The last date to file your income-tax returns is July 31 and that is just a few days away. Most taxpayers find filing income tax returns to be a tedious affair, replete with the risk of committing errors. However, starting early is an antidote to the last-minute filing stress and mistakes that can invite notices from the income tax department.

Many salaried individuals have already received their Form-16, which is the key document needed to commence the tax return-filing process for the financial year 2022-23 (assessment year 2023-24)

Once you get hold of your Form-16, you should log on to the income tax e-filing portal to access the right income tax return (ITR) forms. Here’s a guide to selecting the one applicable to you.

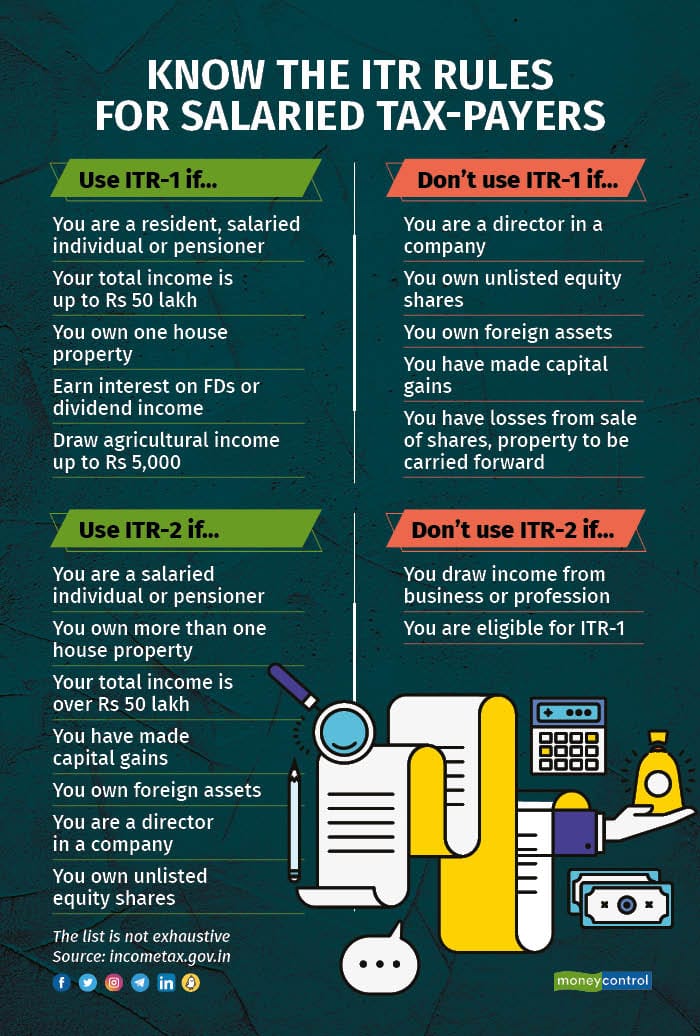

To start with, you need to select your ITR forms – the one relevant for you depends on several factors including the residency status, sources of income, your total income during the year, assets that you own and so on.

For salaried taxpayers, ITR-1 and ITR-2 are the relevant forms.

“Before choosing the form, check your Annual Information Statement available on the e-filing portal. This will display income like capital gains and interest income that you may not have accounted for,” says Chetan Chandak, Director, TaxBirbal, a tax consultancy firm.

Also read: ITR filing mistakes: Common errors to avoid while filing income tax return for FY 2022-23

Changes in ITR forms for assessment year 2023-24Besides the regular details on your salary, bank accounts and interest income, this form needs certain additional disclosures this year in ITR-2.

From April 1, 2022, gains made from transactions in virtual digital assets (VDA) attract tax. Transactions in assets such as cryptocurrency and non-fungible tokens exceeding Rs 10,000 attract tax deducted at source of 1 percent. You will have to make the disclosures in a separate VDA schedule. You will also have to make additional disclosures if you have been actively trading in the equity market.

Also read: New ITR forms require details of virtual digital assets, share trading

This form is meant for resident individuals with income from salary (or pension) of up to Rs 50 lakh, who own one house property and earn fixed deposit interest and dividend income. Agricultural income, if any, should not be more than Rs 5,000.

If you use the official e-filing website to file returns, you can download the Excel utility, enter the required information and upload the file to submit returns.

You can also file the returns directly on the portal through the online mode. A lot of data is pre-filled, as the income tax department has access to your financial transactions, but ensure that you verify all the information before proceeding.

“Many people do not report interest income or dividend income correctly. This data goes to the I-T department from the banks, so it will reflect in your AIS. If you fail to report the income, it will attract an intimation from the tax department and you may be required to file revised return,” says Chandak.

Also read: Getting started with I-T return filing? Verify your Form 26AS and Annual Information Statement first

Salary more than Rs 50 lakh? Use ITR-2Salaried individuals can also use ITR-2, which is meant for tax-payers with relatively more complex financial dealings. Put simply, you have to use this form if you do not have any income from business or profession and are not eligible to file returns through ITR-1. For instance, if your total income is over Rs 50 lakh, you cannot file returns using ITR-1.

Likewise, if you have sold equity shares, mutual fund units or property to net capital gains, you have to use ITR-2, not ITR-1. ITR-2 is the form you have to select if you own assets abroad or are a director in a company. “If any resident taxpayer has any foreign bank account, ESOP or other securities account, they have to compulsorily file the return in Form ITR-2 and report these assets in Schedule FA. Failure to report could result in severe penalties,” says Chandak.

Also read: Your guide to filing income tax returns

Filing returns using the wrong form will invite noticeIf you were to use the wrong form to file your return, it will be considered ‘defective.’ For instance, if you have capital gains and yet use ITR-1, it will be seen as non-disclosure of all income sources. The income tax department could ask you to file revised returns and failure. If you do not do so in time, your return will be treated as an invalid one.

“The taxpayer will get a chance to rectify the defective return within 15 days of intimation. Still if he does not, then the return would be treated as invalid, as if not filed. Thereafter again on receipt of a notice from the officer, one gets a chance to file the ITR but with penal consequences,” said Vivek Jalan, a partner at Tax Connect Advisory, a multi-disciplinary tax consultancy firm.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.