Sagar Mehta*, a 45-year-old Mumbai resident, got a rude shock when he received a notice in May from the Bombay High Court, of the demolition of his residential building for unauthorised construction. He purchased this residential property 10 years ago. "I had no idea our building was constructed illegally. We've been living here peacefully for a decade, and now we're faced with the prospect of losing our home," Mehta said.

Mehta's immediate concern is finding new accommodation. "We're also worried about the financial implications and paying monthly rent," he added. The court has advised affected residents of his society to pursue legal action against the developers for damages.

Mehta’s isn't an isolated case. Numerous residential projects across India have faced demolition due to unauthorised construction. In November 2024, over 40 unauthorised residential buildings were demolished in Nalasopara, Mumbai, affecting thousands of families.

Similarly, in Kalyan-Dombivli, a four-storey building was demolished in March following a Bombay High Court order on illegal constructions. More recently, the Bombay High Court ordered the demolition of properties in Maharashtra's Thane district, allegedly linked to the underworld, which could leave around 400 families homeless.

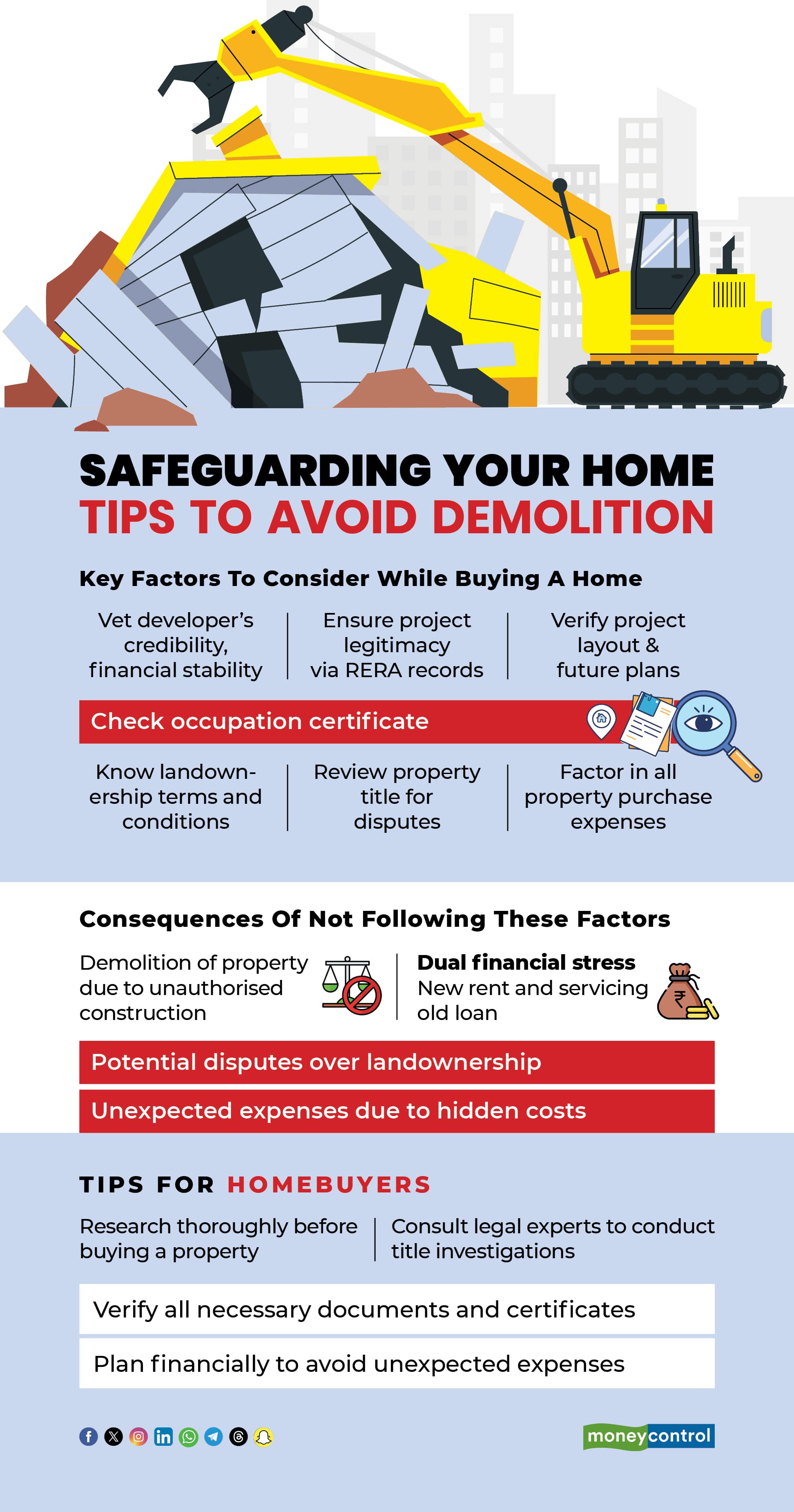

A home provides a sense of security for individuals and their families, often representing a lifetime's savings and significant financial commitment through home loans. To safeguard this investment, prospective buyers should carefully consider key factors to avoid demolition situations like Mehta and other families.

Choose a reputed developer

When buying a property, it's essential to thoroughly research the developer's credibility, financial stability, and ability to deliver the project on schedule. This includes verifying necessary approvals, reviewing past projects, and checking feedback from previous customers.

Check RERA records

When buying a property on a new project, start by checking the Real Estate (Regulation and Development) Act, 2016 (RERA) registration page for project details. Additionally, visit the Sub-Registrar's office to obtain an Encumbrance Certificate, which provides information on registered property documents and helps identify potential title issues.

The RERA mandates registration of new projects with the state's RERA Authority. Under RERA, builders and developers must disclose crucial project details, including title documents, plans, permissions, ongoing litigation, developer rights, sales data, construction progress, and expected completion dates.

Verify property project details before investing

Buyers should be cautious of discrepancies between property brochures and reality. Since projects are often launched in stages, it's crucial to check for potential future illegal developments or constructions within the project that may alter the initial layout.

For example, a promised green belt might later become a high-rise building. “To avoid such surprises, buyers should thoroughly research the locality and gather as much information as possible before investing in under-construction property,” advises Harshil Morjaria, a certified financial planner at ValueCurve Financial Services.

Also read | Active investing still beats passive strategies fairly often, says Arun Kumar of FundsIndia

Don’t skip the IOD and OC check

Building permissions are granted by the authorities to ensure compliance with the approved plans. To begin construction, developers need to obtain an Intimation of Disapproval (IOD), which signifies that their building plans have been sanctioned.

After construction is complete, the municipal corporation inspects the building and issues an Occupation Certificate (OC), permitting occupancy. “The OC is crucial as it validates the building's construction according to sanctioned plans. If this has not been obtained, there is a risk of the property getting demolished,” says Swati Marfatia, an advocate. Buyers should verify the OC before purchasing a flat to ensure the building is legally fit to live in.

Know the terms of your property's land before you buy

When buying a property, it's crucial to understand the land tenure, particularly in metro cities like Mumbai where properties are often built on leasehold land granted by the municipal corporation or collector.

Leasehold land is owned by the government or a private entity and leased to developers for a fixed period, typically ranging from 30 to 99 years. During this time, the leaseholder can use the land but must adhere to the lease conditions. Upon lease expiration, ownership reverts to the original owner unless renewed. This type of landownership is common in metro cities for residential purposes.

Further, there are properties built on joint ownership, which occur when two or more individuals share ownership of a property, often arising from inheritance, joint purchases, or business partnerships. There are disputes arising in future related to land acquisition in such joint ownerships. “In the event of a dispute, the division of ownership is typically determined by legal property laws or a mutually agreed-upon arrangement,” says Marfatia.

Also read | Understanding REIT yields: What Indian investors need to know

Title investigation: A crucial step in securing a home loan

Most purchasers rely on bank loans, which come with specific requirements, property valuation and property assessments. Banks prioritise legal clearance and obtaining a No Objection Certificate (NOC) from society before disbursing the loan. The loan is typically disbursed after the property assessment is complete and all original documents are received.

According to a retail banker requesting anonymity, “Title investigation is crucial when buying a flat with a home loan, as it involves a thorough review of the property's ownership history to ensure it is free from any encumbrances or disputes before loan approval."

By conducting thorough due diligence, property buyers can gain a comprehensive understanding of their purchase. Given the complexity of property laws in India, which involve multiple state and central regulations, it's highly recommended that buyers consult a legal expert to conduct a title investigation, ensuring a secure transaction.

Also read | Home loan dilemma: Should you prepay or invest after repo rate cut?

Know the total costs while purchasing

When purchasing a property, buyers incur various costs, including stamp duty, a tax levied by the state government on legal documents; registration charges, payable to the Sub-Registrar's office; society or condominium transfer fees, typically shared between the buyer and seller; brokerage charges, ranging from 1-2 percent; parking charges and so on. Buyers should factor these costs into their financial planning to avoid unexpected expenses.

*Note: Name changed

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.