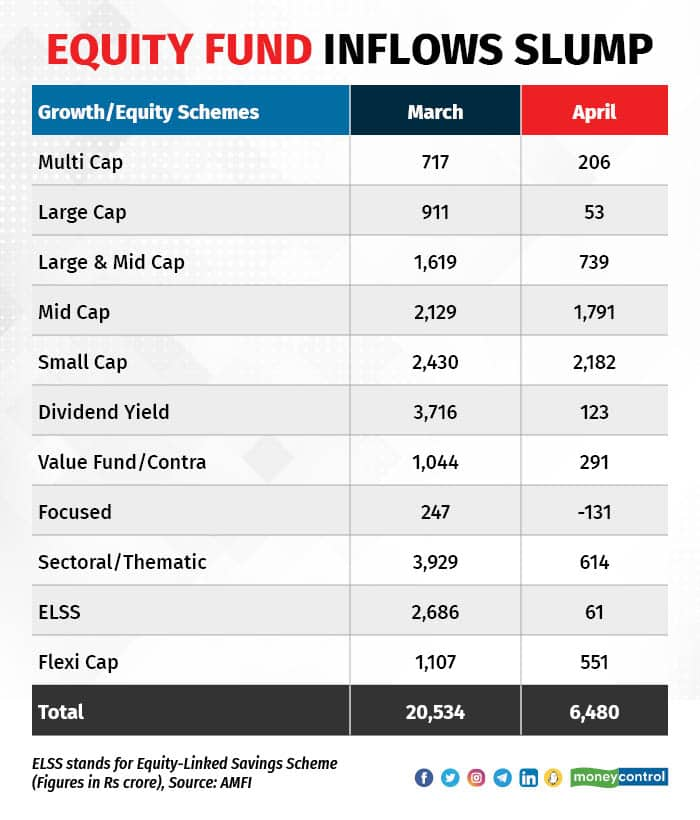

Net inflows into open-ended equity mutual funds slumped 68.44 percent to Rs 6,480.29 crore in April over the previous month given volatile markets and investors taking some money off the table to take advantage of the rally, data released by the Association of Mutual Funds in India (AMFI) showed.

Despite the fall, equity fund inflows have remained in the positive zone for 26 straight months, starting with March 2021.

In March 2023, net inflows into equity funds had jumped 31 percent to Rs 20,534.21 crore month-on-month (MOM), a one-year high then. February net equity inflows had stood at Rs 15,685.57 crore.

“The dip in net flows could be attributed to a sharp drop in gross purchases MOM at -34 percent and a steady rise in redemptions at 9 percent MOM. The rise in valuations could have made investors stay away from fresh investments or take off some money to take advantage of the rally,” said Sriram BKR, Senior Investment Strategist at Geojit Financial Services.

Also read | Planning to sell your property? Know your responsibilities as a seller

Indian markets have remained volatile over the past few months with BSE benchmark Sensex and NSE headline index Nifty remaining flat since the start of the year. In April, Sensex rose 3.35 percent, while Nifty gained 4.06 percent. The indices had inched lower by similar margins in March.

Meanwhile, April equity inflows have been the lowest since November 2022, when the number had stood at around Rs 2,500 crore.

Regarding systematic investment plans (SIPs), there was a small dip because the last two days of April were markets holiday (Saturday and Sunday). Usually, there is a heightened demand for SIPs during the last few days of a month. Experts see a positive spillover effect on May SIP numbers.

In April, fresh investments via SIPs stood at Rs 13,727.63 crore compared with Rs 14,276 crore in March, a fresh all-time high then.

Betting on smaller caps

As per N. S. Venkatesh, Chief Executive Officer (CEO), AMFI, the dip in equity fund inflows could be attributed to volatile markets in the recent past and the lower number of trading days in April.

During the month, the trading days of stock markets were 17 on account of Mahavir Jayanti and Good Friday, apart from regular weekends.

Also read | Long-term wealth creation: Here are the small-cap stocks that children-oriented mutual funds love to hold

In the equity fund category, the highest inflows were seen in Small Cap Fund at Rs 2,182.44 crore, followed by Mid Cap Fund at Rs 1,790.98 crore.

“Smallcaps look reasonably attractive at these levels post the price correction they went through during FY22-23,” said Akhil Chaturvedi, Chief Business Officer, Motilal Oswal Asset Management Company.

Categories such as Multi Cap Fund and Large Cap Fund continued to see lower inflows at Rs 206.27 crore and Rs 52.63 crore, respectively, during April.

Meanwhile, there were small outflows of Rs 130.91 crore seen in Focussed Fund.

“Given the sharp uptick in the markets seen recently, investors may have chosen to be on the sidelines and wait for a more opportune time to invest in equities,” said Himanshu Srivastava, Associate Director - Manager Research, Morningstar India.

To be sure, equity inflows were also supported by investments into ICICI Prudential Innovation Fund (Rs 1,612 crore) during the new fund offer (NFO) period.

Debt stays strong

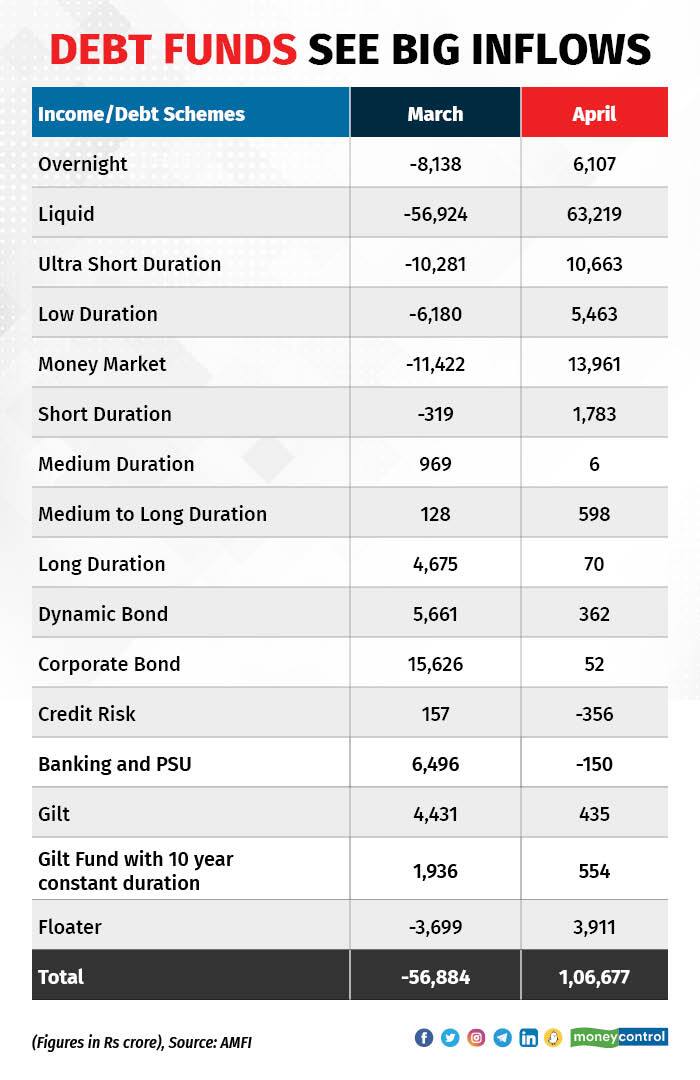

Debt funds saw overall net inflows of Rs 1.07 trillion during April with categories such as Liquid Fund witnessing net buying to the tune of Rs 63,219.33 crore, followed by Money Market Fund at Rs 13,960.96 crore.

In March, debt funds had seen net outflows of Rs 56,884.13 crore mainly driven by selling in Liquid Fund and Money Market Fund.

The inflows in debt funds were strong despite the new taxation regime (introduced on April 1), which has made these categories of funds somewhat unattractive from the taxation point of view.

“After meeting the tax liabilities of the last financial year in March, corporates would have parked their excess investible money in liquid fund and ultra-short duration fund categories, for a short period, thereby leading to huge inflows in these categories. Also, investors would have preferred to invest in categories with shorter maturity profile, such as low duration, money market and short duration funds since there is still some degree of uncertainty over the direction that RBI could take with respect to interest rates going ahead,” said Srivastava.

During April, only Credit Risk Fund and Banking and PSU Fund saw selling of Rs 356.12 crore and Rs 149.52 crore, respectively, from the debt category.

Also read | 5 mistakes investors make that destroy wealth

Other categories shine too

In the hybrid space, Balanced Hybrid Fund/Aggressive Hybrid Fund and Conservative Hybrid Fund saw net outflows of Rs 431.54 crore and Rs 204.98 crore, respectively.

Overall, Hybrid Schemes saw net inflows Rs 3,316.99 crore thanks to buying of Rs 3,716.23 crore in Arbitrage Funds.

“Investors have also taken advantage of better investment environment in debt markets and also spurred by adverse change in taxation for debt funds by increasing allocation to Hybrid funds,” said Chaturvedi.

In passive schemes, Index Funds and Other Exchange-Traded Funds (ETFs) saw buying worth Rs 147.37 crore and Rs 6,790.45 crore, respectively.

Also read | Investment advisors say advertisement code restrictive, seek clarity on key aspects

After witnessing some selling in March, Gold ETFs saw net inflows of Rs 124.54 crore in April.

Overall, net inflows into open-ended mutual funds came in at Rs 1.24 trillion during April largely driven by debt mutual funds. The open-ended mutual fund had seen net outflows of Rs 21,693.91 crore in March.

Overall, the assets under management (AUM) of the Indian mutual fund industry zoomed past the Rs 41 trillion mark and stood at Rs 41.30 trillion at the end of April.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.