Indian crypto investors are on the sidelines, waiting for signs of a revival in prices of their digital assets. They seem to be headed for a tough ride, though, at least in the first half of 2023.

The digital asset market will need more time to recover from a series of setbacks, including bankruptcies, frauds and crash of asset prices amid increased surveillances by governments around the world, including India’s.

After witnessing exponential growth in 2020-21, the global crypto market came to a standstill in 2022 with many events bringing attention to the industry's flaws.

Crypto market capitalisation started reversing from the final weeks of 2021 after reaching an all-time high of $3 trillion on November 10, 2021. On November 21, 2022, the market capitalization of cryptocurrencies fell to a 2022 low of $727.58 billion.

“In 2021, a lot of serious investors, such as high net-worth individuals (HNIs) and institutional players, were planning to enter crypto. That process has slowed down, not just because of the bear market, but also because of the catastrophes that we experienced during the last eight months or so starting from Luna, Celsius, Alameda Research, FTX and Genesis to Gemini,” said Anurag Dixit, founder of Kunji, a crypto asset management platform that offers predefined investment strategies that are actively managed.

The year that was

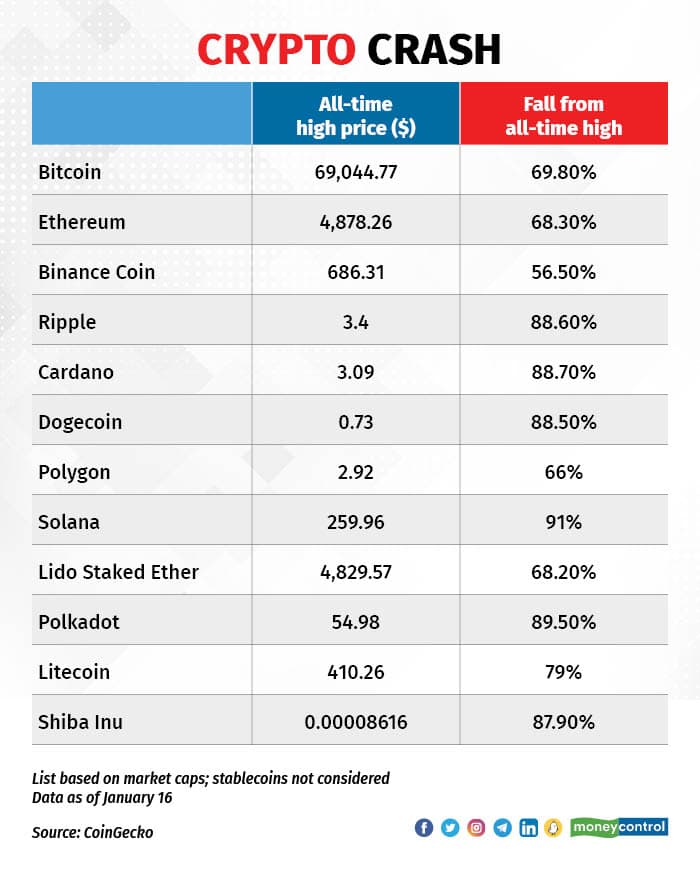

Data shows that 2022 was the second-worst single-year performance for Bitcoin since 2011 in terms of both year-on-year (-64%) and decline from an all-time high (-74%).

Also read | Check out Moneycontrol’s curated list of 30 investment-worthy mutual fund schemes

Crypto assets have been a victim of worries over inflation and interest rates after the Ukraine-Russia war broke out. The problems aggravated with the downfall of Terra Luna in May.

According to Kunji, while the initial impact of Terra Luna’s collapse was immense, the downfalls and bankruptcies of crypto entities that followed it were catastrophic, and the fallout from the recent FTX-Alameda collapse was almost unforeseen.

“It wasn’t just a downfall but an enormous breach of ecosystem-wide trust,” it said in a recent report.

The downward spiral in cryptos began in November 2021 as expectations of the US Federal Reserve focusing on interest rate hikes, inflation and tapering asset purchase triggered a risk-off on global assets.

Many crypto lenders including BlockFi, Three Arrows Capital, Voyager and Celsius Network were part of the collateral damage to the crypto market crash in 2022.

Cryptocurrencies suffered some sizable losses. Cardano (ADA) fell by 85 percent and Solana (SOL) by 94%. Both dropped out of the top ten cryptocurrency rankings. The original altcoin (an alternative digital currency to Bitcoin), Ethereum (ETH), lost 68% of its value year-on-year.

Crypto regulations: Impending threat or unavoidable reality?

In India, the central government has been sharpening its gaze over cryptocurrencies, thanks in part to the terror financing that the crypto world confronts. Pending the Cryptocurrency Bill that the government wanted to introduce around the end of 2021, but didn’t, it taxed virtual digital assets (in other words, cryptocurrencies, non-fungible tokens and so on) in Budget 2022. That added to the misery of crypto investors.

To be sure, Reserve Bank of India (RBI) Governor Shaktikanta Das has also repeatedly warned against the ill-effects of increased use of cryptocurrencies.

In the 2022-23 union budget, the government had said that gains arising out of crypto assets would be taxed at 30 percent irrespective of the individual’s income tax slab rate.

Further, the losses from one crypto can’t be adjusted against gains from another and no carry-forward of losses to future years is allowed.

In addition, a 1 percent Tax Deducted at Source (TDS) was made applicable on each transfer of such assets.

“After the taxation came from April 1 last year, interest in crypto has died down, volumes have died and then this crash also happened in prices. There is a sense of bottom-fishing happening, but it's not a very confident one,” said Amit Kumar Gupta, founder and CIO, FinTrekk Capital.

All eyes on Budget 2023

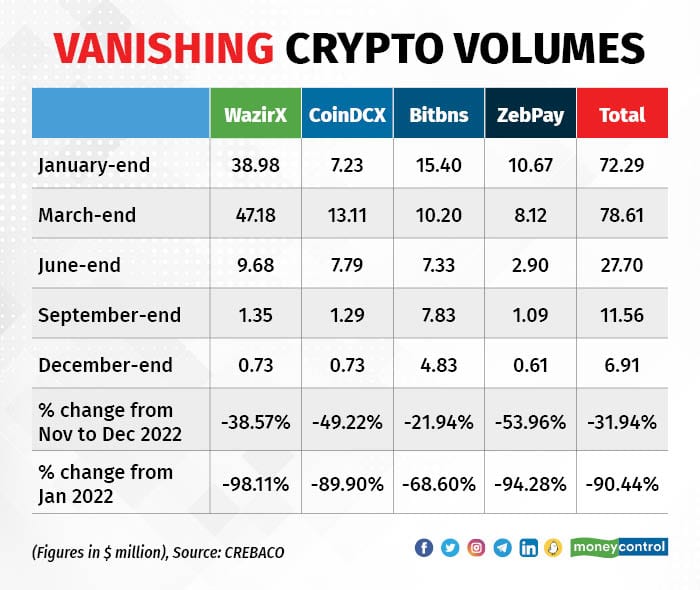

The crypto industry in India came down crashing in 2022 with trading volumes plummeting around 90 percent on domestic exchanges on the back of up to an 90 percent drop in asset prices and the new taxation policy for crypto assets.

Experts say that the high rate of TDS, which was introduced to track crypto assets’ movement, has pushed transactions offshore.

According to recent research by Esya Centre, a Delhi-based technology policy think tank, Indian investors shifted over $3.8 billion in trading volume from local to international crypto exchanges after the new taxation policy was unveiled.

Now, investors are hoping that Budget 2023-24 provides them some relief.

Meyyappan Nagappan, partner-tax, at Trilegal, a law firm, believes that lowering of the TDS is a much-needed step and there is a likelihood that we may see some clarifications on the treatment of cryptos.

“Since the government sees value in blockchain technology and with India well positioned to be the global Web3 hub, it is hoped that the right signal is sent to the market by rationalizing the tax regime for crypto and digital assets. Narrowing and clarifying the scope of virtual digital assets along with ensuring digital assets are treated on par with tangible assets would go a long way in giving confidence to investors and developers,” said Nagappan.

Some experts don’t see any change in crypto taxation in the upcoming Budget.

“We don’t see much relief in the Budget this year as the impact of the announcements of the last Budget would be visible this year only,” said Sidharth Sogani, founder and CEO of CREBACO, a crypto research firm.

2023 forecast for cryptocurrencies

Experts say that investors who entered cryptos in 2021 are sitting on losses. They do not want to book the losses and also seem hesitant in adding to their positions.

A study conducted by the Basel, Switzerland-based Bank of International Settlements, between 2015 and 2022, estimated that 73-81 percent of investors lost money on their investments in crypto assets.

However, the crypto market has begun the year on a promising note with the price of Bitcoin topping the $21,000 level for the first time since November 2022.

BlackRock, the world's largest asset manager, entering the crypto arena is seen as a major boost to the sector. The asset manager adding Bitcoin as an eligible investment in its funds could accelerate the token’s institutional entry into the global market.

Kunji’s Dixit believes that right now in India there are mostly retail players. “We expect institutional players to come in when there's probably more clarity from a market stability and regulatory uncertainty point of view,” he said.

In India, the Web3 industry has set an ambitious goal of becoming a global hub for Web3, blockchain, and crypto innovation over the next five years, with the potential to contribute over $1 trillion to support India in achieving its goal of becoming a $5 trillion economy.

Eye on the Fed

“Notably, the trend of crypto adoption and institutionalization has grown and we anticipate that the movement towards DeFi and self-custody will accelerate in 2023 as users look to secure their assets,” said Sumit Gupta, Cofounder and CEO, CoinDCX, a crypto exchange.

DeFi is short for decentralised finance.

One major sign of reversal of the crypto outlook could be the US Federal Reserve stopping interest rate hikes.

“What has happened is that bonds are giving good money. Till the risk appetite comes back, I don't think crypto will see any major buying, at least not in the first half of 2023,” said FinTrekk Capital’s Amit Kumar Gupta.

In terms of prices, Bitcoin may have broken the $21,000 level recently, but sustaining above this zone will be key for the crypto bulls.

Wall of worries

“The market is expected to remain sideways till second half of the year. At most on the upper side, BTC is likely to hit $21,000-23,000 and on the lower side it could be $12,000-13,000 levels. For the next six months, I don’t see either of these levels breaking,” said CREBACO’s Sogani.

After several landmine events in 2022, the crypto market continues to climb a wall of worries. Fresh insolvencies, accelerating inflation and Covid-19’s comeback (at least in China so far) have the potential to cause considerable moves to the downside.

While 2021 was a breakout year for crypto, 2022 tested the resolve of investors. Experts feel that 2023 will likely be a make or break year for cryptos.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.