Revenue and earnings of Indian IT companies will take a massive hit from the US recession, according to a latest report from Jefferies.

Whenever US real GDP growth has fallen to zero percent, and this has happened twice (see graph below), global IT services spends have seen a marked growth moderation and growth for Indian IT services. The same trend is expected to play out in CY23 and FY24, added Jefferies.

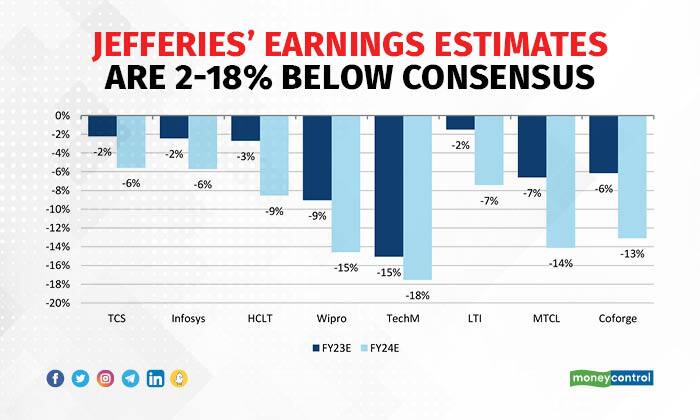

They see revenue growth for the companies moderating sharply by 340bps in FY24, and the analysts have cut their revenue and EPS estimates by up to 15 percent. They expect earnings cuts to lead to further PE derating for the stocks. Jefferies has lowered their target prices by 20-45 percent and their target PEs by 20-40 percent. Their earnings’ estimates diverge from consensus estimates, and the divergence is the least for TCS and Infosys, and highest for TechM and Wipro.

Also read: Strong cross-currency headwinds ahead for IT industry

Consensus EPS estimates for FY24 have already been lowered by 2-6 percent from peak but they are far from the 8-40 percent cuts seen during previous recessions. “This suggests that downward earnings revision cycle has only just begun,” said their report.

Larger companies are likely to be better placed because clients may choose to fund their transformation programmes by “lowering discretionary spends, increasing large outsourcing deals and potentially consolidating IT vendors”. In this context, wrote the analysts, TCS/ Infosys are better placed while Mindtree/Coforge are the worst placed. Indian IT services firms have consistently gained market share over the last 20 years and they may gain more, with vendor consolidation.

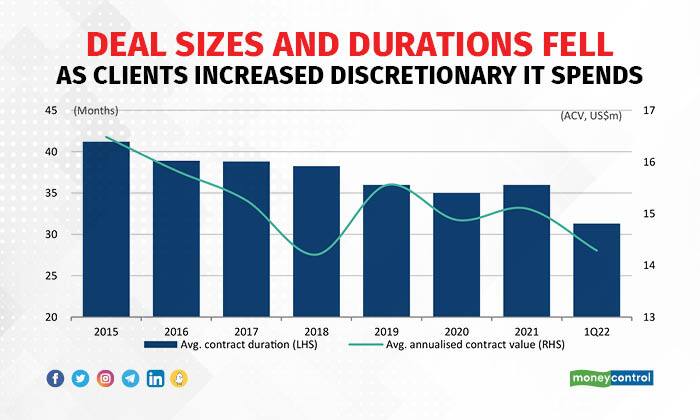

Over the last few years, the IT companies’ clients increased their discretionary IT spends (see below) with contract durations and value decreasing. This trend is likely to see a reversal. “With clients looking to cut costs through large outsourcing deals, deal sizes/ duration will rise,” said the report.

With mid-sized firms more dependent on a few clients, they are more vulnerable.

The good news is that Indian IT is better placed than previous recessions.

“While a sharp moderation in growth is almost certain in FY24, we do note that this recession is different in two key ways. First, clients are undergoing large-scale tech transformation which might not be abruptly stopped. Given this, growth in global IT spends might remain above trend-rate beyond FY24. Second, Indian IT companies have emerged as strong transformation partners while maintaining their cost leadership which should impact them less vs. their global counterparts,” said the report.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!