Bears tightened control on Dalal Street as Indian markets ended lower for the third consecutive session on September 6, with Nifty falling near 24,800 while the Sensex broke the 81,000 mark. At close, the Sensex was down 1,017.23 points or 1.24 percent at 81,183.93, and the Nifty was down 292.95 points or 1.17 percent at 24,852.15.

All eyes are on the upcoming mid-September FOMC meeting, with expectations of a rate cut, likely influenced by U.S. employment data. Domestically, investors will monitor the rupee's movement against the dollar, crude oil prices, and the investment activity of FPIs and DIIs. Geopolitical shifts and crude oil prices will also be among the key factors influencing market trends.

Osho Krishan, Senior Analyst - Technical & Derivative Research, Angel One

AU Small Finance Bank | CMP: Rs 703

It has recently experienced a significant surge from the lows of 600 and soared over 15 percent in the last couple of trading weeks. With the recent developments, the counter has conquered many resilience and has seen a trend reversal. Going ahead, the breakout on the daily chart is likely to trigger bullish traction in the counter. From a technical perspective, the indicators have rebounded from oversold conditions and have displayed a positive crossover, signalling a bullish trend in the stock.

Strategy: BUY around Rs 700

Target: Rs 780

Stop Loss: Rs 660

NESCO | CMP: Rs 995.30

NESCO is in a stellar up move, hovering in a cycle of higher highs – higher lows on all the time frame charts. In the recent session, the counter has showcased a decisive spurt in price and volumes, suggesting the continuation of the uptrend. Also, on the oscillator front, MACD signals a strong momentum, suggesting a potential upside journey into uncharted territory for the counter.

Strategy: BUY around Rs 990-980

Target: Rs 1,090

Stop Loss: Rs 930

Aether Industries | CMP: Rs 935.70

It has demonstrated impressive gains in the recent trading session, which has been backed by robust volumes. Additionally, the counter comfortably hovers above all its significant EMAs on the daily time frame. On the technical front, the counter witnessed a sloping trendline breakout and is likely to ascend in the comparable period. Also, the recent upward momentum has been underpinned by positive crossovers of the moving averages and seems poised to continue its upward move in the comparable period.

Strategy: BUY around Rs 930-920

Target: Rs 1,000

Stop Loss: Rs 870

Nandish Shah, Senior Technical and Derivative Analyst, HDFC Securities

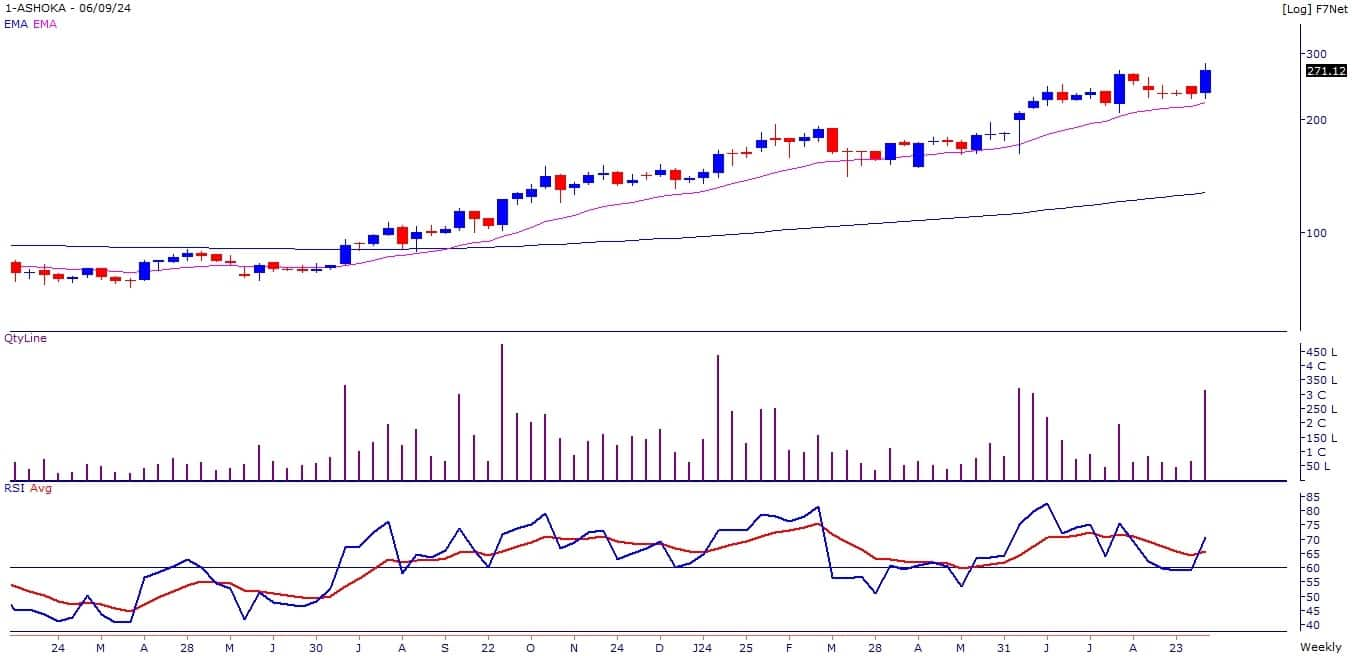

Ashoka Buildcon | CMP: Rs 271

After consolidating for the last few weeks, stock price resumed its uptrend to close at all-time high levels. The price rise is accompanied by a sharp rise in the volumes suggesting strength in the uptrend. Momentum Indicators and Oscillators like MFI and RSI are sloping upwards and placed above 60 on the daily and weekly chart, suggesting strength in the current bullish trend.

Strategy: BUY

Target: Rs 290, 310

Stop-loss: Rs 250

Religare | CMP: Rs 277

Stock price has broken out on the weekly chart from the downward sloping trendline to close at highest level since July 2016. Accumulation is seen in the stocks where up days volumes are higher as compared to down days. Momentum Indicators and Oscillators are showing strength in the current uptrend of the stock.

Stock price has broken out on the weekly chart from the downward sloping trendline to close at highest level since July 2016. Accumulation is seen in the stocks where up days volumes are higher as compared to down days. Momentum Indicators and Oscillators are showing strength in the current uptrend of the stock.

Strategy: BUY

Target: Rs 300, 315

Stop-loss: Rs 255

M&M Finance | CMP: Rs 327

The stock price has broken out from the last few weeks' consolidation to close at the highest level since July 2023 with higher volumes. It has broken out from the downward-sloping trendline adjoining the highs of 07-July-2024 and 28-June-2024 on the weekly chart. The primary trend of the stock remains positive as it is placed above its important long-term moving averages

The stock price has broken out from the last few weeks' consolidation to close at the highest level since July 2023 with higher volumes. It has broken out from the downward-sloping trendline adjoining the highs of 07-July-2024 and 28-June-2024 on the weekly chart. The primary trend of the stock remains positive as it is placed above its important long-term moving averages

Strategy: BUY

Target: Rs 352, 370

Stop-loss: Rs 305

Rajesh Palviya, Senior Vice President Research (Head Technical Derivatives) at Axis Securities

Nectar Lifesciences | CMP: Rs 51

On the weekly time frame, the stock has decisively broken out "Cup & Handle" formation at 48 levels on a closing basis. This breakout is accompanied by a huge volume indicating increased participation. Recently the stock has recaptured its 20, 50, 100 and 200-day SMA and rebounded sharply which reconfirms the bullish trend.

These averages are also inching up along with the price rise which supports bullish momentum. The weekly and monthly "Band Bollinger" buy signal shows increased momentum. The daily, weekly, and monthly strength indicator RSI is in positive terrain which justifies rising strength across all the time frames.

Strategy: BUY, HOLD, ACCUMULATE

Target: Rs 75-85

Stop-loss: Rs 44-37

Pidilite Industries | CMP: Rs 3,238

On the weekly cine chart, the stock has confirmed four four-month "consolidation Range" (3,220-3,030) breakouts indicating strong comebacks of bulls. The stock is in a strong uptrend across all the time frames which shows bullish sentiments.

The stock is well placed above its 20, 50, 100, and 200-day SMA and these averages are also inching up along with price rise which reaffirms the bullish trend. The daily, weekly, and monthly strength indicator RSI is in positive terrain which justifies rising strength across all the time frames.

Strategy: BUY, HOLD, ACCUMULATE

Target: Rs 3,350-3,485

Stop-loss: Rs 3,170-3,135

MCX | CMP: Rs 5,390

The stock is in a strong uptrend across all the time frames which shows bullish sentiments. The stock is well placed above its 20, 50, 100, and 200-day SMA and these averages are also inching up along with price rise which reaffirms the bullish trend. The daily, weekly, and monthly strength indicator RSI is in positive terrain which justifies rising strength across all the time frames.

Strategy: BUY, HOLD, ACCUMULATE

Target: Rs 5,600-5,800

Stop-loss: Rs 5,120-4,848

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!