Aside from dealing a blow to debt funds, Budget 2023 (last year’s Budget) blew another hole in the Rs 50 lakh crore Indian mutual fund (MF) industry. It made the new tax regime the default tax regime, effective April 1, 2023. The move — an otherwise sound tax policy with lower rates, but no tax benefits — has left the Equity-Linked Savings Scheme (ELSS) out in the cold. Also known as tax-saving MF schemes, ELSS offers Section 80C tax deduction benefits up to a limit of Rs 1.5 lakh.

The current financial year (2023-24) will be the first where taxpayers will have filed their taxes under the new regime as the default one, unless they wish to switch back to the old regime, in which case they have to fill out a form.

What, then, is the future of ELSS where, as per anecdotal evidence, a majority of investors invest just to get the income-tax benefits? The future of ELSS appears to be in doubt as the government seems focused on enhancing, pushing, and popularising the new tax regime.

Changing strategiesSome mutual fund houses, such as PPFAS Asset Management Co Ltd, India’s 18th largest fund house with assets under management (AUM) of over Rs 60,000 crore, don’t talk much about tax savings anymore, even though that’s been the core purpose of Parag Parikh ELSS Tax Saver (PETS), its tax-saving fund. Neil Parag Parikh, Chairman and Chief Executive Officer, PPFAS Mutual Fund, says that when the window to invest internationally by mutual funds got shut in February 2022, unitholders demanded a pure India investment diversified scheme as an alternative to Parag Parikh Flexi Cap Fund (PPFCF), the MF’s flagship fund that used to invest up to 25 percent in international stocks. “That is when we told our investors to invest in PETS, ignoring the tax benefits it also gives,” says Parikh.

PPFAS MF has stuck to its long-standing belief to launch as few funds as possible and, among equities, stick to diversified funds. Since PETS and PPFCF are both diversified, the fund house projects the former as the latter’s alternative, minus the international stocks. Tax-saving funds, by law, are prohibited from investing in foreign securities. “Barring the international exposure (of PPFCF), the strategy of both schemes is similar,” says Parikh, adding that PETS’ smaller corpus (Rs 2,761 crore) is also a good alternative for those who fear that PPFAS’ large corpus (Rs 55,034 crore) might slow it down. The narrative suited PPFAS because, by then, the new income-tax regime had come about.

Elsewhere, fund houses are optimistic about investors coming into tax-saving funds. The newly launched Zerodha AMC kicked off on MF Street in November 2023 with two schemes — one of which was a tax-saving fund called the Zerodha ELSS Tax Saver Nifty Large Midcap 250 Index Fund. The fund’s size has grown to Rs 46 crore, as per Value Research at the end of January 2024. Was its CEO Vishal Jain too brave to launch an ELSS in the same year that the new tax regime was made the default one?

Jain says that the compulsory three-year lock-in is beneficial for ELSS investors. He says that the Nifty 500 index has lost money a negligible number of times if you stay invested over any three-year period over the past few years. He is right. The Nifty 500 index has lost money just 6 percent of the time, as per a three-year rolling return analysis between 2009 and date (on daily basis). Here, we checked out (multiple and with a daily frequency) 3-year returns over a period spanning 2009 and date. “The lock-in ensures that investors weather the ups and downs in the market better as they cannot panic and withdraw during volatile phases,” says Jain.

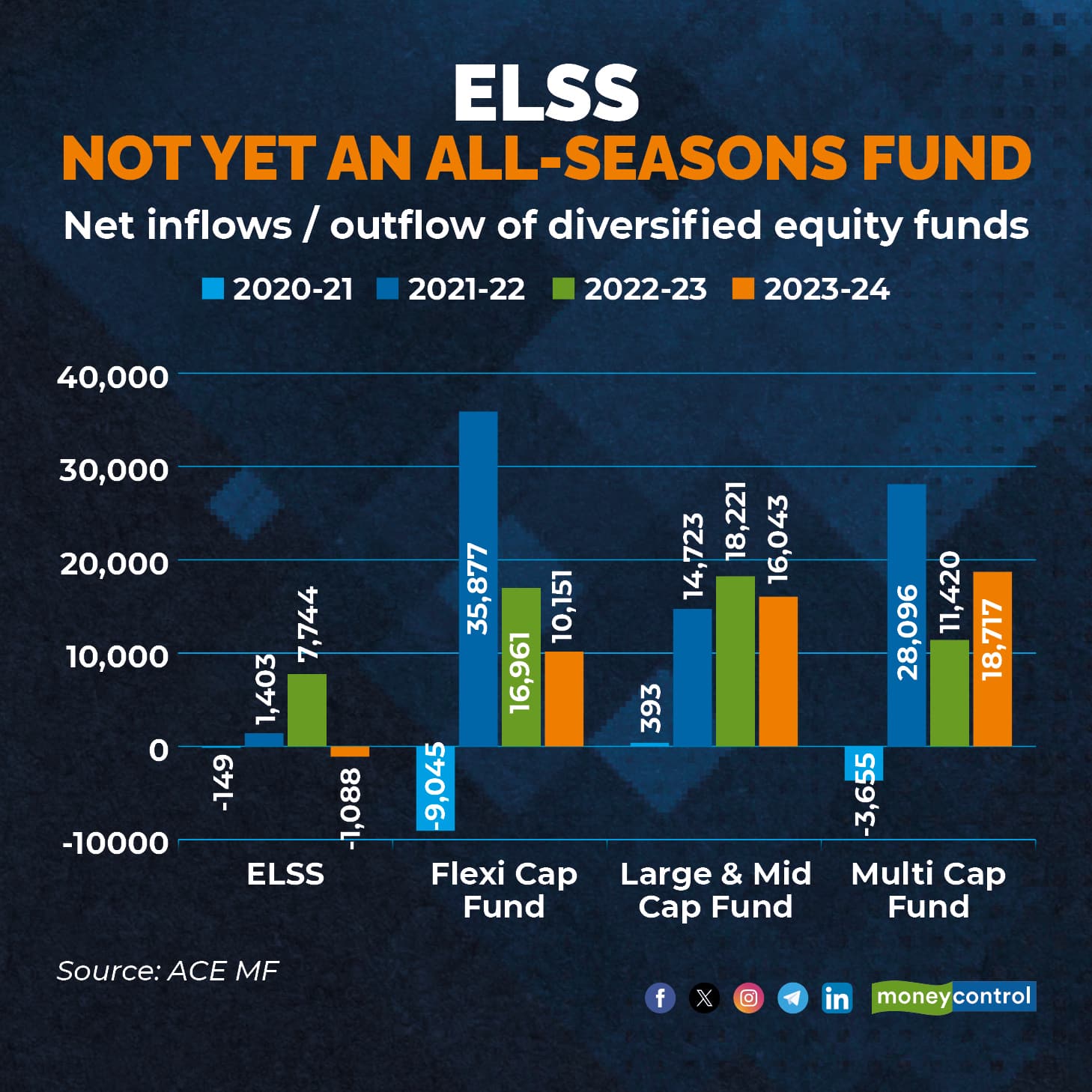

Also read: Not just tax savings, ELSS funds win the long-term race too. Here are the top ELSS schemes that delivered better long-term return over the last 15 years.The ELSS pieFinancial advisors and distributors say that most investors prefer to invest in ELSS due to its tax-saving bonus. A Moneycontrol analysis of the inflows and outflows of ELSS schemes shows that they pale in comparison to other diversified equity funds, such as Flexi Cap, Large & Mid Cap and Multi Cap funds.

Investors appear to invest in ELSS mainly for tax-saving purposes. Hence the gush of investments during January - March periods.

Investors appear to invest in ELSS mainly for tax-saving purposes. Hence the gush of investments during January - March periods.A further analysis of inflows and outflows data also shows that ELSS inflows are seasonal as compared to other mainstream diversified funds. That’s largely because, typically, tax-saving funds attract money in the last few months of the financial year (November–March) when people rush to make their last-minute tax savings. In 2023-24, ELSS got net inflows (more money came in than went out) in October, November 2023, and January 2024. The rest of the months saw net outflows. The previous financial year was better (net inflows in 10 out of 12 months). The year 2021-22 was tough, but that was partly because of the COVID-19-led disruption in equity markets. Only the November-March period saw net inflows.

Also read: Confused over which mutual fund to invest in? Check out MC30 list of investment - worthy schemes by MoneycontrolThe overall market size of ELSS is Rs 2,04,369.62 crore, smaller than the large-cap, mid-cap, small-cap, and flexi-cap funds.

The ELSS pieIs the end near?

The ELSS pieIs the end near?Fund houses, by and large, don’t appear to be too worked up about the future of ELSS, just yet. “ELSS provides an investor with the twin benefits of wealth creation and tax deduction under Section 80C of the Income Tax Act. Another benefit is that, given the three-year lock-in, ELSS instils the virtue of long-term investing,” says Chintan Haria, Principal Investment Strategy, ICICI Prudential AMC.

Swarup Mohanty, CEO and Director, Mirae Asset Investment Managers, says that inflows into ELSS follow performance. That’s why he says he is not worried. “Our inflows have not gone down at all. Initially (last year after the Budget announcement), we were worried that investors would leave ELSS funds, but they didn't. People also invest in ELSS because of their superior performance,” he says.

But to be sure, inflows into ELSS funds might not pose an existential challenge to large ELSS schemes like Mohanty’s, whose ELSS is the second-largest in the category with assets worth Rs 20,950 crore. Eight out of 38 ELSS funds are more than Rs 10,000 crore each.

DSP ELSS Tax Saver Fund is one of the few schemes that still advertise consistently during the January–March months with its popular ‘BACHAO’ (referring to saving your taxable income) and ‘AXE YOUR TAX’. “Our messaging has not changed. Because there are people who would still adopt the old tax regime, and this is an option,” says Kalpen Parekh, MD, and CEO, of DSP Mutual Fund.

Financial advisors and distributors are more pensive in their forecasts. “Things have changed for ELSS schemes. We believe that the new tax regime will be the focal point going forward, and the old tax regime will die. Tax-saving funds might still be relevant for those who stick with the old regime, but for how long? Besides, even the Section 80C basket is crowded, and most salaried taxpayers exhaust this limit with their contributions to the Employees’ Provident Fund or tuition fees for their children,” says Suresh Sadagopan, founder of Ladder7 Financial Advisories.

“The popularity of ELSS has gone down over the years,” says Anup Bhaiya, founder and Managing Director of Money Honey Financial Services. Bhaiya concedes that fund houses generally don’t aggressively hawk their tax-saver funds like they used to, but these funds haven’t lost their relevance yet. These schemes still give you exposure to equity and come with a good, long-term track record. A Moneycontrol analysis shows that the three-year lock-in helps.

Over long term, ELSS has a slight edge over Flexi-Cap funds

Over long term, ELSS has a slight edge over Flexi-Cap fundsBut as more people shift to the new tax regime — we'll get to know these numbers by July as people start to file their taxes — ELSS funds have to shift a gear or two up on the performance front as the lure of tax savings goes down.

With inputs from Dhuraivel GunasekaranDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.