A rising market is all about making money. When benchmark indices are up and all kinds of stocks are returning handsomely, investors don't care where their money is coming from. But when the market turns, the focus quickly shifts to the quality.

Axis Bluechip Fund makes for a perfect port to weather the storm for investors trying to pick high-quality growth stocks that are less susceptible to market volatility.

The scheme, launched in February 2010, aims to achieve long-term capital appreciation by investing in a diversified portfolio predominantly consisting of equity and equity-related securities of large-cap companies.

Since November 2016, the fund has been managed by Shreyash Devalkar, Senior Fund Manager at Axis AMC. He has over 16 years of experience in equity markets and also manages Axis Midcap Fund, Axis Multicap Fund and Axis Equity Hybrid Fund, among others.

Investment strategy

Axis Bluechip Fund aims to beat the Nifty 50 while undertaking risk that is lower than that of the benchmark index. The fund's investment philosophy has clearly defined four pillars that define high quality business – strong competitive positioning, cash flow generation with sound balance sheet, credible management team and sustainable growth potential.

The fundamentals of these companies are studied further to arrive at their fair value, which is then used to construct a bottom–up, stock–by-stock portfolio.

"Stocks are selected in the portfolio based on their ability to grow earnings on a sustainable basis from a medium term perspective while maintaining a highly liquid and risk managed portfolio. The expected earnings growth of the portfolio is higher than that of the benchmark NIFTY 50," says Devalkar.

"The strategy is to invest mainly in leader companies which operate in a secular growth segment and has leading market share in their areas of operation. Challenger companies are those which are gaining markets share due to differentiated offering or cost advantage, in large sectors," he adds.

The leaders offer steady returns, while challengers offer alpha -- the extra return offered by the benchmark.

The fund has been true to its label and has consistently allocated more than 80 percent of its capital to large-cap companies. "For its midcap allocations, the portfolio looks to keep a high hurdle in terms of quality and growth potential," says Devalkar.

Returns

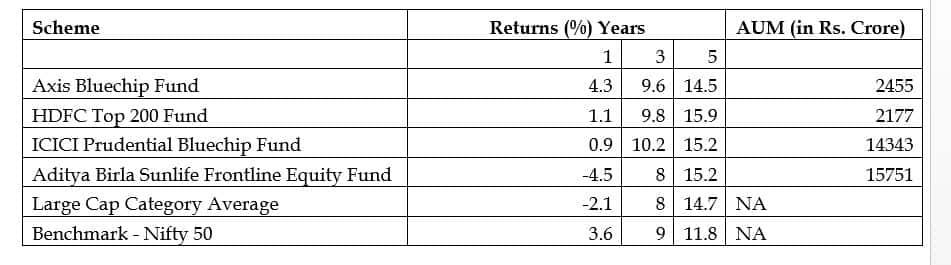

Sticking to the investment philosophy has worked well for the scheme. The fund's returns have been as follows:

Should you invest now?

A weak rupee, IL&FS' default, NBFCs' asset-liability mismatch and the high valuation of stocks are the primary drivers of the current stock market crash.

Although this may be the best time to invest in stocks, one may find it difficult to invest in highly volatile mid-cap oriented schemes. Axis Bluechip Fund's focus on large-cap stocks should help it steer clear of the turbulence gripping the market.

Although the scheme is focused on large caps, it does not compromise on return. The large-cap-focused portfolios can give better returns than the benchmark, and the fund manager has demonstrated his ability to pick winners in the past.

The scheme can be a part of one's core mutual fund portfolio that has an investment horizon of more than five years. Investors should ideally buy into this scheme through systematic investment plans (SIPs).

Expert take

"We like the fund on account of it sticking to its mandate of being a pure large cap fund with ~90 percent or more of the portfolio being parked in the top 100 companies. The fund uses a bottom up approach to pick stocks, and has an actively managed portfolio," says Renu Pothen, Head of Research, FundSuperMart.

She recommends this scheme for conservative/moderately conservative/balanced portfolios on account of the large-cap tilt, which enables it to perform consistently during different market cycles. Its meager mid-cap allocation helps it take advantage of short-term opportunities, which generate alpha for the portfolio.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.