Anubhav Sahu

Moneycontrol Research

The Supreme Court recently lifted the ban on petcoke, allowing it as feedstock for the calcined petroleum coke (CPC) value chain. Though it offers a major relief to the industry, the approval comes with a rider on emission control and quantitative upper limit for imports. The import quota does not take expansion plans into consideration and hence brings in growth uncertainty to that extent.

SC ruling allows petcoke for domestic calcining industry

The ruling states that the domestic calcining industry can import up to 1.4 million tonne of green petroleum coke (GPC) annually. The apex court also permitted the domestic aluminium industry to use up to 0.5 MT of imported CPC per year.

Current domestic manufacturing capacity

The CPC industry in India consists of 28 companies with an installed capacity of 2.06 MT. Of these, six companies (see table below), with a capacity of 1.17 MT, entirely depend on GPC imports to manufacture CPC. The balance operate on relatively low grade domestic GPC. At 85 percent utilisation for the six calciners, GPC requirement is around 1.35 MT. Among these, the prominent ones are Goa Carbon and Rain Industries.

As per its FY18 annual report, Goa Carbon has a CPC manufacturing capacity of 0.24 MT (an Environment Pollution Control Authority report pegs it at 0.27 MT) from its three plants (Paradeep, Goa and Bilaspur) and operates at about 85 percent utilisation. Rain Industries has a CPC manufacturing capacity of 2.1 MT (US, China and Visakhapatnam). Of this, it produces 0.5 MT in India.

GPC import requirement (tonne) Source: EPCA

Source: EPCA

Import limit doesn’t account for expansion

The apex court judgement is based on EPCA estimate of GPC requirement and doesn’t include future needs as and when capacity expansion is executed. Rain Industries plans to expand CPC capacity by 0.37 MT in Vishakhapatnam. The same is expected to turn operational by Q3 CY19. Given the court’s judgment there is now an uncertainty regarding the same and further clarification from the management is warranted.

Immediate relief for Rain Industries

The court has allowed Rain Industries to avail contracts signed before the last hearing (July 26) and where consignments had already arrived last quarter. This is, however, subject to overall limit, which is 1.4 MT.

In the long term, Rain Industries appears well positioned in terms of environment norms. As per a Central Pollution Control Board (CPCB) report, the court order suggests that emissions during the calcination process needs to be processed through a flue-gas desulphurisation system having efficiency of sulphur removal of over 90 percent. Rain Industries has made suitable investments in the past for flue-gas desulphurisation system both in the US and India.

Resumption of imports comes with a lag

The Supreme Court’s earlier ruling, which led to a two-and-a-half month import ban on pet coke, is expected to have its bearing on the financial performance of both companies. The recent quarterly result of Goa Carbon has been testimony to that.

In the case of Rain Industries, though the company had sufficient GPC inventory, its raw material blending cost had increased due to lack of access to low cost pet coke. Therefore, both Q3 and Q4 CY18 profitability is expected to be impacted. Further, its US CPC operations were also impacted.

Resumption of imports are expected to resume with a lag of few weeks in both cases.

Impact on the aluminium industry

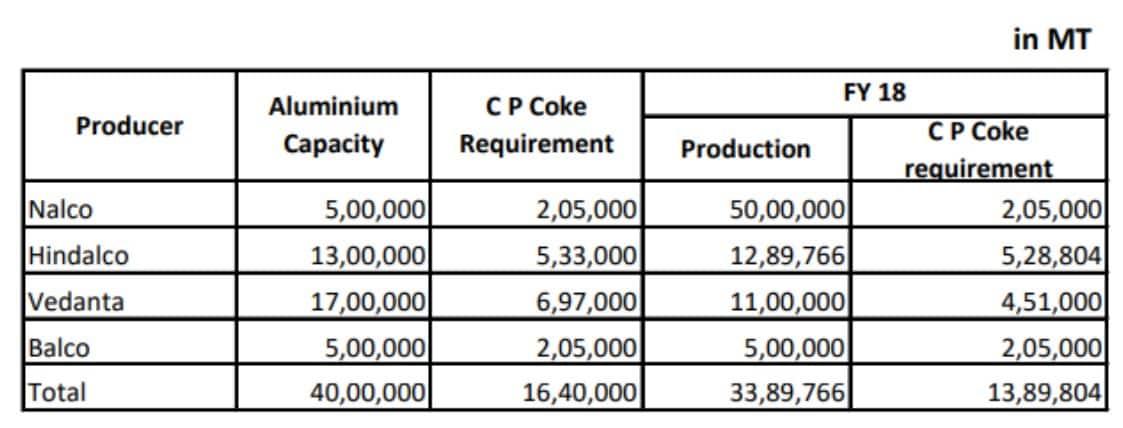

The court’s verdict allowing the domestic aluminium industry to import 0.5 MT of CPC per year is based on EPCA findings.

Source: EPCA

EPCA estimates that the CPC requirement for the aluminium industry is in the 1.4-1.6 MT range. Of this requirement, about 1 MT is supplied by domestic calciner industry, with the balance imported. Here, as well, capacity utilisation has been assumed around 90 percent.

Financial projections under review

The court verdict removes a major hurdle for the petcoke value chain catering to the aluminium industry. Given the strict estimations on the requirements of GPC and CPC, volume growth is expected to moderate. Companies don’t have a leeway in moving beyond a certain capacity utilisation. Raw material requirement and respective legal and government permissions needs to be obtained for expansion plans. To that extent, uncertainty exists and hence we wait for Rain Industries post- quarterly result conference call to tweak our estimates.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.