Salaried individuals with income of Rs 10 lakh will be better off under the old tax regime despite the freshly-sweetened new tax regime in Budget 2023, provided they claim higher tax deductions.

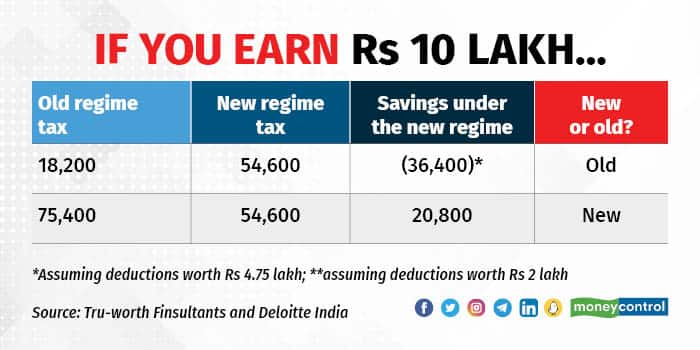

For instance, an individual with a gross salary of Rs 10 lakh claiming deductions of Rs 4.75 lakh will pay income tax of Rs 18,200 under the old tax regime, but this will go up to Rs 54,600 under the new tax regime for 2023-24, which was Rs 78,000 for 2022-23. "Your savings, or your post-tax salary, therefore, will be higher by Rs 36,400," says Tivesh Shah, Founder, Tru-Worth Finsultants.

Also Read: New versus old income tax regime — which one should you go for?

These deductions could include standard deduction of Rs 50,000, housing loan interest deduction of Rs 2 lakh, Section 80C deduction of 1.5 lakh, tax deduction under section 80D of Rs 25,000 on health insurance premiums paid, contribution to National Pension System (NPS) of Rs 50,000 and so on.

Also Read: How would Budget changes affect those earning Rs 15 lakh?

However, if you were to claim tax deductions of only Rs 2 lakh, the new tax regime will work better for you. You will save Rs 20,800 (see table) if you were to switch to the new tax regime as your tax outgo will be lower at Rs 54,600 under the new tax regime post Budget 2023. Under the old tax regime, your tax payable will be higher at Rs 75,400.

Finance Minister Nirmala Sitharaman increased the exemption limit under the new tax regime from Rs 2.5 lakh to Rs 3 lakh and liberalised the tax slabs, in an attempt to woo individual salaried taxpayers to the new regime.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.