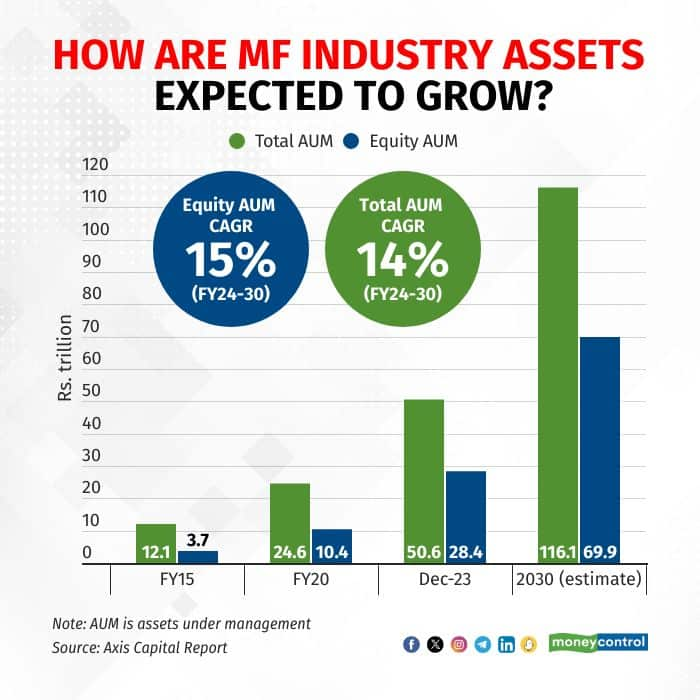

The Indian mutual fund (MF) industry’s assets under management (AUM) are expected to double to Rs 100 trillion by 2030, going by an Axis Capital Report titled ‘India Asset Management AUM on the double: Closing in on Rs 100 trillion.’ This implies a compound annual growth rate, or CAGR, of 14 percent over this period (see graphic).

With 42 million investors, MF penetration in India is less than 5% of the working-age population. Along with the fact that the average value of monthly systematic investment plans (SIPs) is Rs 2,300, indicates there is ample room for growth, according to the report.

It was only in December 2023 that the Indian MF industry’s AUM hit the Rs 50 trillion mark — a doubling of assets in four years. The industry is expected to continue on its growth trajectory.

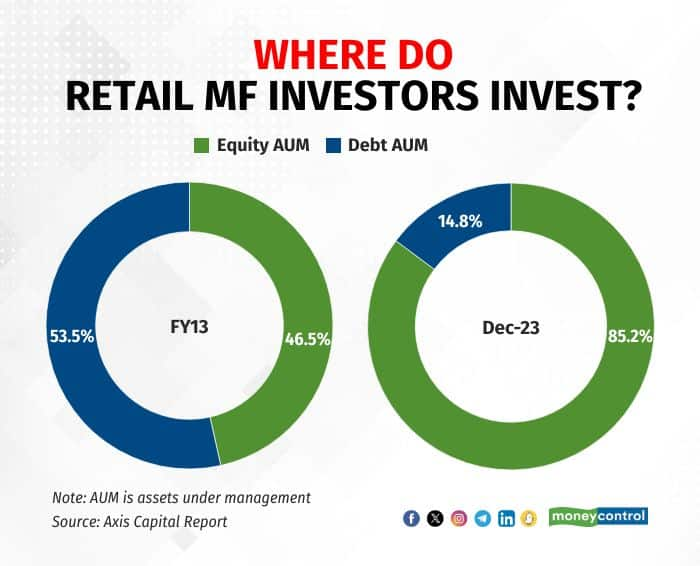

Today, equity MFs and exchange traded funds (ETFs) account for almost 70% of the overall industry AUM (retail and other investors). Debt funds account for the remaining 30%. If we consider only retail equity and debt investors, the share of equity versus debt AUM gets even more skewed (see graphic).

With SIPs and the ‘Mutual Fund Sahi Hain’ campaign promoting MFs, the share of equity MFs and ETFs has risen from around 24 percent in FY14 to 70 percent in December 2023.

A sharper increase in equity AUM since FY19 has been the result of both higher net inflows into such funds, as well as a rising stock market bumping up the value of such investments (mark-to-market gains).

In the coming years too, equity AUM growth is expected to remain higher than the overall industry AUM growth.

Also see: MC30: The best mutual funds to invest inRetail investors to drive growthAccording to the report, the growth in MF industry assets will be driven by rising retail participation in MFs with rising savings. Assuming nominal GDP growth at a CAGR of 11% over 2023-30, the report expects household savings to grow at a similar rate until 2030.

Digitisation has played a key role in attracting more retail investors. Retail participation (including high net-worth individuals) in MFs has gone up from 45% in FY16 to 60 percent now. In December 2023 alone, 4 million new SIP accounts were created.

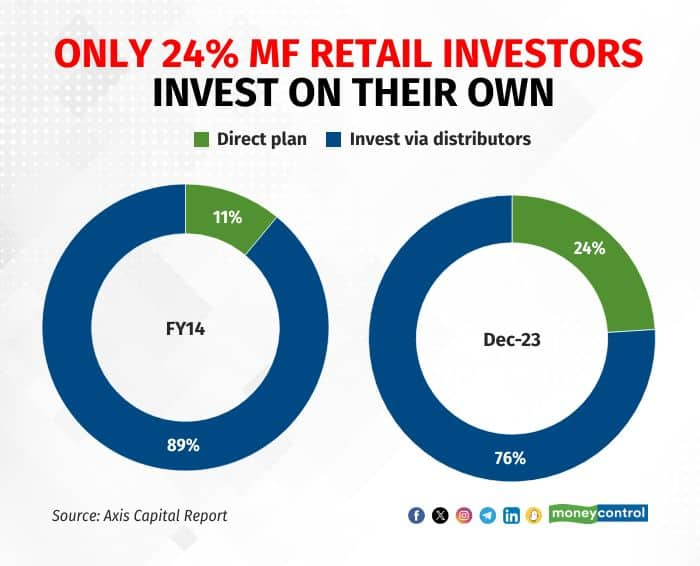

But where do most retail investors source their MF investments from? While the share of direct plans has risen over the years to 24 percent, 76% of investors still invest via MF distributors (see graphic).

Despite many do-it-yourself investment platforms springing up in recent years, a large proportion of MF investors still continue to rely on distributors. G Pradeepkumar, CEO, Union Asset Management Company, however, feels differently. He says that 24 percent is a fairly high share for direct investments considering that it was only 11 percent in FY14.

He further adds, “Most retail investors would find it worthwhile to take the help of distributors or advisors given the large number of schemes available and the increasing popularity of goal-based investments. The expense ratio (which is higher for regular plans than direct plans) is not always the biggest consideration. People look at advice, service etc. as well.”

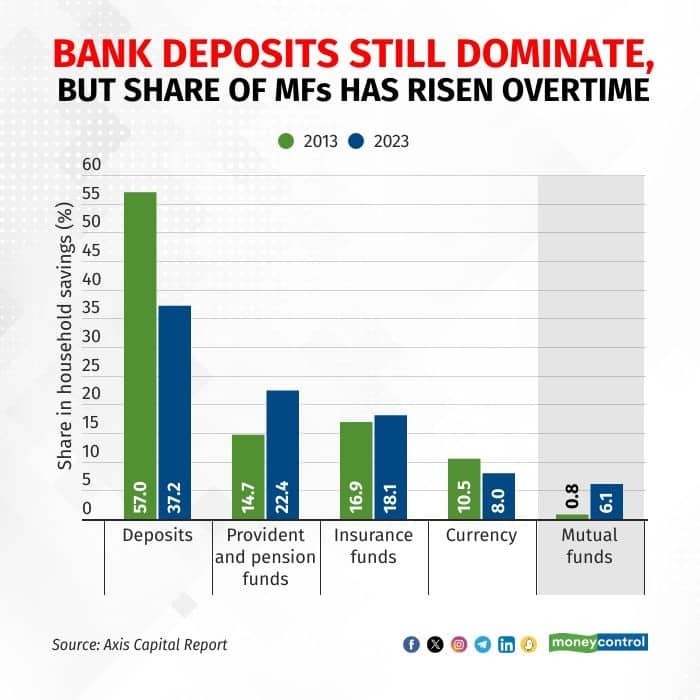

Also read: Has the new income-tax regime killed tax-saving mutual funds? Not yet, but…Share of MFs in household savingsWhen compared with other financial instruments, MFs still rank far below bank deposits and other traditional products on the retail investors’ preference list. Unsurprisingly, bank deposits remain the most preferred financial asset among Indian households, though their share has tapered over the years.

At the same time, while MFs still account for a small share of household savings — 6.1% in 2023 — it is up from a meagre sub-1% 10 years ago (see graphic).

So, what can be done to make MFs even more popular among retail investors? According to Kirtan Shah, MD - Private Wealth, Credence Family Office, the only way to achieve this is by spreading more education around personal finance.

Pradeepkumar talks about the role of distributors in achieving this. He says, “Given our country’s vast geography and large population, a significantly larger number of distributors is vital. The ‘Mutual Funds Sahi Hai’ campaign has worked exceedingly well in creating awareness but in order to get people to actually invest, distributors play a very important role. The industry is working hard to expand their numbers.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.