The travel season is upon us, with Diwali a few days away and Christmas later in the year. There’s a new travel–focused credit card that aims to reward those with wanderlust. ICICI Bank has come out with a co-branded credit card with MakeMyTrip (MMT).

The card has been launched as a dual-network proposition, providing cardholders two separate physical cards – one powered by Mastercard and the other by RuPay network – issued simultaneously at the time of onboarding.

On the RuPay network, the card can be linked to UPI for a range of online payment options and earn reward points (called myCash).

What’s on offer?

As welcome benefits, the card offers a Rs 1,000 MMT voucher and a complimentary MMTBLACK gold membership valid for 12 months.

MMTBLACK is a MakeMyTrip loyalty programme that offers customers 24x7 support, additional privileges such as upgrades, discounts and cashbacks on flight and hotel bookings.

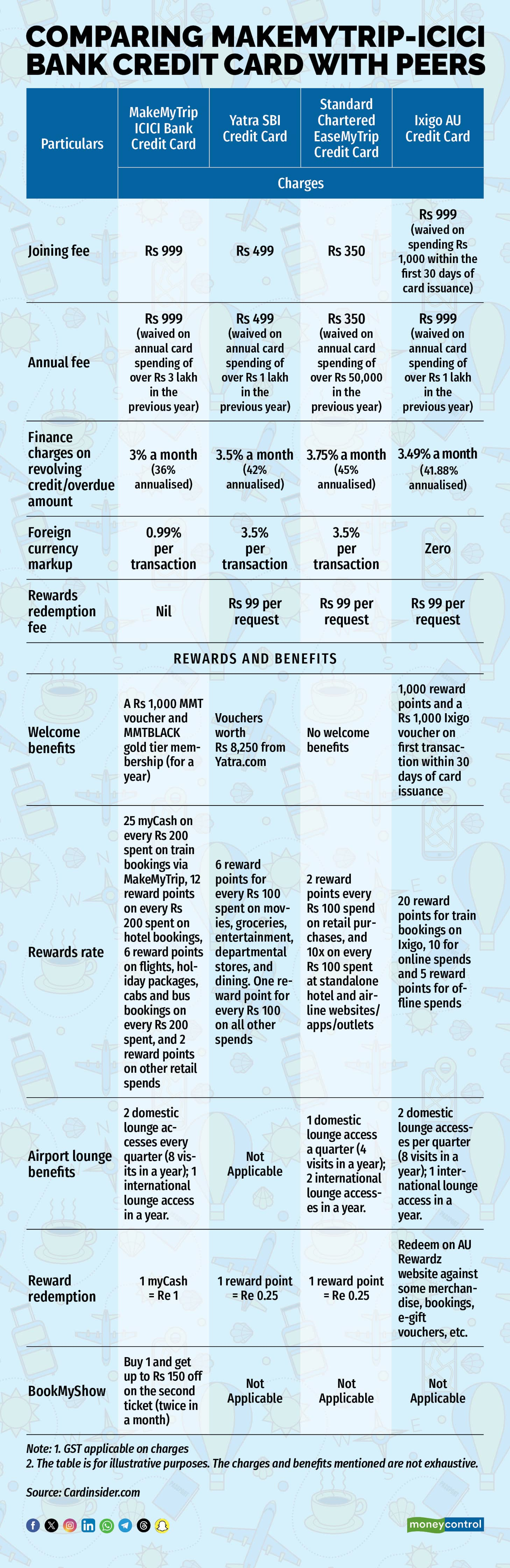

This card offers 25 reward points on every Rs 200 spent on train bookings via MMT, 12 reward points on every Rs 200 spent on hotel bookings, 6 on flights, holiday packages, cabs and bus bookings on every Rs 200 spent, and 2 reward points on other retail spends.

Reward points are not awarded for rent payments, cash withdrawal from ATMs, fuel and other transactions for commercial purposes.

The good news is that the reward points don’t expire.

The primary cardholder is entitled to premium travel benefits, including eight complimentary domestic airport lounge visits a year (two per quarter) and one international lounge access in a year.

Cardholders can reap the benefits of a buy one, get one free movie ticket offer twice a month through BookMyShow or INOX, with discounts capped at Rs 150 for the complimentary ticket.

Charges

There is a joining fee of Rs 999. There is an annual/renewal fee from the second year but this can be waived (check the graphics). Those who cannot meet the spending requirement will have to pay the annual charge but will receive a Rs 1,000 voucher from MakeMyTrip.

Interest charges on the overdue amount or revolving credit are 3 percent a month (36 percent annualised).

What works

The cardholders get enhanced network flexibility with Mastercard and RuPay.

With a 1:1 redemption ratio (1 reward point = Re 1), this card offers greater reward value compared to its competitors.

With MMTBLACK gold membership, cardholders enjoy enhanced travel privileges.

"This loyalty programme provides additional discounts on food and ancillary spends, lowering overall trip expenses," Parijat Garg, a digital lending consultant, said.

Complimentary lounge access makes it a useful option for frequent travellers, bucking the trend of mid-range cards restricting lounge access with a minimum spending criterion in the previous quarter.

Card holders are charged 0.99 percent as a foreign currency markup fee on international transactions, which is low compared to the Yatra SBI Credit Card and Standard Chartered EaseMyTrip Credit Card.

“This is a significant benefit for frequent international travellers as it leads to additional savings,” said Ankur Mittal, co-founder of Card Insider, a credit-card tracking platform.

Also read | Dussehra and financial freedom: Lessons from Ravana’s arrogance, greed and overconfidence

What doesn’t work

The annual/renewal fee of Rs 999 is waived on annual card spending of over Rs 3 lakh in the previous year, which is much higher than other credit cards in this category.

Though the reward points never expire, their utility is restricted to MMT bookings. “This limitation may prove inconvenient for travellers who often compare prices across multiple platforms or prefer booking through other operators,” Garg said.

The card should have offered discounts for dining at restaurants and food-ordering apps, which would have made the card more wholesome, he said.

The number of international lounge visits is limited to one, a dampener for frequent international travellers.

Also read | No change in home loan EMIs as RBI keeps repo rate unchanged for 10th time in a row

Should you apply?

MMT is one of the leading travel booking companies, ideal for planning family trips, vacations, and weekend getaways.

With competitive prices and attractive deals on flights, hotels, cabs, and bus bookings, several travellers prefer MMT for bookings.

Designed for travellers, this co-branded credit card offers a suite of travel-specific features. “However, to reap the rewards, all travel bookings must be done via MMT,” Mittal said.

“Compared to co-branded airline cards, which tie benefits to a specific airline, this credit card offers more versatility," Garg said. The card offers broader benefits on travel bookings through MMT.

“Those already carrying premium cards with extensive travel benefits may not derive significant additional value from this card's rewards programme,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!