WhiteOak Capital Mutual Fund has launched a new ESG fund, the first in India’s Rs 67 trillion mutual fund industry since 2021, when the strategy was in vogue.

ESG stands for environmental, social and governance, a theme that has been slow to take off in India but is increasingly popular abroad.

Last year, the Securities and Exchange Board of India (SEBI) allowed asset management companies (AMCs) to launch funds under the six new strategies under ESG.

Earlier, mutual funds could only launch one scheme under the ESG thematic category for equity schemes.

The six categories are Exclusion, Integration, Best-in-Class & Positive Screening, Impact Investing, Sustainable Objectives, and Transition or transition-related investments. As the name suggests, WhiteOak Capital ESG Best-In-Class Strategy Fund would focus on the best-in-class category.

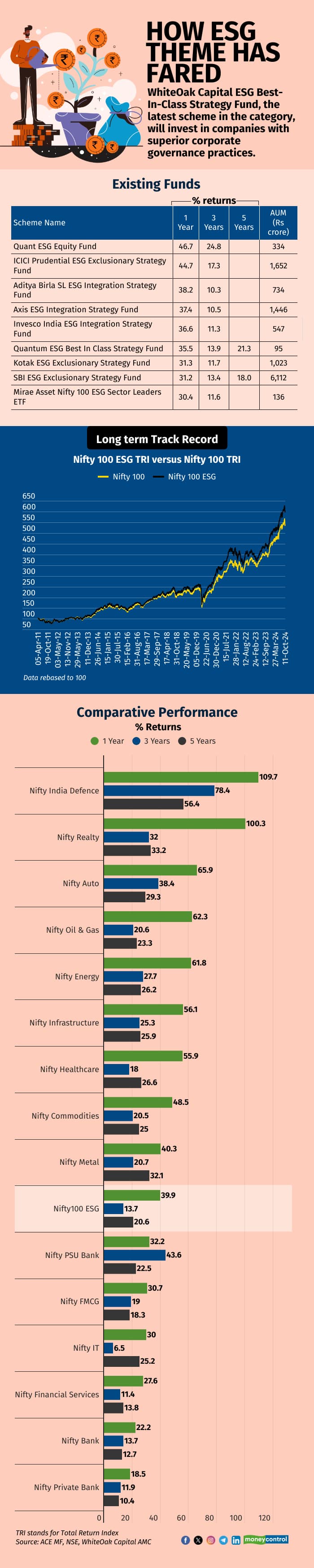

To be sure, existing funds in the category have already transitioned to one of these six sub-categories under the overall ESG theme.

What’s on offer?

The best-in-class ESG strategy selects companies based on the number of filters relevant to ESG screening. WhiteOak Capital ESG Best-In-Class Strategy Fund will invest in companies with superior corporate governance practices.

See here: Can Chinese markets continue to reward investors post 25% rally?

Under the fund’s framework, companies will be assessed based on their accounting practices, alignment with minority shareholders’ interests, capital allocation, board strength and compliance with the relevant laws and regulations.

Based on the assessment, companies will be ranked between one and 12. The scheme will consider companies ranked first to fourth under its framework as its investment universe.

Within the investment universe, the fund will invest in businesses which show superior returns on incremental capital, scalable long-term opportunity, strong execution, etc, which are available at an attractive valuation i.e. the current market price is at a substantial discount to intrinsic value.

One way for a fund under the ESG category to function is to focus on all three parameters — E, S and G.

“E and S factors can sometimes become slightly contentious. The definition boundaries are not well defined, and the universe tends to shrink significantly. The governance factor, on the other hand, is easier to understand and in the long term, this factor matters a lot. In our fund, E and S parameters will also be there, but the main screening will be based on governance,” said Ramesh Mantri, Chief Investment Officer, WhiteOak Capital AMC.

Also see: Can the defence sector continue firing after 100% gains?

The fund will be taking a market capitalisation agonistic view. Also, it is expected to be skewed towards banking, financial services and insurance (BFSI), information technology (IT), consumer and pharma sectors, which typically tend to have good governance standards.

On the other hand, sectors such as oil and gas, materials, commodities and real estate may be underweight in the fund.

WhiteOak Capital ESG Best-In-Class Strategy Fund will be managed by Mantri, Trupti Agarwal, Dheeresh Pathak and Piyush Baranwal.

What works?

After the Covid-19 pandemic, the ESG theme came into prominence with the focus changing to socially responsible practices at the corporate level. Today, ESG considerations have become critical in assessing business longevity and terminal value risk.

The governance factor, which WhiteOak Capital AMC will employ in its fund, has become one of the key parameters in assessing the long-term future of companies by fund houses.

Also read: How a software engineer turned fund manager is getting ready to launch a new mutual fund house

For example, in the past a company collapsed after the management was found to be guilty of manipulating accounts to the tune of Rs 7,000 crore.

Today, almost every fund manager looks at the governance aspect of a company for making investment decisions.

What doesn’t work?

Post 2021, the ESG theme has been underperforming most other strategies. Data shows that Nifty 100 ESG Total Return Index (TRI) has underperformed Nifty 100 TRI over the last three years.

A key reason for the underperformance is that companies from sectors such as commodities, oil and gas and mining, which are rarely included in ESG funds, have done well in the past few years. Public sector companies, which are also typically absent from ESG funds, have done well.

“Two years ago, we were talking of clean fuel, sustainable energy sources and EV, and less of coal power. However, coal and petrol-related products are still widely used. The transition may happen but it will be very slow and organic,” said Vidya Bala, Co-Founder, PrimeInvestor.in.

Read here: WazirX officials face questions as sleuths from govt agencies probe $235-mn crypto hack

However, according to Mantri, the fund house is taking a long-term view that sustainability matters.

“The ESG theme may be out of favour right now, but it is expected to do well in the future. That’s why we thought of launching this product now,” he said.

What should investors do?

The ESG concept, which came into the picture in 2010, is not an asset class and the theme is designed based on certain characteristics. Investors who prefer sustainability along with returns can choose these types of funds.

However, experts feel it is still unclear how the ESG funds are different from other diversified funds.

“Most active fund managers want to build their portfolios with companies that have high corporate governance and are sustainable in the long term,” said Ravi Kumar TV, founder of Gaining Ground Investment Services.

As per Bala, ESG has become one of the factors that most diversified funds consider anyway while filtering their stocks.

“We do not see a need to separately play the ESG theme. For a retail investor, the ESG concept should be a part of their regular diversified funds, rather than playing it in isolation,” she added.

Since ESG is an ongoing trend and more frameworks are work in progress one can wait and watch how this will develop as a category before taking a bet on it.

The new fund offer (NFO) for WhiteOak Capital ESG Best-In-Class Strategy Fund will close on October 25.

Also read: Multi-cap Vs Flexi-cap mutual funds: Where to invest in this market?

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.