Falling interest rates have hurt equity savings and conservative hybrid fund (erstwhile monthly income plans) investors. It has been a double whammy for them. On the one hand, the expected returns are headed lower and, on the other hand, expenses are sticky at the higher end. Investors have to either make peace with low returns or invest in specific bond and equity schemes to benefit from lower expenses and thereby earn a bit more.

Falling returns and sticky expenses

Conservative hybrid funds invest 10-25 percent of their assets in stocks and the rest in bonds. These schemes are taxed like bond funds. Equity savings funds invest around 30-35 per cent in equities and 30-35 percent in bonds. The remaining amount is invested in spot-futures arbitrage opportunities in equities, such that the gross exposure to equities is kept at a minimum of 65 percent. The objective is to qualify for the taxation of equity funds.

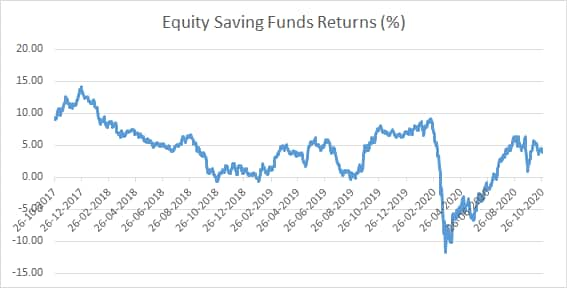

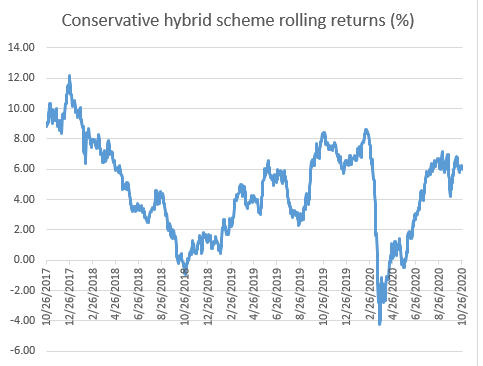

Over the three years ended October 26, 2020, while equity savings funds as a category have delivered one-year rolling returns in the range 14.24 percent and loss of 11.71 percent, conservative hybrid schemes (barring conservative fund of funds) delivered one-year rolling returns in the range of 12.18 percent and a loss of 4.24 percent, according to Value Research. Over the same period of three years, the average expense ratio of equity saving funds went up marginally to 2.15 percent from 2.11 percent on an average. The ratio for conservative hybrid funds also increased to 2.12 from 2.09 percent.

Returns and interest rate movements

As conservative hybrid funds have significant exposure (more than 75 percent) to bonds, the overall expected returns should fall in line with fall in interest rates. Equity savings funds have three drivers of returns – stocks, arbitrage opportunities and bonds. Since arbitrage funds too are expected to deliver less returns, expectations need to be recalibrated. Setting the expectations right can help investors avoid disappointment.

“The assets under management (AUM) of these schemes have not grown for years. And hence, the expense ratio of these schemes is typically in excess of 2 percent,” says Jignesh Shah, founder of Capital Advisors. For example, all equity savings funds put together manage assets worth Rs 10336 crore – the largest scheme has an AUM of Rs 2801 crore. He discards any possibility of fall in expense ratios of these schemes in the near future since he does not expect significant increase in investor interest.

High expense ratios are a big dampener for these schemes. “Investors in equity saving funds cannot be charged high expense ratios in line with those charged on equity funds, as equity saving funds are expected to deliver returns that are a tad above bond funds and less than diversified equity funds,” says Swarup Mohanty, CEO of Mirae Asset Investment Managers (India). “Costs need to be challenged and hence we have consciously kept the expense ratio on our equity saving fund at the lower end,” he adds.

Investors not only pay a high price for the entire scheme in the form of high expense ratio; they also lose out on the taxation front in the case of conservative hybrid funds. The equity component of the conservative equity fund is also taxed as bond scheme.

There are a few more risks investors are exposed to. “To spruce up returns, the fund manager of a conservative hybrid or an equity saving scheme may invest in low rated bonds. Investors have little control over the credit quality in these schemes,” points out Vishal Dhawan, founder and Chief financial planner of Plan Ahead Wealth Advisors. The fund manager has no restriction on investments pertaining to the duration or the credit quality of the bonds held in the portfolio. And the fund manager may be take interest rate and credit risks to generate high returns.

What should you do?

Investors should ideally keep their bond allocation and equity investments separate. It can help you in many ways. “Many a time investors buy into a product such as equity saving fund just because if offers attractive tax treatment, however in that process they end up paying more on expenses and also sacrifice control over risk,” says Dhawan. He advocates separation of bonds and equity investments.

Amol Joshi, founder of Plan Rupee Investment Managers says, “Investors are better off sticking to pure debt and pure equity funds, especially since debt returns are likely to be lower and as debt portfolio quality is of an utmost importance.”

Conservative investors can choose to stay invested in banking & PSU debt and corporate bond funds. Moderate risk takers can go for short-term bond funds.

This approach can help you cut your costs substantially. For example, corporate bond funds and banking & PSU debt funds charge 35-100 basis points.

Jignesh Shah recommends a combination of banking & PSU Bond funds and index funds as an effective alternative. This brings down the cost substantially as index funds charge a fraction of actively managed funds and do away with fund manager risk. In a low return environment, costs become even more important.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!