Highlights:

-Home and MSME loans to be priced on external benchmarks

-Monetary pass-through will improve with this move

-But interest rate and asset liability mismatch risk increases substantially

-HDFC Bank least impacted, HFCs will see higher volatility in margins

----------------------------------------------

In a big push to make transmission of monetary policy more effective, the Reserve Bank of India (RBI) has made it mandatory for banks to link all new floating rate MSME and retail loans to external interest rate benchmarks from October 1, 2019.

Nuances of the regulatory change

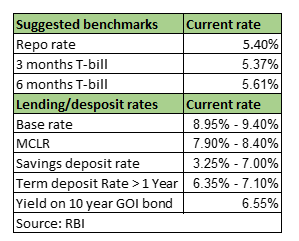

-As per RBI’s order, banks can choose from among RBI repo rate, Government of India 3-month or 6-month Treasury bill (T-bill) yield or any other benchmark market interest rate published by Financial Benchmarks India Private Ltd (FBIL) as the external benchmark.

-The interest rate on the floating loans shall be reset at least once in three months.

-Banks are free to decide the credit spreads over the benchmark as they deem fit. However, the spreads can be changed/altered only on appropriate credit events such as a default or rating downgrade and not otherwise at the discretion of banks.

-Other components of the spread like operating cost can be altered once in three years.

-RBI’s circular is applicable to only new floating rate loans offered from October 1. Existing loans linked to internal benchmarks (MCLR/base rate/BPLR) shall continue till maturity.

Monetary transmission to improve, rate and maturity risk to go up

RBI uses interest rate as the key instrument to achieve the ultimate objectives of monetary policy viz., inflation and growth. But the efficacy of monetary policy depends on the magnitude and the speed with which policy rate changes are transmitted. For more than 20 years after the RBI deregulated banks’ lending rates, the absence of smooth transmission has remained a matter of concern.

Currently, banks have been using internal benchmarks like the base rate and marginal cost of funds based lending rate (MCLR) system for pricing of loans, which has been ineffective so far in better transmission. For instance, in the current cycle, we have seen RBI reducing interest rates by 110 bps, but it has borne little fruit as far as lowering bank lending rates is concerned.

Internationally, financial products are priced using external benchmarks. Financial contracts worth trillions of dollars use LIBOR as the reference benchmark.

Undoubtedly, usage of external benchmarking will improve monetary transmission i.e. changes in the policy repo rate will be meaningfully translated/reflected into bank’s lending rate.

That said, benchmarking wasn’t the only impediment to better monetary transmission. As far as Indian financial system is concerned, banks have not been able to reduce lending rates despite fall in policy rates due to deterioration in the health of the banking sector and also because the funding profile of banks has peculiar rigidities.

Most Indian banks are funded primarily by retail deposits and not from the wholesale market, as is the practice abroad. Since the interest rates on deposits are fixed and sticky, banks are unable to lower lending rates in response to policy action.

With September 4 circular, banks will be exposed to huge interest rate risk and consequently, margin will become highly volatile if they continue to borrow fixed and lend using floating rate linked to an external benchmark.

The new diktat will add a lot of volatility in the financial system. For instance, assume if there is a sudden liquidity crisis and 3 month T-bills rates shoot up 100-200 bps, a mortgage borrower will also end up paying higher rate overnight.

It will be interesting to see if banks start to offer floating rate deposits and saving accounts in a big way -- SBI has introduced this, but on a smaller scale -- to better manage the interest rate risk. However, retail depositors will be particularly averse to such products. Also, banks face huge competition from the government’s small-savings schemes and mutual funds. Both these offer higher tax-adjusted rates compared to bank fixed deposits.

In a falling interest rate regime, it is highly unlikely that banks will reduce rates on deposits as a large interest rate differential in favour of small savings can lead to a significant migration of deposits away from banks, with an adverse impact on banks’ lending capacity.

Hence, we don’t see banks' funding profile changing in a jiffy. And unless the liability (funding) profile transforms, banks will have to use derivatives like interest rate swaps to better manage ALM (asset and liability management) and interest rate risk post the RBI’s diktat on external benchmarking.

Tighter norms not in sync with spirit behind lending rates deregulation

Under new norms specified by the RBI, spread has to be constant, unless there is a solid ground to change such as a mutually agreed credit event. In practicality, spread is often influenced by subjective parameters such as sector outlook, margin protection and market competition, in addition to credit event. For instance, at times, banks may have to reduce spread just to retain customers or increase spread if they want to pull back from a certain segment pursuant to the business strategy.

While banks have freedom to decide on credit spreads, it cannot be frequently tweaked with for competitive positioning/business strategy or margin management.

External benchmarking to largely affect home loans and MSME loans

Since the circular is for floating rate retail and MSME loans, the products affected largely will be mortgages and loan against property to MSMEs. Other retail products such as credit cards, personal loans, education loans, commercial vehicle finance, a large part of passenger car loans all tend to be fixed rate in India, and thus out of the purview of this circular.

Private banks with large home loan portfolio will be most impacted

Retail and MSME floating rate loans are around 25-35 percent of total loans for most leading banks. Among banks, ICICI Bank has the highest share of housing and SME loans at around 39 percent of current loan book. IndusInd Bank has high exposure to fixed-rate auto loans and hence, is relatively less exposed.

HDFC Bank with a highly diversified retail loan book heavy on personal lending will be least impacted by RBI’s stipulation as only 20-22 percent of loans are towards home loans and SMEs. For SBI, around 30 percent loan book will be affected.

HFCs will also face the musicRBI’s norms do not apply directly to housing finance companies (HFCs). But HFCs compete with banks on home loans and will need to catch up with their banking peers on any movement in home loan rates. With home loans constituting more than 70 percent of total loans, HFCs like LIC housing Finance and HDFC will be most impacted.

HFCs may have to revise their home loan rates lower to protect market share, but spreads may still be maintained as incremental funding costs are falling. Managing interest rate risk in the new scenario will be a difficult for HFCs. If they resort to more short-term borrowings through commercial papers to manage interest rate risk, their ALM risk will amplify.

Overall, for both banks and HFCs, the adverse margin impact will be small and only on incremental loans as back-book yields will remain unchanged in the near term. Over the long term, usage of external benchmark will force a big transformation in the liability or funding profile of financial players as liabilities are the ultimate deciding factor for pricing the assets, not any single external benchmark.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.