Bengaluru-resident Rajesh Navaneetham, now 56, spent three decades working in the corporate world before calling it a day at 49. He spent the last 14 years of his corporate life at Dell. Navaneetham says, “When I turned 45, I started thinking about my purpose in life. I was doing very well. I loved the company, but I felt all my time and effort was going towards fulfilling the company’s purpose.” The thought of retiring at 50 struck him at that time. He wanted to instead work for a social enterprise that solved social issues profitably.

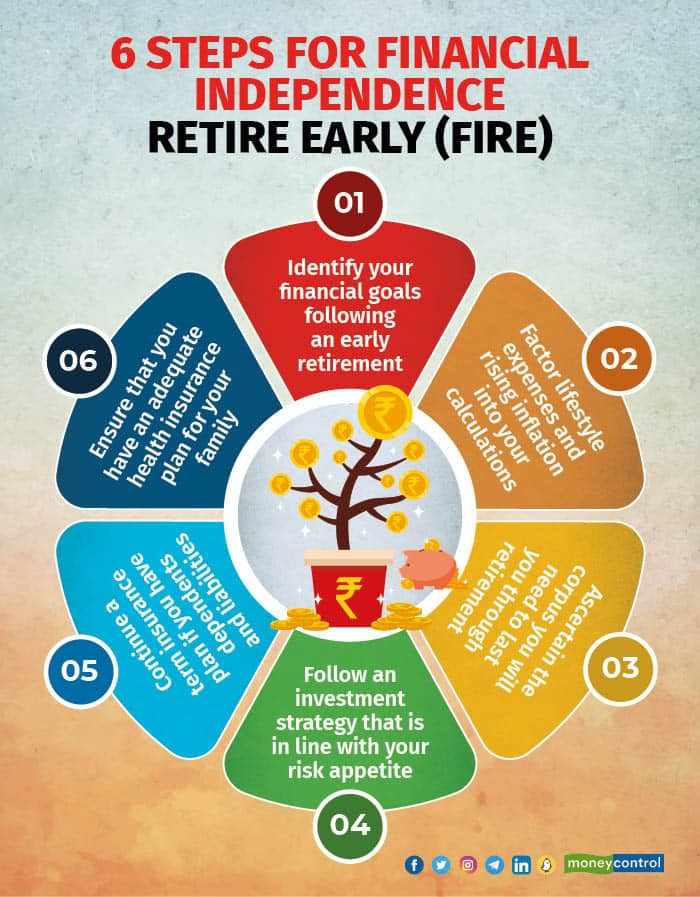

Navaneetham, however, did not take the decision on a whim. He is part of the growing tribe of individuals who are hanging their boots up early, but only after creating an adequate corpus and putting a sound financial plan in place. While contemplating early retirement, he consulted his financial advisor to make a life plan to help him achieve his goal.

“My financial advisor calculated a retirement corpus for me based on my financial goals so that I could leave my job by the time I turned 50,” says Navaneetham. At 45, he had a corpus, but that was not enough for early retirement. So, he started saving every month in a systematic manner. He built the required retirement corpus over the following four years and quit his corporate job at 49. “I would joke that I got permission to leave the job not from my employer but from my financial planner!” says Navaneetham. He also highlights that while still at Dell, he became a member of the Indian Angel Network and was introduced to social enterprises. This helped him prepare for what he wanted to pursue after retirement.

In another instance, S Natarajan, 54, a resident of Mumbai, retired early from Tata Motors. The spark for early retirement had been lit in October 2009, after the birth of a special needs son who would be dependent on him and his spouse for their entire life. After the birth, he thought of having a stress-free life by retiring early from the corporate world and living long for his son. To build the retirement corpus, he relied on his knowledge of financial planning. He planned to have the retirement corpus in place by 2023, when he would be 54. But by saving regularly and investing in a disciplined manner, he was able to build a sufficient retirement corpus two years before his deadline.

Rajesh Navaneetham, a resident of Bengaluru, retired at 49. He followed a template provided by his financial advisor to build a retirement corpus.

Rajesh Navaneetham, a resident of Bengaluru, retired at 49. He followed a template provided by his financial advisor to build a retirement corpus.

Factor in inflation, lifestyle and health expenses

Navaneetham was following a template given by his financial advisor to build his retirement corpus. This took into account different factors, such as the cost of foreign education for his daughter, her marriage expenses, maintaining his family's current lifestyle and planning for annual vacations. His advisor identified all these factors to arrive at the retirement corpus after consulting with him.

Natarajan, too, followed an Excel template prepared by him since 2002. Like Navaneetham, the plan accounted for his lifestyle expenses, inflation, healthcare, life expectancy estimates and the age by which the retirement corpus would be exhausted.

“There will be other factors that might come up as recurring expenses. For instance, house renovation, upgrading to a new car, etc. Therefore, these recurring expenses need to be factored in when you're thinking about your retirement corpus,” says Vishal Dhawan, Founder and CEO, Plan Ahead Wealth Advisors.

S Natarajan, a resident of Mumbai, retired at 52. He and his wife Revathy Natarajan take financial decisions jointly.

S Natarajan, a resident of Mumbai, retired at 52. He and his wife Revathy Natarajan take financial decisions jointly.

Steps to derive the required retirement corpus

Natarajan has listed all the actual expenses line by line in his excel template. This includes house rent, medicines, insurance premium, monthly groceries, vegetables, utility bills, entertainment, income taxes, etc. “It’s better to identify the actual expenses in the last couple of years rather than just going by round numbers while calculating your required retirement corpus,” says Dhawan. He adds, you need to build in some buffers, miscellaneous expenses, etc as a provision. Then try to understand which of these expenses will increase and decrease when you retire.

“A simple rule that you can apply is multiplying the number of years of retirement by your current expenses (also account for your goals, such as children’s education, marriage, etc.),” says Anup Bansal, Co-founder, Scripbox.

Also read: In your early 50s and nearing retirement? These 2 MC30 schemes can take you there

Systematic investment strategy the key

Natarajan built the retirement corpus of Rs 5 crore systematically. During his early years in the corporate job, he invested in a mix of debt instruments and equity assets. His investment portfolio comprised the public provident fund (PPF), voluntary provident fund (VPF) contributions, some mutual fund schemes and equities with a monthly outflow of around Rs 50,000. Since 2017, he has started focussing more on direct equities and started accumulating blue-chip and mid-cap stocks through his own research. In 2019, he encashed two real estate properties and added this amount to the retirement corpus. Post retirement, he has diversified the portfolio to include government securities, exchange-traded funds, equities and cash-component (savings account).

“You need to plan the portfolio strategy for the pre-retirement phase and the post-retirement phase,” says Dhawan. If you run a conservative strategy in both these phases, you may end up needing a larger corpus at retirement to support your living expenses, he adds. If you are comfortable with a more aggressive portfolio, the returns may be able to beat inflation over time. Therefore, the corpus required may be lesser.

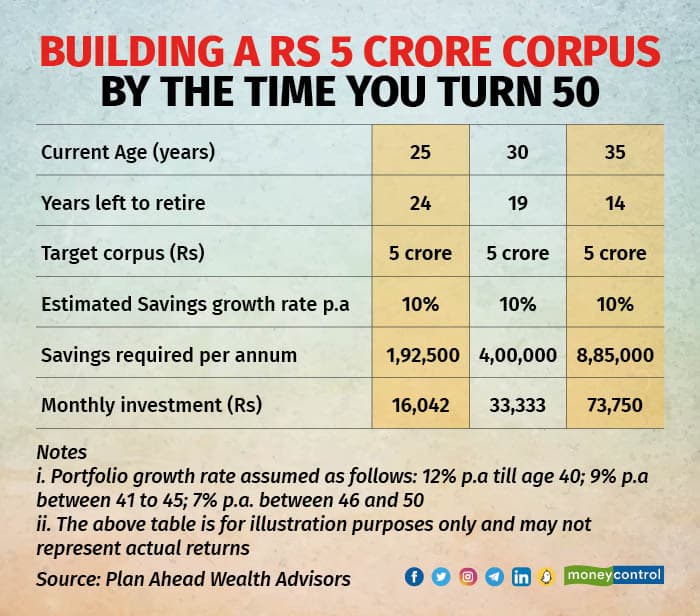

For instance, if you want to retire at 50 and the corpus required is Rs 5 crore, as derived through actual annual expenses, future goals and life expectancy of 85-90 years. Then, if you start saving at age 30, the monthly investment required is Rs 33,333 and if you start saving at age 35, the monthly investment required is more than double, at Rs 73,750 (refer to graphic).

“While building a retirement corpus, don’t take unnecessary risks and get swayed to invest in speculative investments, cryptocurrencies or exotic investments,” says Rishi Piparaiya, author and financial mentor. Keep the retirement corpus aside and don’t gamble with it in equity markets post-retirement, he adds, noting that if you lose it, you are not financially independent anymore.

Continue with your insurance plans

If you have anyone who's dependent on your income, then it’s important to continue a term plan. “It's not expensive, and it’s a good safety net to continue even after early retirement,” says Piparaiya. If you're going to have outstanding loans after your early retirement then, you need to continue the term insurance to cover the liabilities.

Adequate separate health insurance of elderly dependent parents and a floater plan, including your spouse and children, is very important, especially for anyone who's retired. For instance, Natarajan has health insurance cover of Rs 50 lakh, including spouse and children. He has kept a separate health insurance plan of Rs 20 lakh for his elderly mother.

Lifestyle changes post-retirement

It’s important to change your lifestyle after early retirement. “You shouldn’t buy a second car or a third car, or another house for investment/vacation purposes because you have no regular income coming in after early retirement,” says Piparaiya.

For instance, Natarajan sold his car. He is now saving on fuel, car maintenance and monthly driver expenses. He uses cab aggregator services to travel.

Also read: It's not too late to save for retirement in your 40s

Advice for people planning to retire early

“To plan an early retirement, take the help of a trusted (financial) adviser — it’s very important,” says Navaneetham. Spend enough time on finding your purpose in life and writing it down on paper, he adds, noting, “When we put pen to paper, it brings clarity, and it’s nice to share your idea with other people.”

“Focus on creating skill sets to start multiple income streams, including passive income post-retirement,” says Natarajan. Be progressive and don’t reduce expenditure, he adds. A financial plan is one prerequisite for early retirement. But you should also have a plan in place to fulfill your aspirations. Retirement is not a financial decision, it’s more of an aspirational decision. Back it up with strong financial support to ensure smooth sailing.

Bansal says there’s another important non-money aspect to early retirement that is often overlooked: “Retiring early from a job looks very appealing if you can afford it. But I have seen people getting depressed if they are suddenly left with not much to do.” It’s very important to think about how you are going to use your time meaningfully after early retirement, he concludes.

(With inputs from Maulik Madhu)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.