taxes for the Bitcoin gains, and can’t set that off against the losses he made on Ethereum,” says Polepally. However, you can claim the TDS withheld when filing your return.

“For many Indian investors, the government has already collected TDS of 1 percent. Filing taxes is especially important if you have made losses, to get your tax refund,” he adds.

Also listen: Tax filing: Wrong ITR form, faulty disclosure of crypto gains, foreign assets could land you in a soup | Simply Save

Crypto as business income

Tax computation can be quite complicated when crypto earnings happen to be your business income — for instance, if, for services rendered, you accept payment in the form of airdrops or NFTs.

“The compliance norms around that involve two levels. One is that you're part of the commercial income tax regime because you're getting paid for your services, which means that the person that's paying you has to also worry about GST compliance. And your receipt of those payments also has to comply with GST norms,” says Indy Sarker, Co-founder of TaxCryp, a crypto tax compliance firm.

Once you receive this crypto asset, you will have to figure out the ‘cost of acquisition’ in terms of the value of services you have rendered. “This is one area where there’s some uncertainty, and tax advice is recommended,” he adds.

Punit Agarwal, founder of crypto taxation platform KoinX, says that professionals accepting crypto as payments will have to pay tax on its market value at the time of receipt. “The tax rate will be as applicable to the business,” he says.

Experts point out that taxation rules around treating crypto receipts as business income are not clear. “When professionals get crypto in their account, it should be treated as other income or business income, with 30 percent tax on the same. If the crypto coins are held post the income date and sold thereafter, then the individual is supposed to report capital gains or losses based on whether the sale price of the coin is higher or lower than the price of the coin on the income date,” says Polepally.

Airdrops involve sending tokens to individual wallets, either by way of promotion, or in exchange for a small service. They are assumed to have zero cost and 30 percent tax is to be paid on the price at the time of selling. NFTs, on the other hand, are non-fungible and it is difficult to determine their market price. “If you have made gains/losses on the sale of an NFT, you report the same and file taxes accordingly: 30 percent for gains, and nothing for losses,” explains Polepally.

Crypto exchanges’ helping hand

Not only is the tax jolt to crypto enthusiasts hard, the procedure to file returns is tough too. This is why many cryptocurrency exchanges have attempted to ease the process for their customers. “We have introduced detailed transaction history records, which provide investors with comprehensive data on their trading activities,” says Jaideep Yadav, Founder of Kandle, a GameFi firm. In GameFi, users get paid in VDAs (crypto, NFTs, etc) for playing games.

Coinswitch provides its users with TDS and detailed profit and loss reports for the transactions made in a financial year. Likewise, BuyUcoin users can access their transaction history, account statements, tax calculators, and download tax reports.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.