Imparting the best education to children is among the top priorities of most Indian households. Best-in-class universities and institutions overseas are a much sought after option. Making it to Ivy League colleges is a challenge, given the competing talent and the steep costs involved. In such a situation, parents need to plan to create an education corpus for the child’s education overseas. Here is how to do it:

Estimate the costs right

Before getting into where to invest the money for the child’s education, it is better to be clear about the targeted corpus size and then work backwards. If your child is in school and there is at least 10 years on hand, then there are two aspects you should keep in mind. First - there is no clarity on which course your kid will enrol into, and second you have enough time on hand to save money to fund that study.

It is better to check the costs charged by the top colleges for some of the courses today. The cost of education however, includes both the expenses that are charged by the colleges for academic inputs as well as the cost of living. The costs are spread over the tenure of study and these are subject to inflation. While estimating the cost one has to take into account around 4 percent inflation and around 3 percent currency depreciation, experts say. The former is an estimate of increase in the course costs and cost of living, while the latter is the rate at which the rupee has traditionally lost value against the greenback.

For example, a four-year undergraduate course in the US costs around $200,000 today, as per EduFund, which translates into Rs 1.56 crore at the exchange rate of Rs 78 per US dollar. Assuming a child will enrol for the same 15 years from now, then after factoring in for inflation and currency depreciation, as mentioned above, the costs work out to Rs 4.3 crore.

Depending on the country, college and course of your choice, the numbers for your child’s education corpus will change. “Inflation is a silent killer. It is better to account for it well in advance as educational inflation can inflate the cost significantly over the long term,” says Eela Dubey, Co-founder, EduFund.

Invest regularly

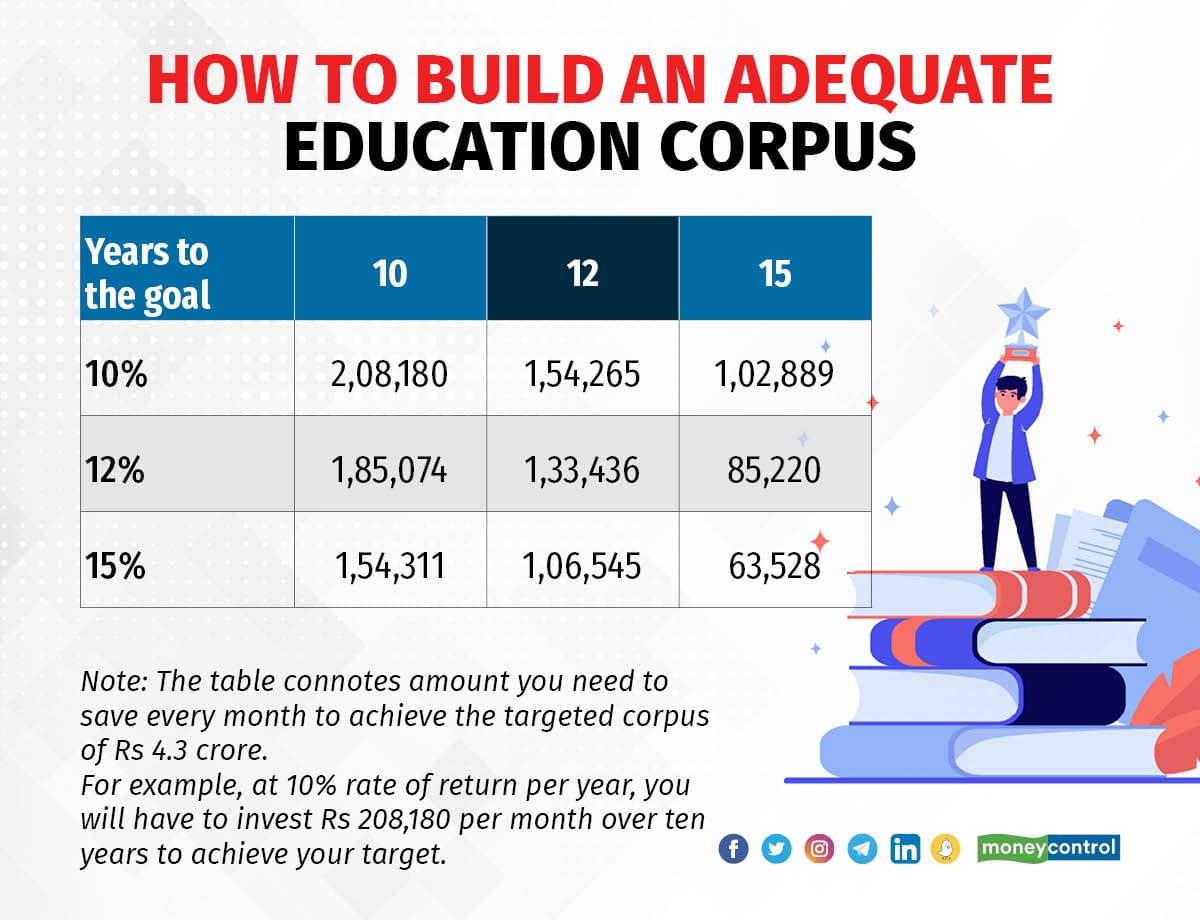

If you get the estimate right and you have adequate time on hand, then you have a strong start. Longer the time on hand, the lesser amount of money you have to invest each month.

If you have 15 years on hand and intend to save the above mentioned Rs 4.3 crore, and expect 15 percent rate of return on your investments, then you have to invest Rs 63,528 per month. The table above gives you an idea of how much you have to invest per month.

Equities are your best bet

The numbers appear steep. But do not lose heart. You may start saving gradually and over a period of time increase your investment to make up for a short-fall. Also, there are scholarships, tuition fee waivers and education loans available in some cases, which too may help.

“Systematic investment plans (SIPS) in well-managed diversified equity mutual funds are the best way to save regularly and earn returns that comfortably beat inflation over the long term,” says Gajendra Kothari, Managing Director and CEO, Etica Wealth Management. One of the best ways to mitigate the currency risk is to invest in dollar-denominated assets such as diversified index funds tracking foreign indices such as Nasdaq 100 and S&P 500, he adds.

Despite volatility in equity markets now across the globe, the long-term numbers look impressive. For the last 15 years ended May 31, 2022, Nifty 50 and Nasdaq 100 indices have given 14.46 percent and 20.93 percent returns.

While investing in equities, avoid chasing themes and sectors that have done well in the past. Do not run away from equities because stock markets have turned volatile. It makes sense to stay the course and not try to time the market.

“It is not mandatory to invest in foreign stocks, as long as your allocation to domestic equity is rewarding. You can keep some of your debt allocation in gold, because gold is a good hedge against an appreciating US dollar,” says Feroze Azeez, Deputy Chief Executive Officer, Anand Rathi Wealth.

Stay focused on the target

Though exposure to stocks ― both domestic and foreign, offer an opportunity to make decent returns, they also come with volatility. It means you have to keep track of the portfolio. As you move closer to your goal, you will have to keep moving money to debt investments, which earn less compared to equities but are also less volatile. “Well-managed debt mutual funds are the tax-efficient debt investment option one can use,” says Kothari.

Conservative investors may also consider fixed deposits (FDs) for debt allocation. For the girl child, an existing Sukanya Samriddhi account can be used for debt investments targeted for education funding, provided you are comfortable with the liquidity constraints it brings with it.

You have to keep watching the cost of education and how they change over a period of time. Your assumptions towards inflation and currency depreciation need to be validated from time to time. If there is a shortfall, then it is better to add to your investments.

While all these investments and timely review of the same should help you achieve the target of education corpus for your child, do not ignore the uncertainties of life. Buy adequate term life insurance well in advance in life. It ensures that the education goal of your kid is fulfilled even if you are not around.

While education loans are available, saving for the education corpus of your child is a good idea. It helps you not to touch money kept aside for your retirement, which cannot be funded by any other means.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!