The benchmark indices fell four-tenths of a percent on November 24, continuing the downtrend and forming a lower-high, lower-low structure for the second straight session. The Nifty 50 closed below the 26,000 level ahead of monthly F&O contracts expiry due on November 25, with momentum indicators showing weakness. The next support for the index is placed at 25,850, the lower end of the previous week's range (25,850–26,250) and the midline of the Bollinger Bands. If the index decisively breaks this level, bears may turn stronger and a fall toward 25,700 is possible. On the higher side, 26,100 and 26,250 are the hurdles to watch, experts said.

Here are 15 data points we have collated to help you spot profitable trades:

1) Key Levels For The Nifty 50 (25,960)

Resistance based on pivot points: 26,093, 26,147, and 26,235

Support based on pivot points: 25,917, 25,862, and 25,774

Special Formation: The Nifty 50 formed a long bearish candle on the daily timeframe and tested the 10-day EMA during the session. The index still held above all key moving averages, but the RSI declined to 57.38 with a bearish crossover, and the Stochastic RSI also turned bearish. The MACD maintained a positive crossover but inclined downward, while the falling histogram suggested weakening momentum. All this indicates caution.

2) Key Levels For The Bank Nifty (58,835)

Resistance based on pivot points: 59,184, 59,340, and 59,592

Support based on pivot points: 58,679, 58,523, and 58,271

Resistance based on Fibonacci retracement: 59,455, 60,875

Support based on Fibonacci retracement: 58,568, 58,300

Special Formation: The Bank Nifty formed a bearish candle with a long upper shadow and a minor lower shadow on the daily charts, accompanied by above-average volumes, indicating weakness and pressure at higher levels. The index still traded above all key moving averages, but the MACD dropped below the reference line with the histogram falling below the zero line. The RSI (at 63.05) and the Stochastic RSI maintained a bearish crossover. All this indicates a weakening momentum setup.

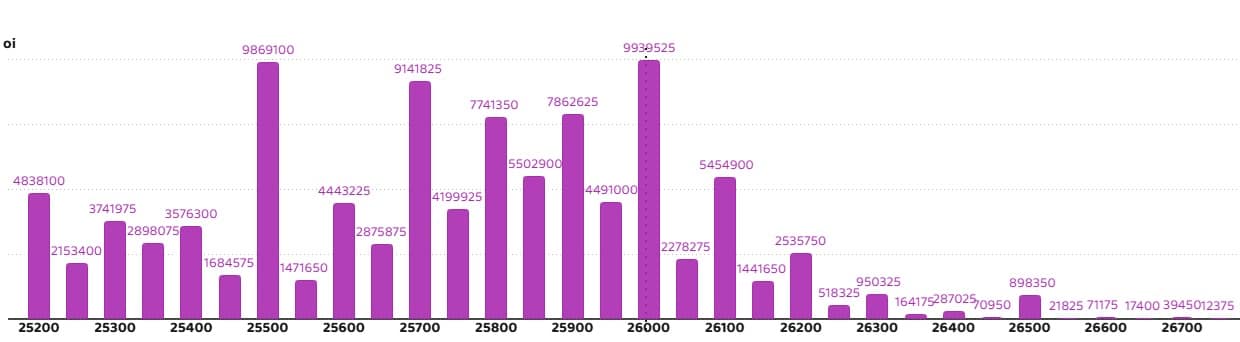

According to the monthly options data, the maximum Call open interest was seen at the 26,100 strike (with 2.08 crore contracts). This level can act as a key resistance level for the Nifty in the short term. It was followed by the 26,200 strike (1.76 crore contracts) and 26,500 strike (1.49 crore contracts).

Maximum Call writing was observed at the 26,100 strike, which saw an addition of 1.17 crore contracts, followed by the 26,150 and 26,300 strikes, which added 61.89 lakh and 57.98 lakh contracts, respectively. The maximum Call unwinding was seen at the 25,700 strike, which shed 2.37 lakh contracts, followed by the 25,500 and 26,550 strikes, which shed 1.53 lakh and 1.04 lakh contracts, respectively.

On the Put side, the 26,000 strike holds the maximum Put open interest (with 99.39 lakh contracts), which can act as a key level for the Nifty in the short term. It was followed by the 25,500 strike (98.69 lakh contracts) and the 25,700 strike (91.41 lakh contracts).

The maximum Put writing was placed at the 25,850 strike, which saw an addition of 15.41 lakh contracts, followed by the 25,500 and 25,750 strikes, which added 13.08 lakh and 12.81 lakh contracts, respectively. The maximum Put unwinding was seen at the 26,150 strike which shed 12.2 lakh contracts, followed by the 26,100 and 26,200 strikes, which shed 11.81 lakh and 11.69 lakh contracts, respectively.

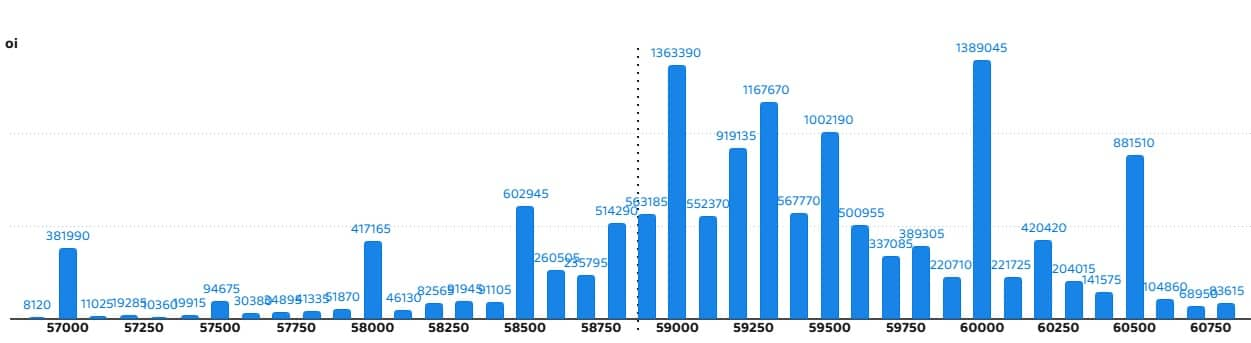

5) Bank Nifty Call Options Data

According to the monthly options data, the 60,000 strike holds the maximum Call open interest, with 13.89 lakh contracts. This can act as a key resistance level for the index in the short term. It was followed by the 59,000 strike (13.63 lakh contracts) and the 59,300 strike (11.67 lakh contracts).

Maximum Call writing was observed at the 59,300 strike (with the addition of 4.41 lakh contracts), followed by the 58,800 strike (3.09 lakh contracts) and 60,200 strike (2.32 lakh contracts). The maximum Call unwinding was seen at the 60,000 strike, which shed 1.54 lakh contracts, followed by the 59,500 and 59,000 strikes, which shed 1.12 lakh and 82,740 contracts, respectively.

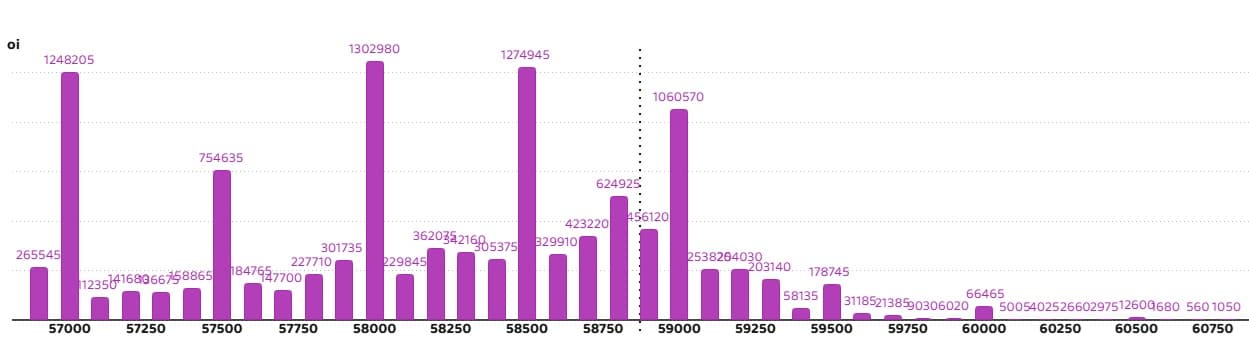

6) Bank Nifty Put Options Data

On the Put side, the maximum Put open interest was seen at the 58,000 strike (with 13.02 lakh contracts), which can act as a key support level for the index. This was followed by the 58,500 strike (12.74 lakh contracts) and the 57,000 strike (12.48 lakh contracts).

The maximum Put writing was placed at the 57,900 strike (which added 1.2 lakh contracts), followed by the 58,700 strike (1.06 lakh contracts) and the 58,000 strike (89,670 contracts). The maximum Put unwinding was seen at the 58,400 strike, which shed 1.24 lakh contracts, followed by the 59,400 and 58,900 strikes, which shed 83,300 and 68,250 contracts, respectively.

The Nifty Put-Call ratio (PCR), which indicates the mood of the market, slipped to 0.77 on November 24, compared to 1.03 in the previous session.

The increasing PCR, or being higher than 0.7 or surpassing 1, means traders are selling more Put options than Call options, which generally indicates the firming up of a bullish sentiment in the market. If the ratio falls below 0.7 or moves towards 0.5, then it indicates selling in Calls is higher than selling in Puts, reflecting a bearish mood in the market.

9) India VIX

The India VIX, also known as the fear gauge, sustained well above the 13 zone and remained above all key moving averages, though it corrected 2.9 percent on Monday to 13.24 (following a 12.3 percent surge in the previous session), signalling a discomfort zone for bulls.

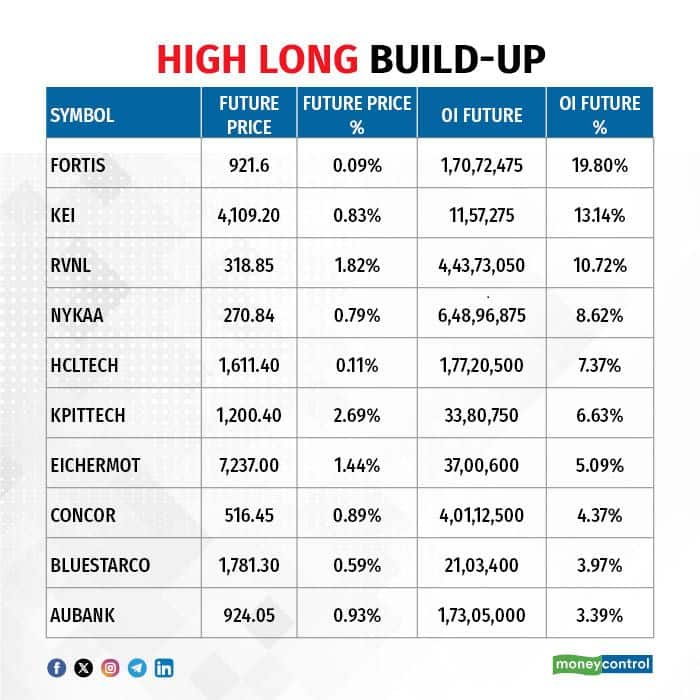

A long build-up was seen in 23 stocks. An increase in open interest (OI) and price indicates a build-up of long positions.

11) Long Unwinding (77 Stocks)

77 stocks saw a decline in open interest (OI) along with a fall in price, indicating long unwinding.

12) Short Build-up (81 Stocks)

81 stocks saw an increase in OI along with a fall in price, indicating a build-up of short positions.

13) Short-Covering (29 Stocks)

29 stocks saw short-covering, meaning a decrease in OI, along with a price increase.

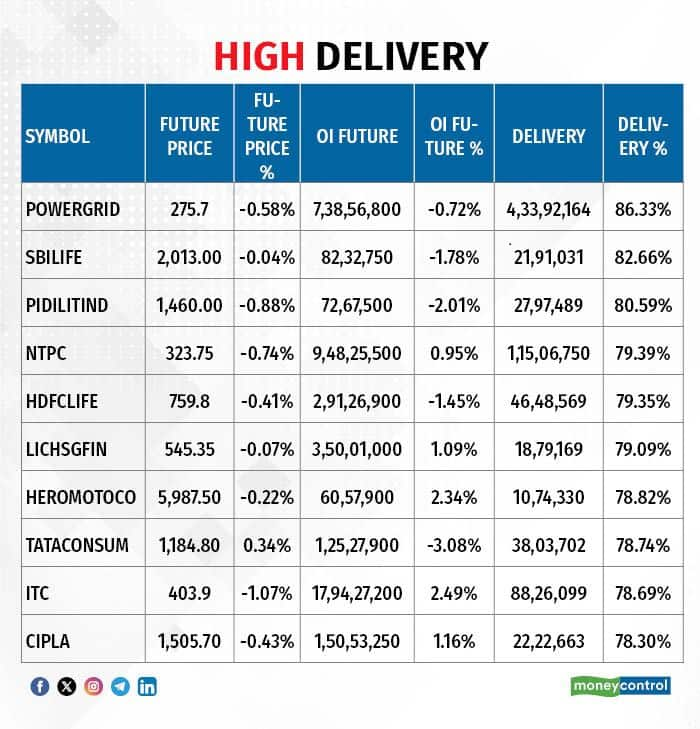

Here are the stocks that saw a high share of delivery trades. A high share of delivery reflects investing (as opposed to trading) interest in a stock.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Stocks added to F&O ban: Nil

Stocks retained in F&O ban: SAIL, Sammaan Capital

Stocks removed from F&O ban: Nil

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.