The equity benchmarks finished flat after a lacklustre session on July 7, while market breadth was favourable for bears. A total of 1,667 shares saw selling pressure compared to 1,008 shares that advanced on the NSE. The market is expected to remain directionless in the upcoming sessions. Below are some short-term trading ideas to consider:

Jigar S Patel, Senior Manager - Equity Research at Anand Rathi

Vijaya Diagnostic Centre | CMP: Rs 1,010

Vijaya Diagnostic Centre has been consolidating within the Rs 900–1,000 range for the past two months. In the previous session, it finally broke out of this range and closed decisively above it, indicating a potential trend shift. Supporting this move, the daily Camarilla monthly pivot chart shows an overlapping higher value relationship, reinforcing the bullish structure.

Additionally, the daily RSI is comfortably placed above the 60 mark, lending further strength to the positive outlook. Traders may consider entering long positions in the Rs 1,015–1,005 zone.

Strategy: Buy

Target: Rs 1,125

Stop-Loss: Rs 960

Varun Beverages | CMP: Rs 464

Varun Beverages has recently formed a Tweezer Bottom near the Rs 446–447 zone, which aligns with the S1 monthly floor pivot—indicating strong support at lower levels. Additionally, the RSI on the daily chart is showing an impulsive V-shaped recovery from the oversold region near the 30 mark, suggesting a potential shift in momentum. Traders may consider entering long positions in the Rs 465–460 zone.

Strategy: Buy

Target: Rs 515

Stop-Loss: Rs 435

Sun Pharmaceutical Industries | CMP: Rs 1,679.9

Sun Pharmaceutical has formed a solid base in the Rs 1,650–1,680 zone, which coincides with the S3 Camarilla monthly pivot, signalling a key support area. This zone also aligns with a rising trendline and pitchfork, adding further technical confluence. These factors suggest that the stock is likely to find buying interest at current levels, and any sustained move above this base could trigger a fresh upside—provided broader market conditions remain supportive. Traders may consider entering long positions in the Rs 1,680–1,670 zone.

Strategy: Buy

Target: Rs 1,785

Stop-Loss: Rs 1,620

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI Securities

Dabur India | CMP: Rs 512.75

Dabur has provided a breakout from sideways consolidation, accompanied by short covering. Significant Put writing along with Call unwinding has resulted in the Put-Call Ratio (PCR) rising above 1; it currently stands at 1.04. Dabur is also trading above its maximum pain and modified maximum pain levels of Rs 500 and Rs 498, respectively, indicating a positive short-term outlook. Buy Dabur Futures in the range of Rs 505 to Rs 510.

Strategy: Buy

Target: Rs 530, Rs 540

Stop-Loss: Rs 492

Indian Oil Corporation | CMP: Rs 153.75

The overall trend in crude oil prices remains negative, and with OPEC increasing supply, prices are expected to remain under pressure in the short to medium term. IOC has broken out from a sideways consolidation phase, supported by short covering. The stock has seen fresh Put additions and has moved above both its maximum pain and modified maximum pain levels, which is positive for the short term. Buy IOC July Futures in the range of Rs 153 to Rs 155.

Strategy: Buy

Target: Rs 162, Rs 166

Stop-Loss: Rs 146

Jubilant Foodworks | CMP: Rs 684.1

Jubilant Foodworks is facing clear resistance at higher levels, with aggressive Call writing restricting its upward movement—indicating a higher probability of a downside from current levels. It is trading below its maximum pain and modified maximum pain levels, which is considered negative in the short term. Sell Jubilant FoodWorks Futures in the range of Rs 690–684.

Strategy: Sell

Target: Rs 655, Rs 630

Stop-Loss: Rs 707

Vidnyan S Sawant, Head of Research at GEPL Capital

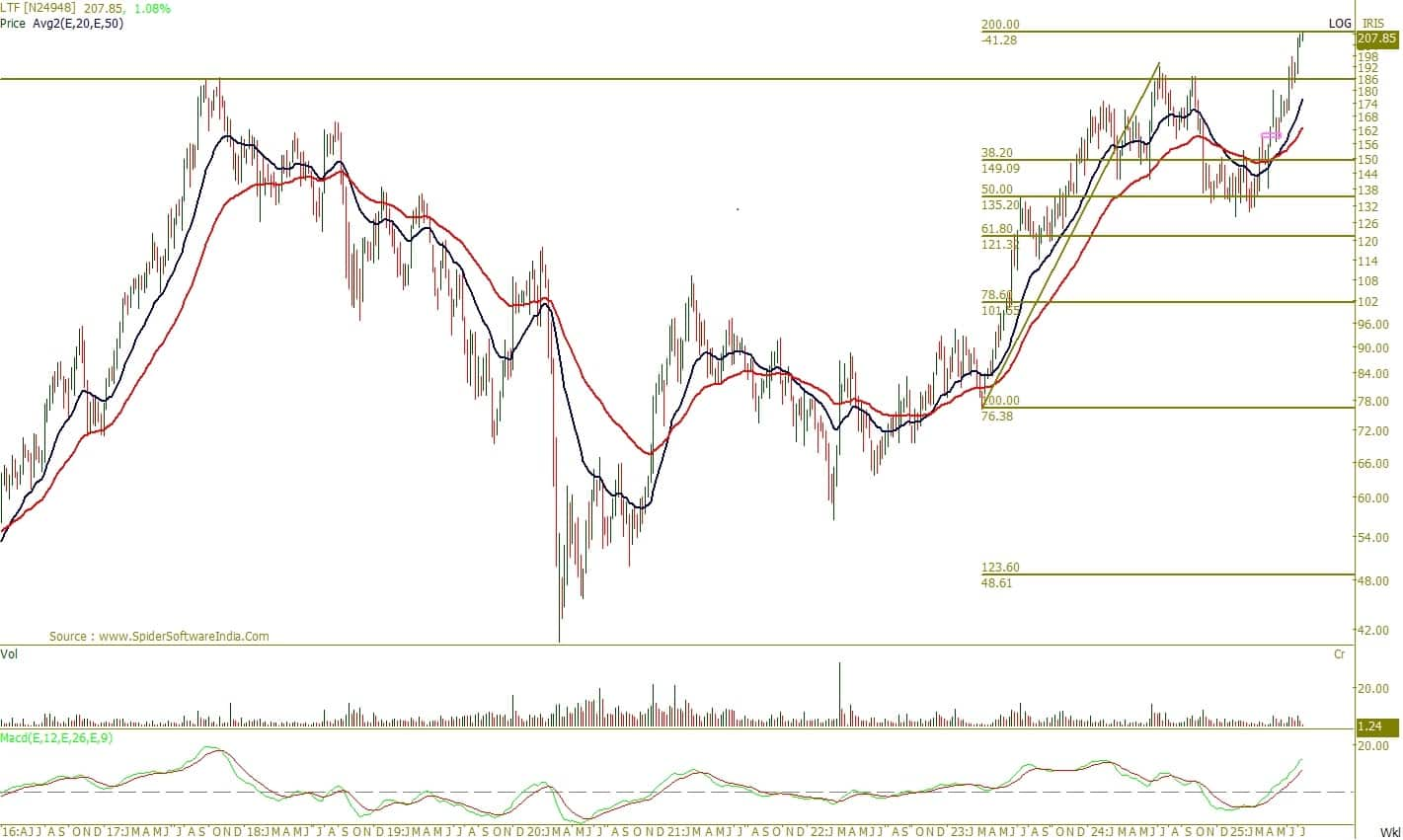

L&T Finance | CMP: Rs 207.77

L&T Finance is exhibiting a strong uptrend across monthly, weekly, and daily timeframes, marked by consistent higher highs and higher lows. A recent breakout from a bullish Cup and Handle pattern on the monthly chart, supported by a strong candlestick, signals renewed buying interest. On the weekly scale, the stock hit a fresh all-time high with a rising MACD, reinforcing momentum. This confluence of price structure and indicators suggests continued upside potential in the near term.

Strategy: Buy

Target: Rs 233

Stop-Loss: Rs 197

Fiem Industries | CMP: Rs 1,975.2

Fiem has been in a strong uptrend since 2020, consistently forming higher tops and bottoms—indicating a robust long-term bullish structure. This month, the stock broke above its 2024 swing high with a strong bullish candle, and volume exceeded the 20-month average, confirming strong market participation.

On the weekly chart, a 27-week correction has been swiftly retraced in just 8 weeks, highlighting aggressive buying interest. The daily chart further confirms strength, with the stock trading above its 20-, 50-, and 100-day EMAs, while the rising MACD indicates momentum acceleration.

Strategy: Buy

Target: Rs 2,271

Stop-Loss: Rs 1,876

Can Fin Homes | CMP: Rs 820.3

Can Fin Homes is in a strong long-term uptrend, forming higher bottoms since 2018 on the monthly chart. A positive polarity shift from the February 2023 swing high on the weekly chart has led to a series of higher highs and higher lows. It is currently trading above its 12- and 26-week EMAs, indicating trend strength. The MACD remains in buy mode across timeframes, reinforcing the bullish momentum.

Strategy: Buy

Target: Rs 918

Stop-Loss: Rs 779

JK Lakshmi Cement | CMP: Rs 978.3

JK Lakshmi Cement posted a new all-time high last week, highlighting strong bullish momentum and a solid price structure. On the monthly chart, it has demonstrated a faster retracement—recovering a 12-month decline in just 5 months—signalling renewed strength.

Last week’s breakout from a channel pattern (formed since November 2023), supported by a bullish candlestick and rising volumes above the 20-week average, reflects strong market participation and high relative strength. Additionally, the MACD remains above the zero line on the weekly chart, indicating sustained trend strength and continued momentum, further reinforcing the bullish outlook.

Strategy: Buy

Target: Rs 1,117

Stop-Loss: Rs 930

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.