Neha DaveMoneycontrol Research

HDFC Bank is planning to list its non-banking subsidiary, HDB Financial Services, in FY20 and has appointed investment bankers for the same, according to media reports. The bank is likely to raise up to Rs 10,000 crore through the issue.

HDFC Bank owns 95.9 percent in HDB. Hence, value unlocking in HDB will be particularly important to shareholders of HDFC Bank. Investors would like to know how much the potential listing of HDB can add to HDFC Bank’s stock performance. But for that, we first need to know HDB’s valuation.

What valuation will HDB command?

HDB, set up as a non-bank financing company (NBFC) by HDFC Bank in June 2007, has emerged as one of the larger players in the retail financing space over the past few years. It has presence in 961 cities through 1,350 branches as of end March 2019.

According to a news article, investors are buying shares of unlisted HDB at around Rs 1,000- 1,050 per share over the counter, valuing HDB at Rs 79,000 – 82,500 crore. If we incorporate this expected valuation of HDB to arrive at the fair price for HDFC Bank, there is significant upside to HDFC Bank’s share price.

Let’s understand the maths.

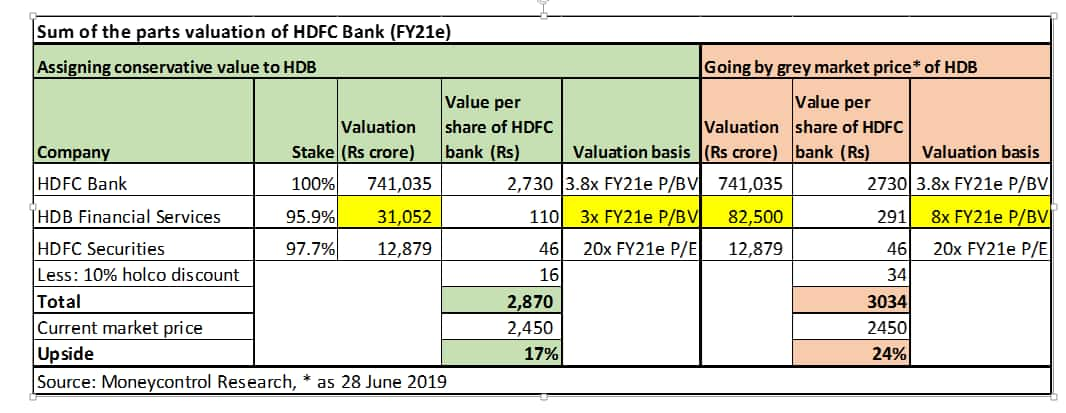

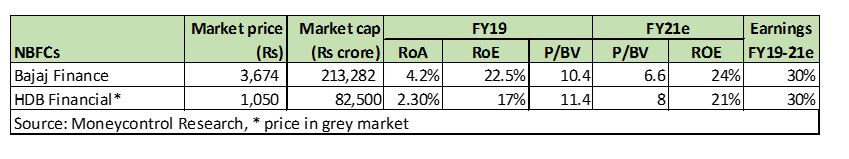

By conservatively assigning a multiple of 3x to estimated book value for FY21, we get valuation of Rs 31,000 crore for HDB, which translates into Rs 395 per share. However, HDB shares are trading at Rs 1,050 in the grey market, implying 8 times FY21e book value (or 11.4 times trailing FY19 book). This is a high premium valuation for an NBFC. Nonetheless, investors of HDFC Bank will rejoice as the upside potential to HDFC Bank will only increase.

The sum of parts valuation for HDFC Bank indicates more than 20 percent upside over the current market price, if the grey market valuation of HDB is anything to go by.

But why should one assign premium valuation to HDB?

One of the reasons for market to ascribe a high valuation to HDB is its performance, which has been impressive so far.

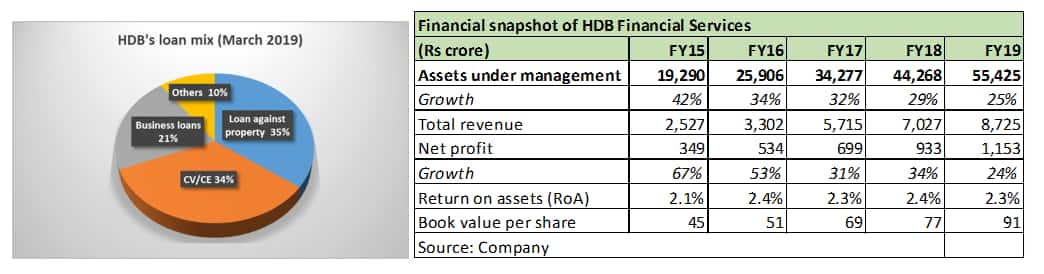

HDB’s asset portfolio stood at Rs 55,425 crore as of end March and has grown at a CAGR of over 30 percent in the past 5 years. The loan book has diversified with increased presence in commercial vehicles and construction equipment (CV/CE) financing and business loans. As a result, the share of loans against property (LAP) declined to 35 percent as on March 31, from 60 percent as on March 31, 2016.

The unsecured loan segment constitutes around 21 percent of the overall portfolio as of March-end. The company is aggressively expanding into consumer durable financing and widening its reach to metros, moving on from the traditional focus on the self-employed segment in non-metros.

HDB’s profit more than doubled during the past four years to Rs 1,153 crore in FY19. Return on assets (RoA) has been steady at around 2.3-2.4 percent in the past 4 years, aided by the healthy net interest margin (NIM) and low credit cost.

HDB's asset quality is reasonably healthy with gross NPAs (GNPA) of 1.8 percent as on March 31. The loan book, however, is relatively unseasoned and has to be fully tested across economic cycles.

Brand value of HDFC Group

But the more important reason for HDB to command high valuation is that it enjoys strong parentage. So far, HDFC Bank has cumulatively infused Rs 3,480 crore in HDB.

The HDFC Group has incubated many successful financial services businesses (Gruh Finance, HDFC Life and HDFC AMC), all of which are trading at a significant premium valuation. For instance, Gruh for a long time traded at more than 8-9 times forward P/BV multiple. In fact, HDFC sold Gruh to Bandhan at a trailing P/BV of around 14 times. So, despite the sectoral concerns, there are very few reasons to doubt the potential high valuation of HDB.

On a relative basis too, HDB is valued higher (in grey market) than Bajaj Finance, which is trading at 6.6 times FY21 estimated book even though Bajaj’s RoE is slightly higher than HDB. Probably, investors are believing that “HDB could be the next Bajaj Finance”.

What should investors do?

While HDFC Bank has underperformed corporate lenders (ICICI bank and Axis Bank) in the past 1 year, value unlocking of HDB in FY20 can significantly add to the stock’s performance. Hence, investors should consider buying HDFC Bank.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.