The benchmark indices snapped a three-day gain streak, with the Nifty 50 falling 0.4 percent on September 19. The market breadth remained slightly in favour of bears. About 1,421 shares declined compared to 1,352 advancing shares on the NSE. Consolidation may be seen for a few more sessions before entering a new leg of the upmove. Below are some short-term trading ideas to consider:

Rajesh Palviya, Senior Vice President Research (Head Technical Derivatives) at Axis Securities

Swiggy | CMP: Rs 458.5

On the daily timeframe, Swiggy has confirmed a "Rounded Bottom" formation breakout at Rs 459 levels on a closing basis. This breakout is accompanied by huge volumes, which signify increased participation in the rally. The stock is well placed above its 20, 50, 100, and 200-day SMAs, which reconfirms a bullish trend, and these averages are also inching up along with the price rise, further confirming the bullish trend. The daily Bollinger Bands buy signal indicates increased momentum. The daily and weekly strength indicator RSI indicates rising strength.

Strategy: Buy

Target: Rs 503, Rs 540

Stop-Loss: Rs 455

Sequent Scientific | CMP: Rs 200.6

On the weekly timeframe, Sequent Scientific has confirmed an "Inverse Head & Shoulder" pattern at Rs 191 levels on a closing basis, along with huge volumes. The daily Bollinger Bands buy signal indicates increased momentum. Currently, the stock is well placed above its 20, 50, 100, and 200-day SMAs, which reconfirms a bullish trend. The daily, weekly, and monthly strength indicator RSI indicates rising strength.

Strategy: Buy

Target: Rs 219, Rs 235

Stop-Loss: Rs 191

Canara Bank | CMP: Rs 117.76

On the weekly chart, Canara Bank has confirmed a "down-sloping" channel breakout at Rs 114 levels on a closing basis. This breakout is accompanied by huge volumes, indicating increased participation. The daily Bollinger Bands buy signal indicates increased momentum. The daily, weekly, and monthly strength indicator RSI indicates rising strength. The stock is well placed above its 20, 50, 100, and 200-day SMAs, which reconfirms a bullish trend.

Strategy: Buy

Target: Rs 127, Rs 133

Stop-Loss: Rs 114

Rajesh Bhosale, Technical Analyst at Angel One

Sammaan Capital | CMP: Rs 143.21

Sammaan Capital has shown impressive strength since the beginning of September and, in the latest week, has confirmed a bullish reversal breakout from an Inverse Head and Shoulders pattern. This breakout is well-supported by robust volumes and a strong bullish candlestick formation, adding conviction to the move. Further, a bullish crossover between the 89-DMA and 200-DMA has been observed, reinforcing the positive momentum and suggesting the potential for sustained upside in the near term.

Strategy: Buy

Target: Rs 160

Stop-Loss: Rs 135

Phoenix Mills | CMP: Rs 1,629.8

After marking an all-time high near Rs 2,050 levels in July last year, Phoenix Mills consolidated within a broad descending triangle pattern. Over the past year, the stock repeatedly faced resistance along the descending trendline, but has now successfully broken out on the upside, indicating a strong reversal.

Adding to this, the daily chart also highlights a Cup and Handle bullish breakout, with prices moving decisively above the 200-day SMA. With this confluence of bullish patterns and key technical confirmations, we anticipate a robust upside in the stock, turning the overall outlook strongly positive.

Strategy: Buy

Target: Rs 1,710

Stop-Loss: Rs 1,588

Great Eastern Shipping Company | CMP: Rs 1,054.4

On the weekly chart, Great Eastern Shipping Company has confirmed a Cup and Handle bullish reversal breakout, supported by strong volumes and a robust bullish candlestick formation. On the momentum front, the weekly RSI (Relative Strength Index) smoothed indicator has moved past the 60 level, signaling a pickup in positive momentum and strengthening prospects of further upside in the near term.

Strategy: Buy

Target: Rs 1,175

Stop-Loss: Rs 990

Anshul Jain, Head of Research at Lakshmishree Investments

AGI Infra | CMP: Rs 1,176.4

AGI Infra rallied 14% in just 5 sessions, forming a strong pole followed by 23 days of consolidation, shaping a bullish flag on the daily charts. This structure has now completed a textbook pole-and-flag formation. A breakout above the Rs 1,195–1,205 zone will confirm strength and likely propel the stock toward Rs 1,450 levels.

Volumes during the pole were high, while consolidation saw dried-up volumes, which is an ideal flag characteristic. A strong volume breakout above resistance will be key for momentum. With indicators cooled off during consolidation, AGI Infra is well-positioned for an impulsive upmove once the breakout materializes.

Strategy: Buy

Target: Rs 1,450

Stop-Loss: Rs 1,120

Venus Pipes and Tubes | CMP: Rs 1,396.2

Venus Pipes is forming a 33-day Cup and Handle pattern, indicating potential momentum buildup in the sector, as other pipe companies are also showing strength. The stock is resting on its short-term moving averages (10 and 20), both of which have turned bullish and can act as a propeller for further upside. A breakout above Rs 1,405 with strong volumes will confirm the pattern and open the way for an immediate rally toward Rs 1,600 levels. Structure, moving averages, and sectoral momentum remain aligned for a bullish move, making Venus Pipes an interesting candidate on breakout.

Strategy: Buy

Target: Rs 1,600

Stop-Loss: Rs 1,300

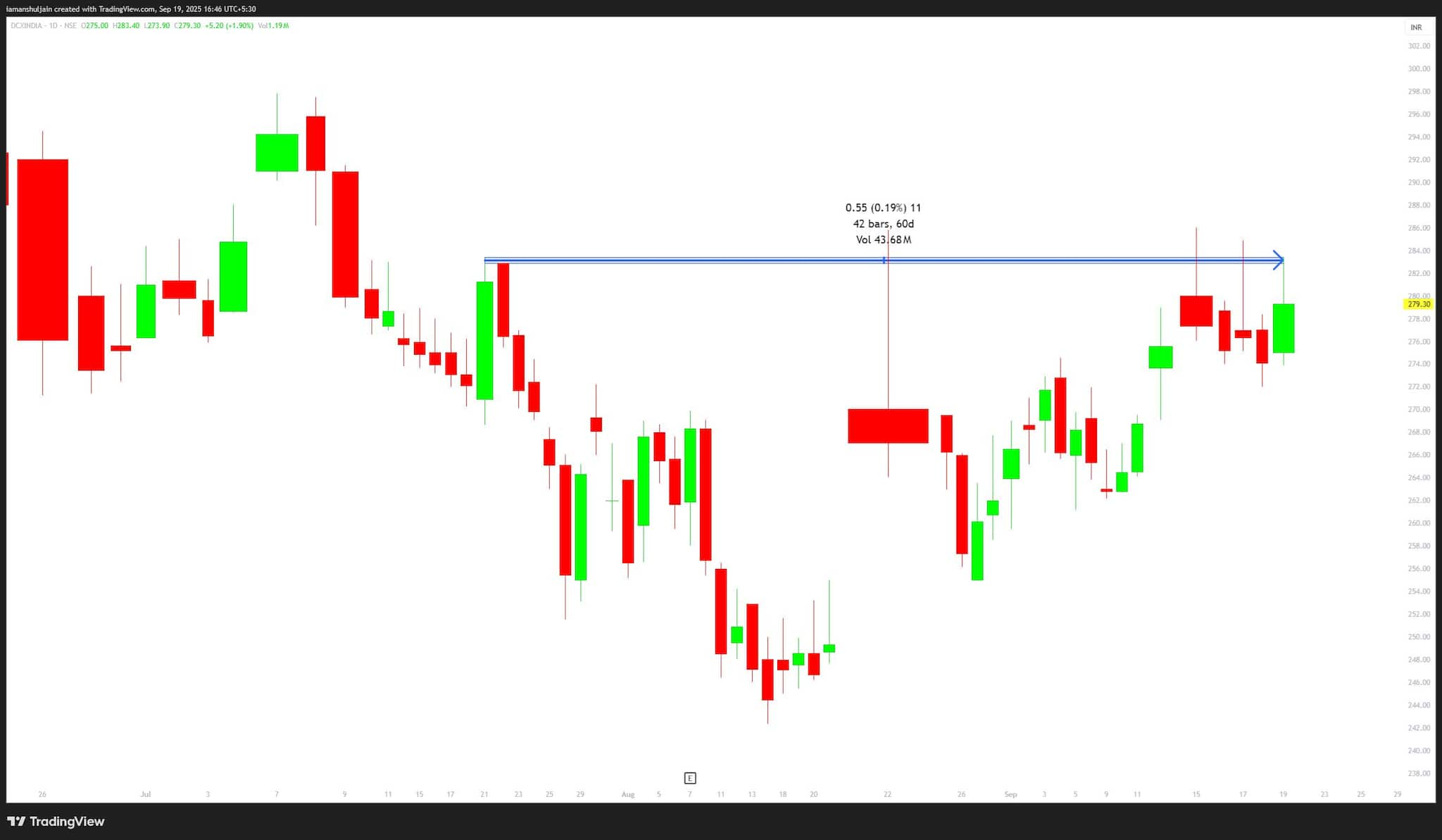

DCX Systems | CMP: Rs 279.3

DCX India, after posting strong earnings and a bullish gap-up, has been consolidating for 42 days while forming a Cup and Handle pattern. The volume behaviour is ideal, with higher volumes on up moves and dried-up volumes during consolidation, indicating accumulation. The stock is currently testing the neckline of the pattern, and a sustained move above Rs 284 will invite momentum buying. A close above Rs 290 will confirm a decisive breakout and set the stage for a strong rally ahead. With consolidation almost complete, price action and structure favour an imminent bullish breakout.

Strategy: Buy

Target: Rs 340

Stop-Loss: Rs 260

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!