Many of us put off investments and savings till we reach our 40s. Then, we panic. A person in her 40s has usually worked for over 20 years but often enough, many find that they have not saved enough for their future. Many have this complaint despite doing well in their careers and earning a good salary.

While beginning the process of investing in your 40s isn’t ideal, it isn’t as bad as it may look at first either.

Better late than never

You need to play a bit of catch-up no doubt when you start late. But the good part is that there are quite a few things in your favour.

What works in your favour in your 40s? Let’s consider the example of my friend who is in this situation.

Most investors focus more on getting higher returns. But when you are just starting (even if you are a bit late to the investing game), 'saving more' is a lot more important than higher returns. This sounds counterintuitive but it’s true.

What to do if you start late

A typical person in her early 40s would still have nearly 15 more years to go in her corporate/earning career. This is a good enough a time period to have equity in her portfolio. So apart from the mandatory employee’ provident fund (EPF) contributions, it’s better to allocate the remaining surplus (or at least a major chunk of it) to equities.

Where to invest? Pick one or two large-cap index funds. If picking one, then go for either a Nifty-based or Sensex-based fund.

If you have a slightly higher risk appetite, then also include the Nifty Next50 index fund. Add one or two flexicap or large and midcap funds. That’s about it.

You can also consider having a pure midcap fund, international fund and a bit of gold allocation. But it’s not that urgent when beginning. These can come in a bit later.

Top up your SIP; invest bonuses, don’t spend them

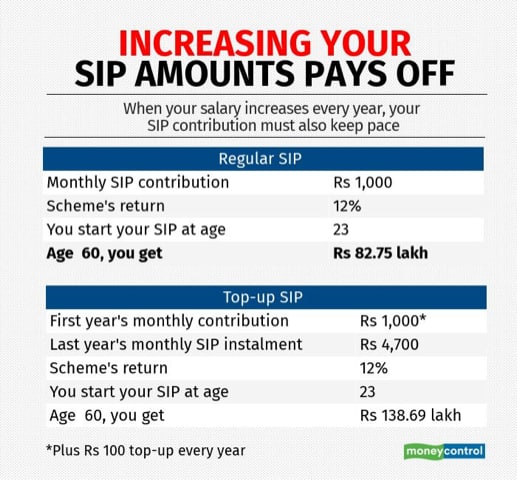

Make sure you keep increasing your regular investment periodically. Your income will (hopefully) increase every year. So why should your investments stagnate? Just try to invest a bit more every year by increasing systematic investment plan (SIP). You will be surprised how much larger your portfolio becomes eventually.

Make sure that in addition to regular monthly investments you also pump in your bonuses, incentives and other windfalls into your savings. Spending a bit of this extra money is perfectly okay. But a major chunk should go towards savings when you are starting late.

You might feel that if you are late, you need to take a lot of risks to compensate for the delay. That is not true at all. Taking on more risk doesn’t guarantee better results. It might in fact backfire big time. So don’t make that mistake.

Get yourself a financial advisor

The 20s or the 30s could be a good time to go on your own and invest directly. But when you are in your 40s, time is running out. Do not hesitate in talking to a good investment advisor.

DIY investing is glamorous to talk about. But if you are already late to investing, then you cannot afford to experiment a lot and go wrong. You have less time so you need to be a bit careful. Talk to an expert if you have doubts.

How to invest in your 50s?

That was about starting in your 40s. But if you are a bit older, like in the early 50s, then don’t delay this any further. Let’s be honest: you are already a little too late. But do what you can without further delay.

And does it make sense to clear all your loans before you start investing?

Being free of debt is divine. But if you are in your 40s and have a loan or two, then don’t wait until you are debt-free to begin building wealth.

That’s about it. But the important thing is to not delay things any further. Start when you can. Do what you should.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.