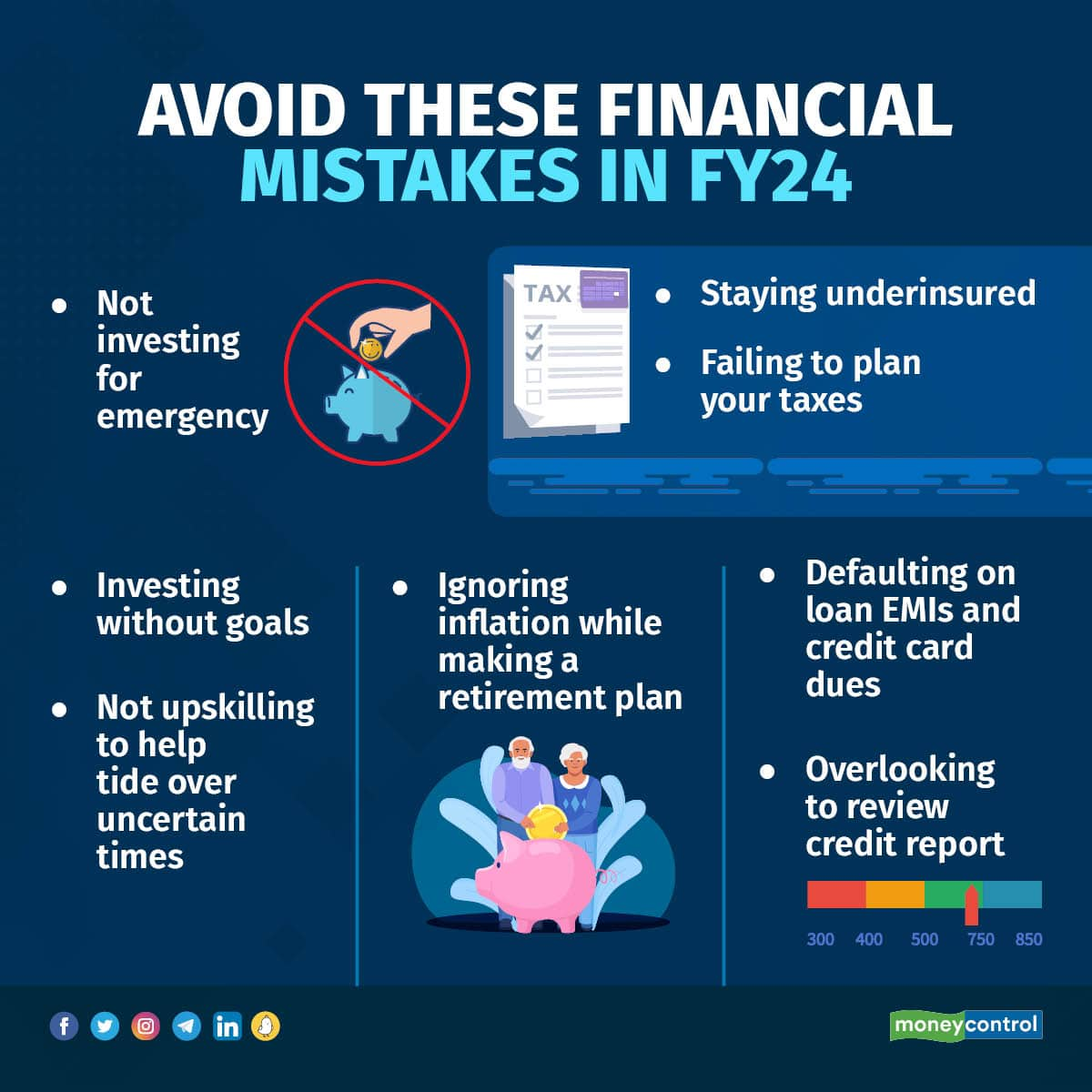

As we step into the new financial year 2023-24 (FY24), it's important to be aware of the common financial mistakes that can cost you dearly. From overspending via credit cards to not investing enough to tackle emergencies, procrastinating tax planning, not reviewing your credit report, and more, here is a quick rundown on the pitfalls to avoid.

Mistake #1: Inadequate emergency fund

Not having an emergency fund can put you in a difficult financial situation in case of any uncertainty, such as hospitalisation of a family member, job loss, etc. So, aim to save at least six months’ worth of living expenses in an emergency fund that you can access quickly.

Having a safety net in the form of an emergency fund not only adds to financial stability, but also leads to peace of mind.

“In the event of unexpected job losses, having at least six months to one year of living expenses saved up can help you bounce back quickly and get through financial turmoil without much stress,” says Varun Girilal, Managing Partner at Scripbox.

Also read | Your 2023-24 money calendar: Keep your dates with your moneybox, investments, taxes, lender and more

Mistake #2: Leaving insurance out of your financial planning

It is crucial to focus on comprehensive healthcare planning and not just during unforeseen incidents and critical illnesses. A good healthcare plan acts as a safeguard against emergencies and chronic illnesses that can potentially result in disastrous financial losses. “Hence, one should prioritise healthcare plans over other investments when doing financial planning,” says Aniruddha Sen, Co-founder, Kenko Health. He adds, when considering a healthcare plan, it is equally important to evaluate and plan for primary healthcare and other related expenses, such as doctor consults, lab/diagnostics tests, medicines and healthcare products.

With ever-increasing inflation, the cost of medical and hospitalisation products and services has also increased significantly. Therefore, thorough planning for both primary and critical healthcare will help manage expenses and avoid impact on savings or long-term financial planning.

Review your health insurance plan at least once in five years. “This ensures that any changes in your lifestyle, life stage, income, medical conditions, and so on, are reflected in your health plan coverage, too,” says Sen. Also, take into account the cost of healthcare in the city of your residence.

A term insurance policy is critical to protect your loved ones in the event of your untimely death. “Life insurance can provide financial support to your beneficiaries and help cover expenses such as future financial goals, outstanding debts and living expenses,” says Colonel Sanjeev Govila (retd), CEO of Hum Fauji Initiatives, a financial planning firm. While you should factor in your income, future goals and dependents’ needs, among other things, as a thumb rule, make sure you have a term cover of at least 10-15 times your annual income.

Also read | 7 changes in financial landscape you need to know this April

Mistake #3: Procrastinating tax planning

Procrastinating is essentially failing to plan ahead, which results in missed deadlines, penalties, and lost opportunities to minimise your tax liability. “While waiting until the last minute to plan for your taxes you will end up investing in sub-optimal tax solutions and you may not take an informed decision,” says Govila. He adds, to avoid these potential dangers, it's essential to plan ahead and start your tax planning at the start of a new financial year. This includes keeping accurate records throughout the year, staying up-to-date on changes to tax rules, and working with a qualified tax professional who can help you identify opportunities to minimise your tax liability and avoid costly mistakes.

Mistake #4: Investing without a financial goal

When you don't have a set financial goal or plan, you may be more likely to make impulsive investment decisions based on short-term market trends or rumours, which can result in significant losses. “Investing without a financial goal can be a recipe for financial disaster, since you may not know why you're investing in a particular asset or a scheme,” says Govila.

To begin with, determine a financial goal and your risk appetite. “Then create a summary of your existing investments, including details such as initial investment value, current value, and returns. Track the objective and time horizon with which you made each investment,” says Girilal. By doing this consistently over three to five years, you will gain valuable insights into how your net worth is growing and how your portfolio is performing. This can help you map your savings and investments to specific goals.

Mistake #5: Not upskilling for uncertain time

The recent layoffs from globally renowned companies serve as a stark reminder that there is no job security despite spending many years with an organisation, and it's essential to be prepared for the worst.

“Continuous learning and skill enhancement are equally vital for personal and professional growth,” says Girilal of Scripbox. This will add to building a financial cushion, he added.

Mistake #6: Making a retirement plan without accounting for inflation

Inflation erodes the purchasing power of money over time. When you're making retirement plans, it's important to consider how inflation will affect the amount of money you'll need to cover your expenses in the future. For example, if you plan to retire in 20 years and you currently need Rs 50,000 per month to cover your expenses, you'll need to factor in the rate of inflation over those 20 years to determine how much money you'll actually need. “By accounting for inflation, you can estimate how much your retirement savings will need to grow over time to keep pace with the rising cost of living,” says Adhil Shetty, CEO, BankBazaar.com.

Shetty explains with an illustration. Assuming an average inflation rate of 6 percent, the value of Rs 50,000 in 20 years will be around Rs 1.22 lakh in today's rupees. This means that if you don't factor in inflation, you may underestimate the amount of money you'll need at the time of retirement and may not have enough to cover your expenses.

“Not accounting for inflation in your retirement plans can be a costly mistake that could significantly affect your standard of living in retirement,” says Govila.

Mistake #7: Defaulting on loan EMIs and credit card dues

Every open line of credit, regardless of whether it is a credit card, home loan, personal loan or a short-term pay day loan from a fintech lender, has to be mandatorily reported to the credit bureaus.

This means every payment towards these loans gets tracked. “On-time payments have a big weightage in calculating your credit score, and every default on loan EMIs and credit card dues can have a significant negative impact on your credit score,” says Shetty.

“Failing to make timely payments for dues can affect a person’s credit score,” says Sanjeet Dawar, Managing Director, CRIF High Mark, a credit bureau. He adds, the borrower's creditworthiness is negatively affected, and the person may face difficulty in getting credit in the future. The borrower may even be denied loans in certain circumstances.

Also read | 5 key factors to note while reviewing your credit report

Mistake #8: Not reviewing your credit report

Vigilant monitoring of credit reports is critical to detect unintended missed payments, loans, credit inaccuracies, identity fraud, or unknown transactions. “This financial habit allows users to take timely corrective action and swiftly resolve any discrepancies found in the credit report,” says Dawar. Your credit report should always be accurate and up-to-date.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.