The benchmark indices finished the volatile session flat with a negative bias on March 3, continuing their southward journey for the ninth consecutive day. The market breadth remained in control of bears, as a total of 1,910 shares saw correction compared to 760 advancing shares on the NSE. The market may attempt a bounce back considering the oversold conditions, but it is unlikely to sustain the same. Below are some trading ideas for the near term:

Jigar S Patel, Senior Manager - Equity Research at Anand Rathi

Larsen & Toubro | CMP: Rs 3,197.3

Recently, Larsen & Toubro underwent a Head and Shoulders breakdown, leading to a sharp 20% correction from its peak. The stock has now met the pattern’s minimum downside target, suggesting that a base formation could emerge in the Rs 3,080-3,120 range. Traders may consider entering long positions in the Rs 3,200-3,150 zone, with an upside target of Rs 3,450.

Strategy: Buy

Target: Rs 3,450

Stop-Loss: Rs 3,037

Hindalco Industries | CMP: Rs 636.55

The entire month of February has been phenomenal for Hindalco, as it has rallied almost 18% from the bottom of approximately Rs 560. Last week, we saw a decent correction of 6% from the Rs 656 (the recent swing). Currently, Hindalco has closed above its previous breakout zone, forming a Hammer-like candlestick that aligns with the R1 monthly pivot, as depicted in the chart. Thus, we expect Hindalco to make another high in the ongoing uptrend. Traders may consider entering long positions in the Rs 633-637 zone, with an upside target of Rs 680.

Strategy: Buy

Target: Rs 680

Stop-Loss: Rs 608

Tata Motors | CMP: Rs 621.15

Tata Motors has taken support at the 50% retracement level of its rally from March 2020 to July 2024, aligning with key weekly and quarterly S1 support levels. Additionally, the weekly RSI is in the oversold zone, indicating a potential rebound in the coming sessions. Traders may consider entering buy positions in the Rs 615-625 zone, with a target of Rs 720.

Strategy: Buy

Target: Rs 720

Stop-Loss: Rs 570

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI Securities

PFC Futures | CMP: Rs 381

Power Finance Corporation (PFC) has outperformed the Nifty in the recent fall, as it has managed to hold on to its previous lows, and the overall fall so far has been due to long unwinding. After the price correction, there is a high possibility of an uptrend, as there has been a positive divergence. The stock has witnessed good addition on the Rs 370 strike Put, which will act as a support. Buy PFC Futures in the range of Rs 381 to Rs 375.

Strategy: Buy

Target: Rs 395, Rs 410

Stop-Loss: Rs 365

JSW Energy Futures | CMP: Rs 475.7

JSW Energy has fallen sharply since it was introduced into the derivatives segment. The stock prices fell sharply with open interest rising, clearly indicating that short positions have built up in the stock. Now, with the prices holding at previous lows and the momentum indicator showing positive divergence, there is a high possibility of short covering in the near term. Hence, the risk: reward is favourable on the long side. Buy JSW Energy Futures in the range of Rs 475-465.

Strategy: Buy

Target: Rs 500, Rs 515

Stop-Loss: Rs 450

Bajaj Finance Futures | CMP: Rs 8,665

Bajaj Finance has witnessed a huge breakout from the sideways consolidation, which has come on account of short covering. Now, the shorts seem to have covered quite a lot, and the stock is outperforming its index; hence, long buildup is quite likely from hereon. There has been massive Put additions from Rs 8,500 to Rs 8,000 levels, and the Call base is directly at Rs 9,000 levels, making the risk: reward quite favourable on the long side. It is also trading well above its maximum pain level of Rs 8,500. Buy Bajaj Finance Futures in the range of Rs 8,664 to Rs 8,600.

Strategy: Buy

Target: Rs 8,900, Rs 9,100

Stop-Loss: Rs 8,390

Anshul Jain, Head of Research at Lakshmishree Investments

Narayana Hrudayalaya | CMP: Rs 1,615.6

Narayana Hrudayalaya has broken out of a 260-day bullish Volatility Contraction Pattern (VCP), with a 2,800% surge in volume to 11.9 million shares, signaling institutional interest despite weak market conditions. The breakout emerged from the 10-day moving average, with the 10, 20, and 50-day averages aligned bullishly, confirming the uptrend. With strong momentum, Narayana Hrudayalaya is poised for further gains, with targets near Rs 2,000 levels. This breakout suggests potential upside, making Narayana Hrudayalaya a stock to watch closely.

Strategy: Buy

Target: Rs 1,850

Stop-Loss: Rs 1,530

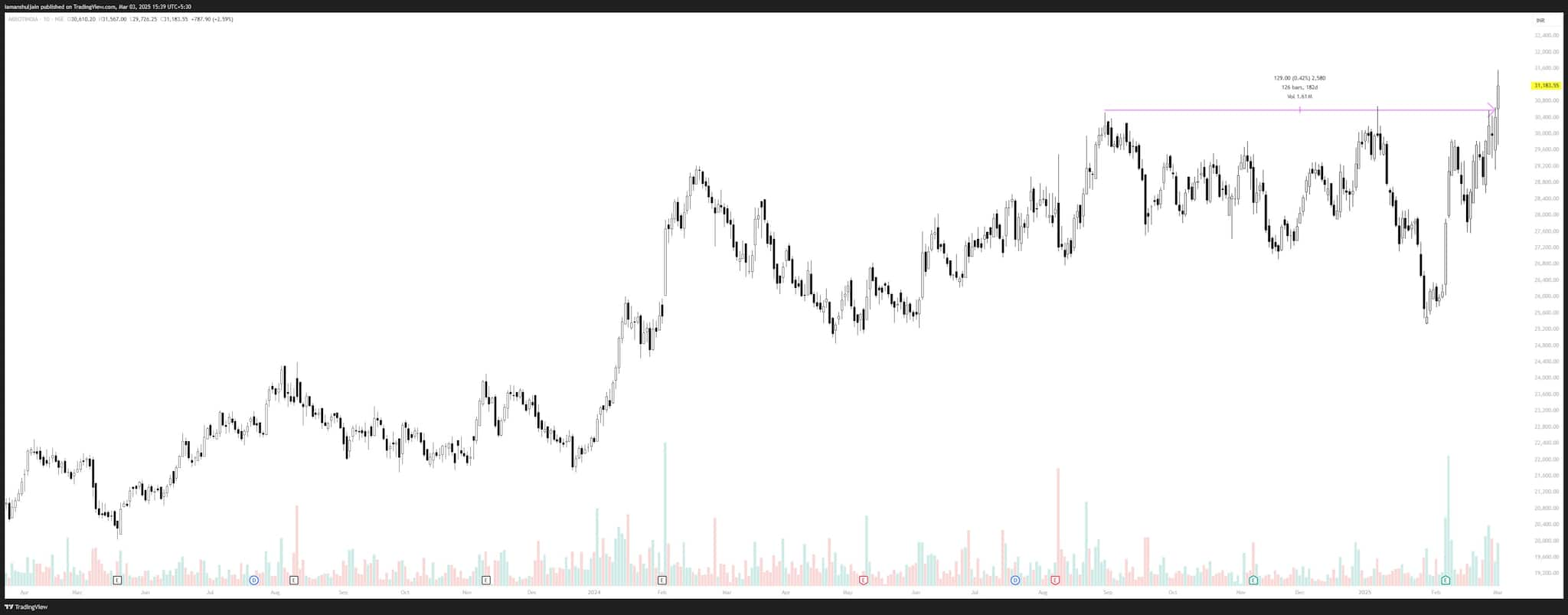

Abbott India | CMP: Rs 31,183.55

Abbott India has broken out of a 126-day rounding bottom pattern, with a flush inside the pattern indicating that weak hands have been shaken out. The right-side volume surge suggests strong institutional activity, and Monday’s breakout occurred on twice the 50-day average volume, reinforcing the bullish momentum. Additionally, the 10, 20, and 50-day moving averages have formed a bullish crossover and are trading comfortably above each other, confirming the uptrend. With strong technical signals, Abbott India appears well-positioned for further upside in the near term.

Strategy: Buy

Target: Rs 38,000

Stop-Loss: Rs 29,000

Bajaj Finserv | CMP: Rs 1,838.55

Bajaj Finserv is trading just below the pivotal Rs 1,900 level, forming a 93-day bullish rounding bottom pattern. The initial breakout occurred on high volume, while the last two sessions saw a low-volume pullback, indicating that weak hands are being shaken out. For the bullish momentum to continue, the stock needs to reclaim and sustain above Rs 1,900, which appears likely given the strong volume pattern. A decisive move above this level could signal further upside, making Bajaj Finserv a stock to watch closely in the coming sessions.

Strategy: Buy

Target: Rs 1,900

Stop-Loss: Rs 1,800

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.