Jitendra Kumar GuptaMoneycontrol Research

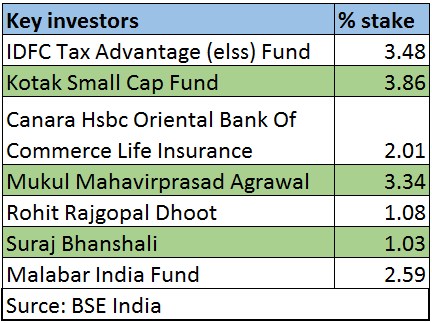

If you keenly follow where the smart money getting deployed, you would not miss Apollo Pipes. Investors such as Vallabh Bhansali (family), Mukul Agrawal, Kotak Small Cap, IDFC and few others already find their names in the shareholders list. Very recently, Malabar India Fund, an investment boutique run on value investing philosophy, has picked up a 2.59 percent stake at about Rs 400 a share.

Key rational

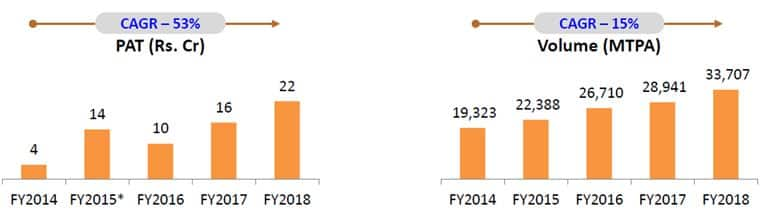

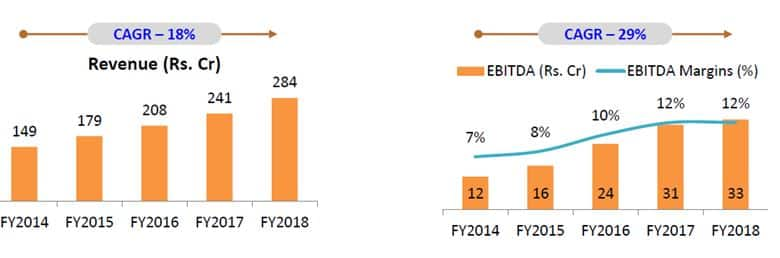

Apollo Pipes, which commenced its business in the year 2000, is a fast growing company manufacturing plastic pipes for various industrial, housing and agriculture applications. It has demonstrated continues improvement in the profitability and return ratios led by operational efficiencies and strategic efforts that isolate it from the highly commoditised market. Moreover, with prudent management of its balance sheet, it qualifies most of the hygiene factors for a good investment. What is interesting, post close to 45 percent correction in its share price, stock at current market price has become relatively cheaper. It is currently trading at 15 times its FY19 estimated earnings. Valuations are reasonable considering low debt in the books, higher return on capital of 28 percent and strong earnings growth. Apparently, on a PEG ratio (PE to earnings growth) stock is trading at 0.4 times because of the expected earnings growth of about 40-45 percent over the next two years.

Driver of growth

A large part of its growth would come from the capacity expansion. The company is doubling its capacity from 53,000 tonnes in FY18 to 100,000 tonne by the end of FY20. Interestingly, the capex would be largely funded through internal accruals without putting pressure on the balance sheet. Last fiscal, the company generated close to Rs 96 crore cash from operations. Besides, the promoters have recently infused about Rs 200 crore through preferential allotment, which will be converted into equity over the next few years.

“We are sitting on a capital work in progress of about Rs 35 crore and cash of about Rs 140 crore. So the funding is already ready for these projects. There could be an increase in equity capital over the next three years as a result of the conversion of shares, but that would be marginal,” said AK Jain, CFO, Apollo Pipes

Capacity expansion would help in diversification and increase its market reach. Because of the logistics cost, manufacturing of pipe is considered as highly localised business. The company has largely catered to north Indian markets particularly Uttar Pradesh. However, it has now established a manufacturing facility in Ahmedabad to cater to Western markets. It is also setting up a facility in Raipur, which will take care of eastern and central India.

This would not only help in scaling the business but also help improve margins because of the value-added products. “We are gradually moving in products such as fittings, taps and other water dispensing products, which typically could have margins in the range of 20-50% as against the traditional pipes,” Jain said.

Apollo Pipes is a group company of APL Apollo, a well-known brand in steel based pipes and structures. Apollo Pipes is taking initiatives to strengthen its brand as aspires to become a pan India company. Currently fittings segment accounts for 11% of sales and it intends to take it to 15% by the end of FY20. Besides, it is getting into the UPVC, CPVC used in housing sector, which attracts higher margins. That apart, currently a part of its capital is deployed in the under construction projects. Once the expansion is over and the projects start to generate revenues the return ratios should further improve.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.