What’s the first thing that comes to your mind when inflation goes up? Prices of fruits, and vegetables? Perhaps fuel costs as well. While discussing the cost of lemons, tomatoes, and potatoes have been a rage, there are other areas where inflation has been hurting consistently over time. The cost of education has been one such area that has been affected by sustained price increases. And, the unfortunate reality is that unlike lemons and other food items, no one talks about rising education costs.

Education inflation poses a silent risk to every parent and student. Why? It can disrupt the dreams of a bright future for a child about to enter college, and with ease, if taken lightly. Here’s how: Despite the hard-hitting pandemic, in 2021, Indian Institute of Technology (IIT) — all units in the country — doubled their fees by Rs 90,000 to Rs 2 lakh for all undergraduate courses. For a financially-unprepared parent, this would burn a big hole in the pocket.

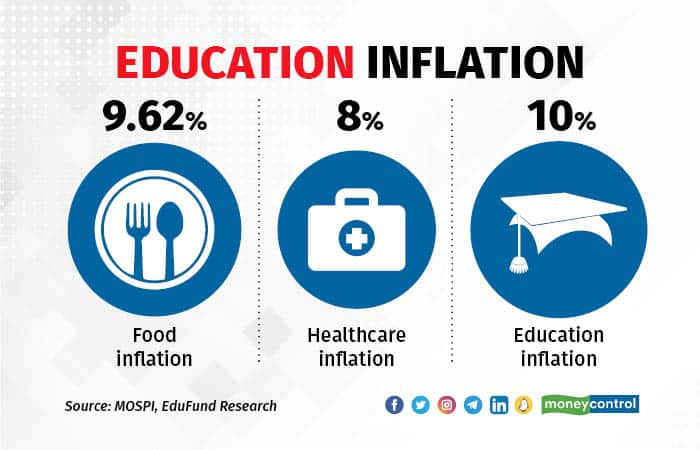

What is education inflation?Take a look at this graphic. Between 2012 and 2020, while food inflation rose by 9.62 percent, education costs climbed by 10 percent.

This data shows the stark reality of how the rise in education costs has surpassed food and healthcare costs in the last decade.

This can be due to several factors — government funding cuts, higher cost of living, tuition fees, administration costs, security, modern school infrastructure, and technological updates by educational institutions.

Further, there are hidden costs to education. For instance, exam registration fees have seen an approximate 6.7 percent hike in the last year. Additionally, the increase in costs of transportation and student accommodation also contribute significantly to the overall increase in education costs. And finally, the food costs are another major contributor that is not highlighted while planning for higher education.

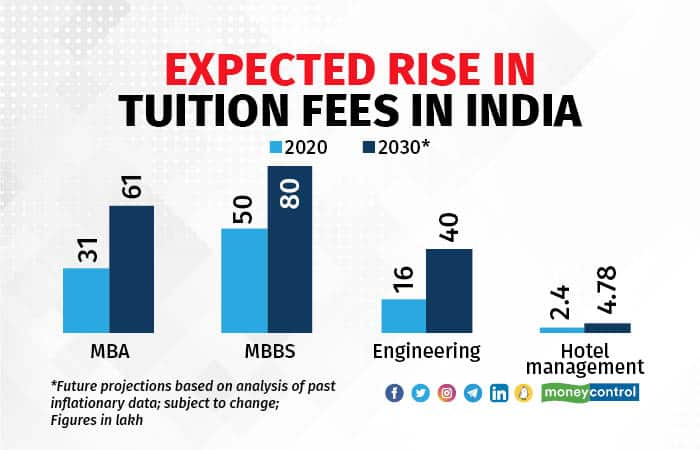

Increasing tuition fees in IndiaTuition fees of colleges in India have seen an enormous rise over the years. In fact, here is some data on full course fees for specific courses and how these are expected to go up, based on the rise in fees over the past years.

The figures are staggering and are one of the main reasons for students dropping out of college midway. According to recent data put out by Unified District Information System for Education, an approximate 39 percent of students aged 20-24 drop out of college to help their families increase their household income. Therefore, it is becoming increasingly obvious that there exists a need for proper education planning in India, as many parents are unaware of the rising cost of tuition fees and the ways to tackle it.

Also read: Studying abroad? Be aware of these 5 additional costs linked to your education Rising cost of overseas educationIf you envision overseas education for your child, you should be prepared to shell out a huge amount for your child's entry into a top university.

Here's an example of why this may be an indispensable part of the process. The average cost of attending a four-year college or university in the United States rose by 497 percent (cumulatively) between the 1985-86 and 2017-18 academic years which is more than twice the rate of annual inflation in the same period. The scenario is not very different for other popular overseas study destinations like the UK, Canada, and Australia. Here is some data to show the cost hikes in two popular international universities from 2015 to 2020:

Even after the coronavirus pandemic, many overseas universities hiked their college fees for 2022-2023. The University of Pennsylvania announced a 2.9 percent increase in tuition fees, while Arizona State University announced that tuition fees would increase by 5 percent for international students. The international students at all three campuses of the University of Illinois are likely to see a 1.5-2.5 percent hike in tuition fees.

How to sensibly save for your child’s college educationUnfortunately, education inflation doesn’t hit you till you are close to paying your child’s college fees, which in many cases happens just one or two years before the deadline approaches. And suddenly, you are left with only two choices — to either compromise on the quality of education, or to opt for loans which come at a high-interest rate.

Irrespective of your choice, your child will suffer. Both these decisions will have a massive impact on your child’s future.

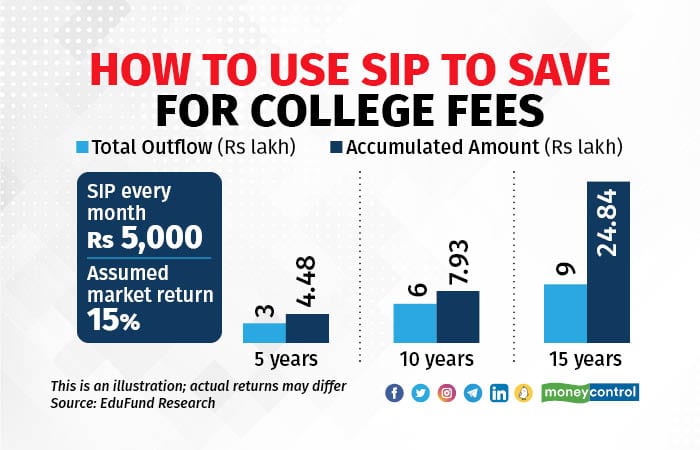

You can avoid financial stress by saving early for your child’s college education. The sooner you begin investing in your child’s education expenses, the more time you give your savings to grow. Here is an example of how you could create an education fund for your child by investing early:

Find yourself the right investment tool that suits your educational goal and start investing to achieve the goal. If you are overwhelmed with the available options, then seek out a financial expert to help you with your education investments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.