Wealth management is not only about generating returns. While that is one of the most important components, it is equally important to manage risk so that wealth is available for use when you need it. So, a critical question is how much do you need or how do you calculate the monetary value for a goal?

Goals differ across individuals and money needed to fund them also varies across people. However, there are some guiding principles on how much is enough. The same principles are applicable to risk mitigation tools (such as term insurance). In this piece, I am going to focus on the question – how much is enough for term insurance?

Determining the ideal term cover amount

What is term insurance? It is a life insurance product which offers financial coverage to the policyholder for a specific time. In the case of death of the policyholder, the cover amount is paid to the nominee of the policyholder. This is often a very useful risk mitigant if a bread earner is no more before some of his/her goals (which need to be met irrespective, such as children’s education) are adequately funded. Further, the question always arises - how long should the coverage be?

A guiding rule of thumb for term insurance when taken for specific goals is that: a) It should be the value of the goal less the money already allocated to this goal (through investments) and b) the term insurance cover should cease once the goal is met.

Let’s take the case of Manish* (aged 36 years) has one kid – Ahaana* (who is an 8-year-old). He is planning for her education in an overseas university once she turns 18. He estimates that he would need Rs 4 crore for funding her education (undergraduate and postgraduate) and would need these funds in ten years’ time. Manish has been aggressively saving for this goal and has already saved Rs 1 crore towards this goal.

Meticulous term insurance coverage planning can help optimise benefits, reduce premium outgo

Meticulous term insurance coverage planning can help optimise benefits, reduce premium outgo

This is simplistically taking a term cover for the gap so that even if something adverse were to happen today, funds would be available for this goal. The insurance amount received should be invested back to a low-risk investment avenue which beats the education inflation rate.

However, he would continue to invest during these 10 years towards this goal. So, by the latter part of this period, he would have already covered part of the liability and may end up having excess insurance (for which you may be paying a premium).

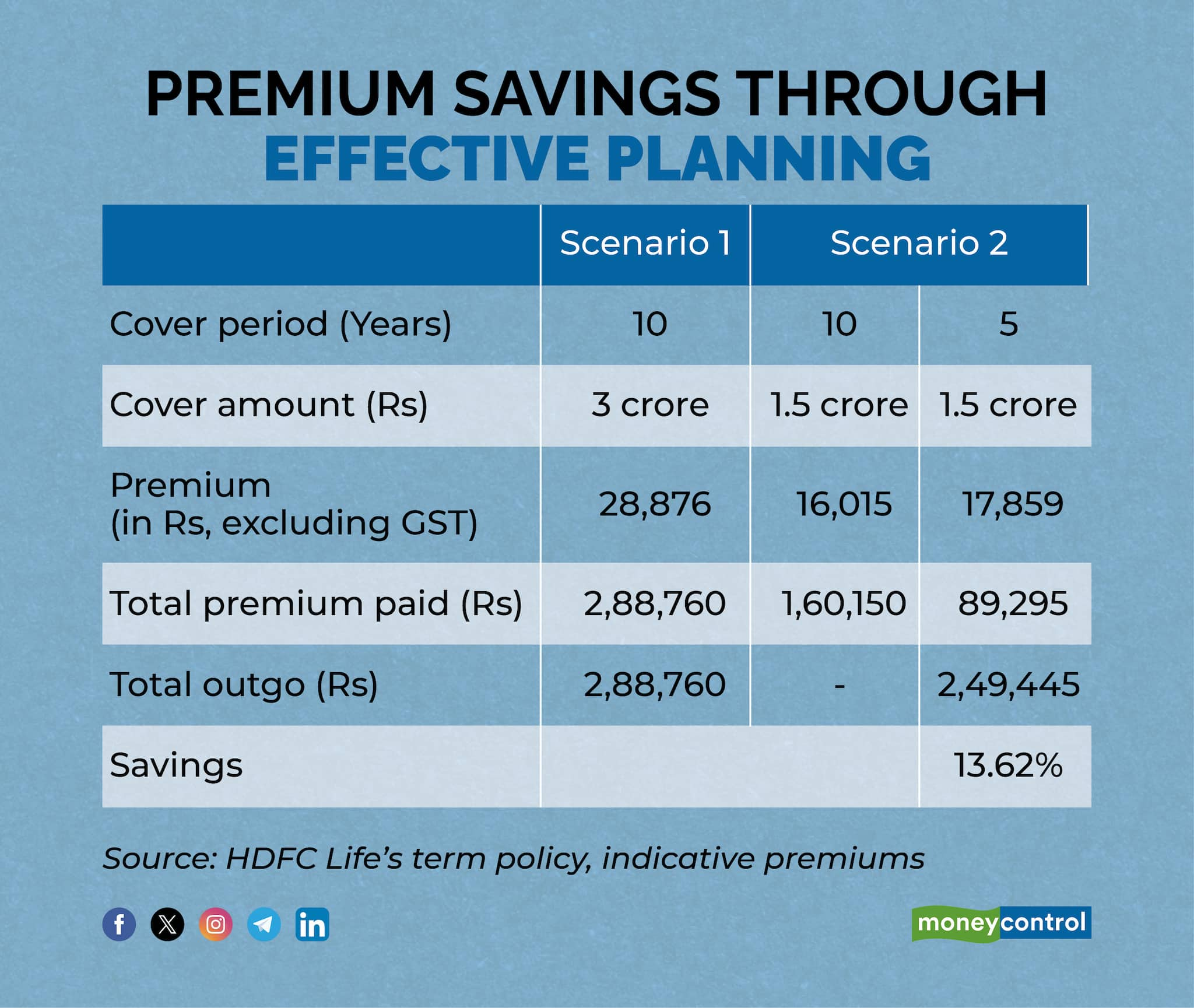

Assuming the policyholder survives for another five years, then his savings should add another Rs 1.5 crore to the investment basket for this goal, the insurance cover should reduce to that extent. So, your gap in savings at that point in time may be Rs 1.5 crore. So, if he had taken two term plans – one of Rs 1.5 crore for 10 years and another one of Rs 1.5 crore for five years, then the term plan for five years will mature then, and the premium outgo will reduce at that stage.

Split term coverage across goals to save on premiums

Split term coverage across goals to save on premiums

Also read: Want to take out a life insurance policy? Here are the term plans on offer

This could theoretically reduce premium by 10-15 percent (in this example, approximately Rs 40,000 over the life of the policy in absolute terms). The reduction is due to fewer number of years of premium payment for the Rs 1.5-crore policy.

For simplicity, we have not factored in a) higher mortality charges if insurance is for longer tenors; and b) time value of money. This is only for illustration purpose, considering all things equal and premiums would need to be calculated for each individual and could be different. Actual premium would depend on many factors including, but not limited to, age and health of the life insured at the time of taking the policy.

Manish would need to balance the complexity of taking multiple policies with the benefit of reducing premium payment in later years due to investment pools building up. In the above example, if anything happens to Manish in the first five years, the entire Rs 3 crore will be available to cover the education costs of Ahaana. However, if he survives five years and can build the investment corpus for this goal to Rs 2.5 crore in this timeframe, his insurance cover will automatically drop to Rs 1.5 crore (balance amount), reducing his term premium payment.

Also read: Term insurance: A delay in buying can cost you dearly

Holistic assessment of future goals important

Manish may have several other goals which he may believe are important for his family. These could include Ahaana’s wedding or providing for the retirement corpus for his spouse even if he is not there. These could also be for his liabilities (e.g. home loans etc.). He would need to assess term plan requirements for each of these goals and aggregate them to arrive at his total insurance needs.

Not surprisingly, several of these goals would be overlapping in terms of time periods and the better he is able to a) articulate his goals, b) estimate his savings and c) keep a buffer because some of the above estimates could go wrong (i.e. have an omnibus buffer term plan over and above his specific goal-based policies), the more likely he would be able to get a clear view of this term plan needs in different phases of his life.

If he can plan and take term policies for periods aligned to these requirements, he may end up saving on term premiums in the later stages of his life without compromising on the end objectives of mitigating risk). Clearly, these thresholds would be unique to everyone.

*Fictitious names used for the purpose of illustration

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.