International funds have been on a joy ride over the past few years. Specifically, in 2019, of the 471 funds ranked on the basis of their returns during the year, the top 12 were international schemes. Be that as it may, should you jump into the bandwagon and start investing in overseas funds? You may, but return expectations need to be tempered.

Robust performance

According to Value Research, international funds as a category delivered 13.38 per cent over the last one year. Compared to the 14.05 per cent returns that multi-cap funds gave, this performance may look unattractive. But international funds come in various hues. Look closer and you’ll see that funds investing in the US markets did phenomenally well last year. US-focussed international funds gave 26-38 percent returns in 2019.However, the performance chart is headed by Edelweiss Greater China Equity Offshore Fund with 45.74 per cent return in 2019.

Investing overseas

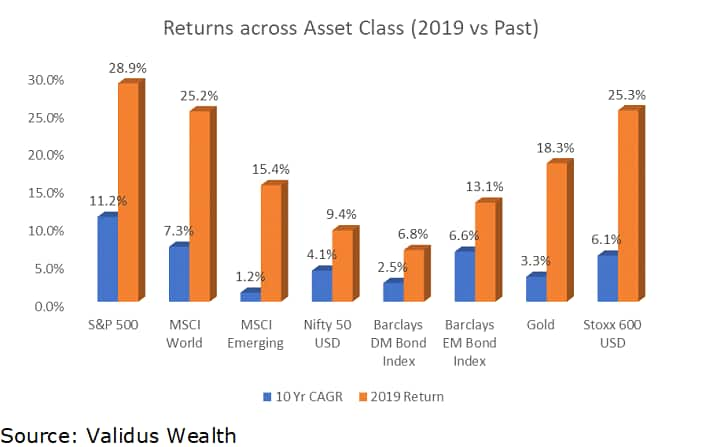

Central bankers worldwide cut interest rates last year to spur growth. It resulted in strong rally in both bond and stock markets. “With a significant amount of developed market debt trading at near zero yields, there is not enough room for further easing in rates and equity markets are already trading at above-average valuations. It is unlikely that this performance would sustain in 2020,” says Rajesh Cheruvu, chief investment officer, Validus Wealth.

“Though you should be diversifying overseas using international equity funds, if you are going to invest in US-focussed equity funds going by their returns in the last one year, then it is highly likely that you will be disappointed,” says Ashish Shanker, head investment advisory, Motilal Oswal Private Wealth Management.

Put simply, investors must moderate their return expectations from mutual fund schemes investing overseas – especially USA focussed funds.

Of course, there is the benefit of diversification. “When the Indian equity markets do not do well, there is a fair chance that markets overseas may be doing well,” says Vikas Gupta, chief investment strategist, Omniscience Capital.

Investing in diverse geographies help to reduce risk. “By investing overseas, investors can ring fence the portfolio from local issues that sometimes affect the Indian economy, which in turn destroy the returns,” said Deepak Chhabria, founder and managing director of Axiom Financial Services.

Given that India is still import dependent, the rupee-dollar exchange rate becomes important.

to benefit from the global themes, you should invest some part of your equity portfolio in overseas markets. If you are likely to spend on dollar-dependent goods and services, the best way to protect yourself is to allocate some of your funds to dollar denominated investments.

Where should you invest?

There are many themes and industries that cannot be found in Indian equity markets. For instance, a lot has been talked about the disruption caused by technological advances. In Indian markets we do not get access to themes such as search engines, e-commerce, artificial intelligence, internet of things. If you invest in developed markets, you get to invest in companies that operate in such emerging themes.

Low correlation with developed markets also helps to bring down portfolio volatility, especially when panic sets in. For example, S&P 500 index fell 38.5 per cent in 2008 when Nifty 50 index halved. Though investing overseas can be a good idea, low familiarity with global markets can be a big impediment for most investors. It is better to invest through regulated products such as mutual funds. “Low-cost index funds and actively managed funds investing in US equities are effective tools to invest overseas,” says Shanker.

“Indian investors have exposure to one of the best emerging markets – India to begin with. Hence they should be investing in the developed markets. Start with the US,” said Gupta. It is better to invest in a staggered manner.

Investors should avoid investing in thematic funds investing overseas. These themes include commodities, energy, agriculture, consumer, real estate, gold mining and technology. Chhabria points out that investors may not manage to time the entry and exit well.

How much to invest?

Some experience in domestic investing would help, before you take the overseas route. Your portfolio size and your investment needs should dictate the allocation to global stocks. If you have financial goals such as funding the education of your kids abroad and foreign vacations, you can have exposure to overseas stocks. “You can invest up to 20 per cent of your equity portfolio overseas,” Cheruvu says.

Invest through systematic investment plans. Aim for minimum five per cent exposure to international markets, say experts.

Beware of risks

Though investing in overseas markets gives diversification to your portfolio, there are risks. Issues in the geographies in which you have invested will influence your returns. For example, the recent Corona virus problem is expected to hurt the Chinese economy.

Currency fluctuation is also a risk. Adverse currency movements can eat into your returns. Factor in rupee depreciation against the dollar into your return expectation.

Though international mutual fund schemes invest in stocks, they are treated as debt funds for the purpose of taxation. Capital gains earned on units held more than three years are taxed at 20 per cent after indexation benefit. If redeemed earlier, the capital gains are taxed at the slab rate of the investor.

Invest around 5-10 percent of your corpus in international funds. International funds can be considered once your domestic portfolio is well-diversified.

The 40% consumption and currency risk argument should be elaborated a bit and a lot simplified.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!