Defence has been the best-performing sector in India over the past year. At the same time, it is the worst-performing category over a one-month timeframe. This raises the question: can it continue to deliver?

Among those betting on this fledgling sector are three passive funds that have come up in the recent past. All three — the Motilal Oswal Nifty India Defence ETF, Motilal Oswal Nifty India Defence Index Fund, and Aditya Birla Sun Life Nifty India Defence Index Fund — were launched in August 2024. HDFC Defence Fund is the only active fund in this category.

The new fund offering (NFO) of the Groww Nifty India Defence ETF and FoF, which is the latest to focus on the theme, opened last week and will close on October 4.

What’s on offer?Defence is one of the newest themes in the Indian mutual fund (MF) industry with just four existing funds as we speak.

All the four funds and the Groww Nifty India Defence ETF and FoF are benchmarked against the Nifty India Defence index.

Also read | National Pension System: How to choose the right annuity plan?

In terms of selection, stocks that get at least 10 percent of their revenues from the defence segment are eligible to be included in the index. The weight of each stock, which is capped at 20 percent, is based on its free float market capitalisation.

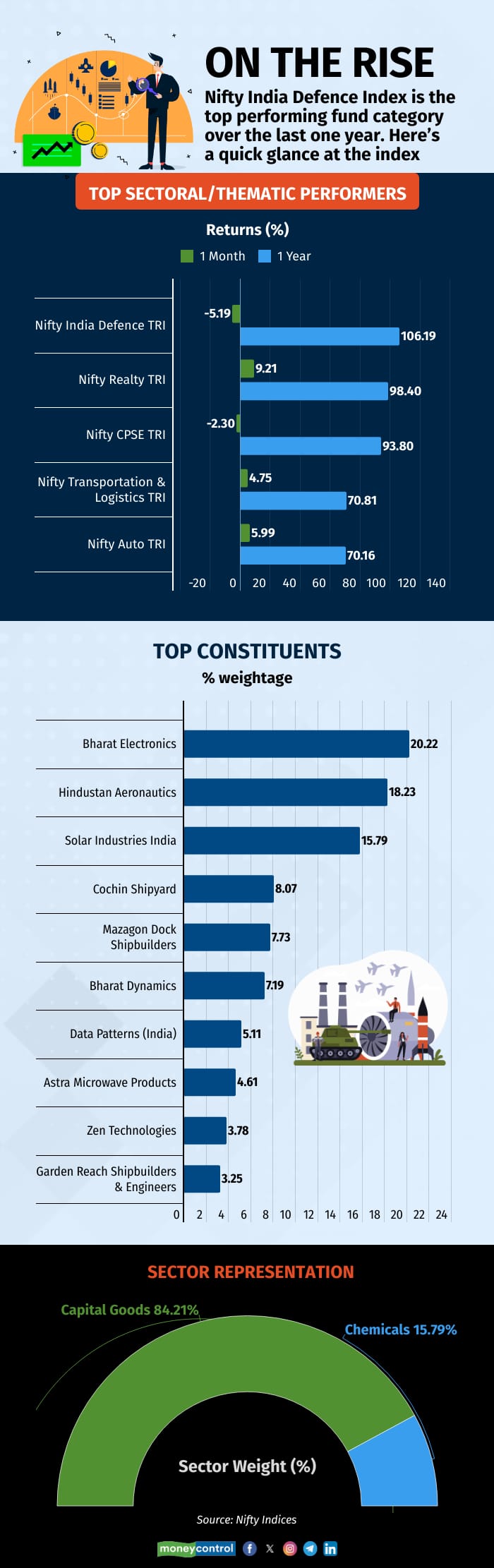

There were 15 constituents of the Nifty India Defence index as of August-end. Bharat Electronics (weightage 20.22 percent), Hindustan Aeronautics (18.23 percent), Solar Industries India (15.79 percent), Cochin Shipyard (8.07 percent), and Mazagon Dock Shipbuilders (7.73 percent) are the top five stocks in the index.

There are only two sectors — capital goods (84.21 percent weightage) and chemicals (15.79 percent) — in the index at present.

The Groww Nifty India Defence ETF and FoF will be managed by Abhishek Jain.

Groww Mutual Fund highlights that India’s defence sector is expanding due to the Rs 3 trillion production target by FY2029, and a projected $138 billion investment pipeline over FY24 to FY32. Additionally, the government has set a defence export target of Rs 50,000 crore by FY29.

The sector is also supported by strong government initiatives under Atmanirbhar Bharat and increasing budgetary allocations, with the FY2024-25 defence budget standing at Rs 6.22 trillion.

As per Varun Gupta, Chief Executive Officer, Groww Mutual Fund, all the companies in this sector look promising. “The companies here have a strong order book. Also, since 2018, the revenue of the companies in the sector has grown by 9 percent, and profit has expanded by 20 percent, consistently. Until about 2018, there were only six listed companies in this space. Now we have more than 20 companies, while the index consists of only 15 companies,” he said.

Also read | Nine big financial changes that you must watch out for in October

Gupta is of the opinion that defence is a very nascent sector from a market listing perspective, and the universe is expected to expand.

What doesn’t work?The Nifty India Defence index has gained 106.18 percent on a one-year basis, while one-month returns stand at -5.19 percent. Also, the valuation of the index has expanded sharply in a very small period.

Data shows that the price-to-earnings (P/E) ratio of the index stood at around 22 in 2022, and touched 70 just a few months back. However, with the recent correction, the PE has come down to 57 as of August-end.

Another factor that works against the index is the small universe of companies that are eligible to get added to the index.

Vikas Gupta, Smallcase Manager and Chief Executive Officer at OmniScience Capital, said in a note that the investment universe needs to be broadened to non-conventional proxy defence and other such firms so that undervalued companies can be found.

Also, the index is top-heavy as the three biggest stocks have around 55 percent weightage.

What should investors do?All 15 companies in the index are showing growth in their order books, indicating future revenue potential. Also, the government’s push for domestic manufacturing is opening up new opportunities for companies, strengthening India's self-reliance in defence.

Take a bet on this sector only if you are bullish on this theme and understand the risks of investing in sectoral / thematic funds, like timing the entry and exit points.

Also read | How not putting your eggs in one basket can help you achieve goals, minimise risks

It is recommended that sectoral / thematic funds should not be part of one's core portfolio and must be a satellite allocation. Also, don't allocate more than 5-10 percent of your portfolio in a specific theme, and only invest as per your risk appetite because defence is a volatile sector.

For investors with a moderate risk appetite, a flexicap or a multicap approach is recommended, which will also take sectoral / thematic calls based on opportunities available in the market.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.