Indian equity benchmarks maintained their northward momentum for the fourth consecutive day, with the Nifty 50 rising 0.35 percent on June 27. Market breadth remained positive, with approximately 1,448 shares advancing versus 1,162 declining on the NSE. Overall, the trend continues to favour the bulls, although some consolidation may occur following a two-week rally. Below are some short-term trading ideas to consider:

Rajesh Palviya, Senior Vice President Research (Head Technical Derivatives) at Axis Securities

Apollo Hospitals Enterprises | CMP: Rs 7,308.5

With Friday’s gains, Apollo Hospitals Enterprises has decisively surpassed the past couple of months’ multiple resistance zone around Rs 7,185 on a closing basis, indicating further strength. This breakout is accompanied by substantial volumes, signifying increased participation. The daily Bollinger Bands buy signal indicates rising momentum. The stock is well-positioned above its 20-, 50-, 100-, and 200-day SMAs, all of which are also inching up alongside prices—reaffirming the bullish trend. The daily and weekly RSI indicate rising strength.

Strategy: Buy

Target: Rs 7,550, Rs 7,800

Stop-Loss: Rs 7,185

ASK Automotive | CMP: Rs 523.5

ASK Automotive is in a strong uptrend, forming a series of higher tops and bottoms across all timeframes. With the latest weekly close, the stock has decisively broken through its multiple resistance zone at Rs 495 on a closing basis, reflecting bullish sentiment. This breakout is accompanied by strong volumes, indicating increased market participation.

The stock is trading above its 20-, 50-, 100-, and 200-day SMAs, which are all trending upward, further confirming the bullish trend. Daily and weekly Bollinger Bands buy signals show increased momentum, while the RSI across daily, weekly, and monthly charts signals rising strength.

Strategy: Buy

Target: Rs 585, Rs 650

Stop-Loss: Rs 504

IndusInd Bank | CMP: Rs 857.7

On the daily chart, IndusInd Bank has exhibited a short-term trend reversal, trending higher while forming a series of higher tops and bottoms. The stock has confirmed a trendline breakout at Rs 855 on a closing basis, supported by strong volumes that reflect increased participation. It is comfortably positioned above its 20-, 50-, and 100-day SMAs, reinforcing a bullish trend. Both daily and weekly RSI indicators point to rising strength.

Strategy: Buy

Target: Rs 910, Rs 950

Stop-Loss: Rs 830

Rajesh Bhosale, Technical Analyst at Angel One

Ashok Leyland | CMP: Rs 249.73

After four weeks of consolidation, Ashok Leyland saw strong positive traction last week, gaining over 6 percent. Viewed in the context of the rally from its April swing low, the recent consolidation forms a classic Flag and Pole pattern—a strong continuation setup. This suggests that the uptrend is likely to resume in the near term. Supporting this outlook, the RSI has crossed above 70, indicating robust strength behind the move. Hence, we recommend buying the stock around Rs 250–247.

Strategy: Buy

Target: Rs 270

Stop-Loss: Rs 239

Grasim Industries | CMP: Rs 2,861.1

For the past seven months, Grasim Industries had consistently faced resistance around the Rs 2,800 level. However, last week, the stock decisively broke above this key hurdle, confirming a breakout from an Inverse Head and Shoulders pattern. The breakout is backed by a noticeable surge in volume, which adds conviction. Additionally, the RSI has generated a fresh buy crossover with its signal line, and prices are now comfortably trading above all major moving averages—reinforcing the bullish view. We recommend buying Grasim Industries around Rs 2,860–2,850.

Strategy: Buy

Target: Rs 3,050

Stop-Loss: Rs 2,760

Laurus Labs | CMP: Rs 701.8

Laurus Labs has delivered a long-term breakout by surpassing its 2021 high, marking a significant structural shift. In the short term, the trend remains strong, with prices consistently forming higher highs and higher lows. Notably, the volume on up moves has been significantly higher than on down moves, indicating strong participation. Momentum oscillators remain in positive territory, supporting a bullish view. Hence, we recommend buying Laurus Labs around Rs 702–698.

Strategy: Buy

Target: Rs 750

Stop-Loss: Rs 679

Anshul Jain, Head of Research at Lakshmishree Investments

LT Foods | CMP: Rs 483.25

LT Foods broke out of a 176-day Cup-and-Handle pattern at Rs 450 in early June. A sharp post-breakout shakeout briefly dragged prices below Rs 400, flushing out weak longs while preserving the core bullish structure. Since then, the stock has reclaimed its pivot and registered a fresh breakout, reflecting renewed strength.

With weak hands eliminated, the structure is now lighter and well-positioned for a larger up move. Momentum oscillators, having cooled from overbought territory, are now curling higher—suggesting ample room for an extended rally in the coming sessions.

Strategy: Buy

Target: Rs 555

Stop-Loss: Rs 460

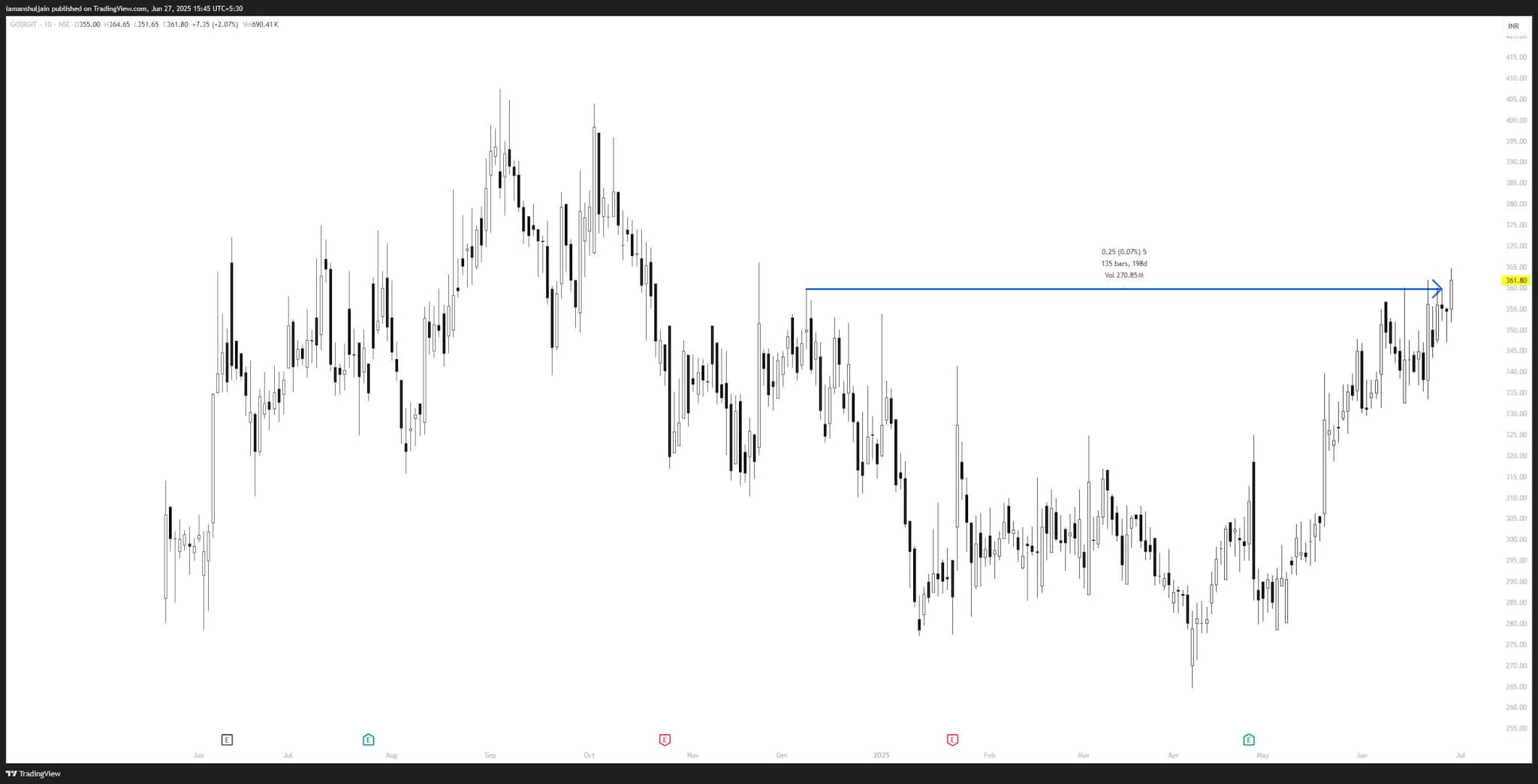

Go Digit General Insurance | CMP: Rs 361.8

Go Digit General has broken out of a 135-day-long Rounding Bottom pattern, with the right shoulder forming a tight 4-inside-bar mini coil—an ideal structure for an explosive follow-through. The breakout has occurred at Rs 360, with immediate support at Rs 330.

While base volumes were relatively low, they were notably accumulative on up candles, indicating quiet accumulation. Momentum indicators are well-aligned and poised to support further gains. With structure, support, and sentiment in sync, the stock appears well-positioned for a sustained upmove in the upcoming sessions.

Strategy: Buy

Target: Rs 450

Stop-Loss: Rs 330

Mahindra and Mahindra | CMP: Rs 3,203.3

The CNX Auto Index is on the verge of a bullish breakout, led by Mahindra & Mahindra, which is forming a 185-day-long Inverse Head and Shoulders pattern. A breach and sustained move above Rs 3,250 will confirm the breakout, potentially opening the path for a swift rally toward Rs 3,700. The volume profile supports this move, and momentum indicators are turning bullish—acting as early signals of an impending breakout. A sector-wide move led by heavyweight names suggests broad participation and strength in the auto space.

Strategy: Buy

Target: Rs 3,500

Stop-Loss: Rs 3,100

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!