The market snapped a two-day losing streak and recovered all its previous day's losses to close above 18,400 level on the Nifty on December 19, backed by positive European peers and short-covering. Most sectors, barring IT and PSU bank, supported the market.

The BSE Sensex rallied 468 points to 61,806, while the Nifty50 rose 151 points to 18,420 and formed a bullish candle on the daily charts.

The positive breadth also boosted broader markets. The Nifty Midcap 100 and Smallcap 100 indices gained half a percent each as about three shares advanced against two declining shares on the NSE.

"On the daily charts, the Nifty formed a bullish candle pattern after the Shooting Star candle formed on Friday's session. However, the Nifty could not cross its previous day’s high and maintained its lower top lower bottom formation indicating the existence of bearish undertone of the index for the short term," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

The momentum indicator RSI is moving around 50 levels, which indicates a lack of momentum in the index.

The Nifty has immediate resistance levels placed at 18,542 (20-day SMA) followed by 18,670 (key resistance) and on the other side, it has a strong support level placed at 18,320 (key support), followed by 18,244 (day's low).

As per the overall price structure and evidence provided by indicators, the market expert feels that the Nifty will move towards 18,133 followed by 17,959 levels. If the Nifty sustains above 18,542 levels, then this corrective view will be negated, he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 18,294, followed by 18,250 and 18,178. If the index moves up, the key resistance levels to watch out for are 18,437 followed by 18,481 and 18,553.

The Nifty Bank also traded higher on December 19, rising 194 points to 43,414 and formed a small-bodied bullish candle on the daily charts but failed to close above the previous day's high.

The important pivot level, which will act as crucial support for the index, is placed at 43,195, followed by 43,114 and 42,984 levels. On the upside, key resistance levels are placed at 43,455 followed by 43,536 & 43,666 levels.

We have seen the maximum Call open interest at 19,000 strike, with 38.28 lakh contracts, which can act as a crucial resistance level in the December series.

This is followed by 18,500 strike, which holds 30.83 lakh contracts, and 18,600 strike, which have more than 26.74 lakh contracts.

Call writing was seen at 18,500 strike, which added 2.6 lakh contracts, followed by 18,600 strike, which added 1.69 lakh contracts, and 18,400 strike which added 1.58 lakh contracts.

Call unwinding was seen at 18,800 strike, which shed 92,600 contracts, followed by 19,600 strike which shed 88,350 contracts and 18,200 strike which shed 51,850 contracts.

We have seen a maximum Put open interest at 18,000 strike, with 42.66 lakh contracts which can act as a crucial support level in the December series.

This is followed by 18,300 strike, which holds 39.17 lakh contracts, and 17,500 strike, which has accumulated 31.3 lakh contracts.

Put writing was seen at 18,300 strike, which added 7.43 lakh contracts, followed by 18,400 strike, which added 6.28 lakh contracts and 18,200 strike which added 2.62 lakh contracts.

Put unwinding was seen at 17,700 strike, which shed 1.99 lakh contracts, followed by 18,700 strike which shed 1.63 lakh contracts, and 18,800 strike which shed 1.57 lakh contracts.

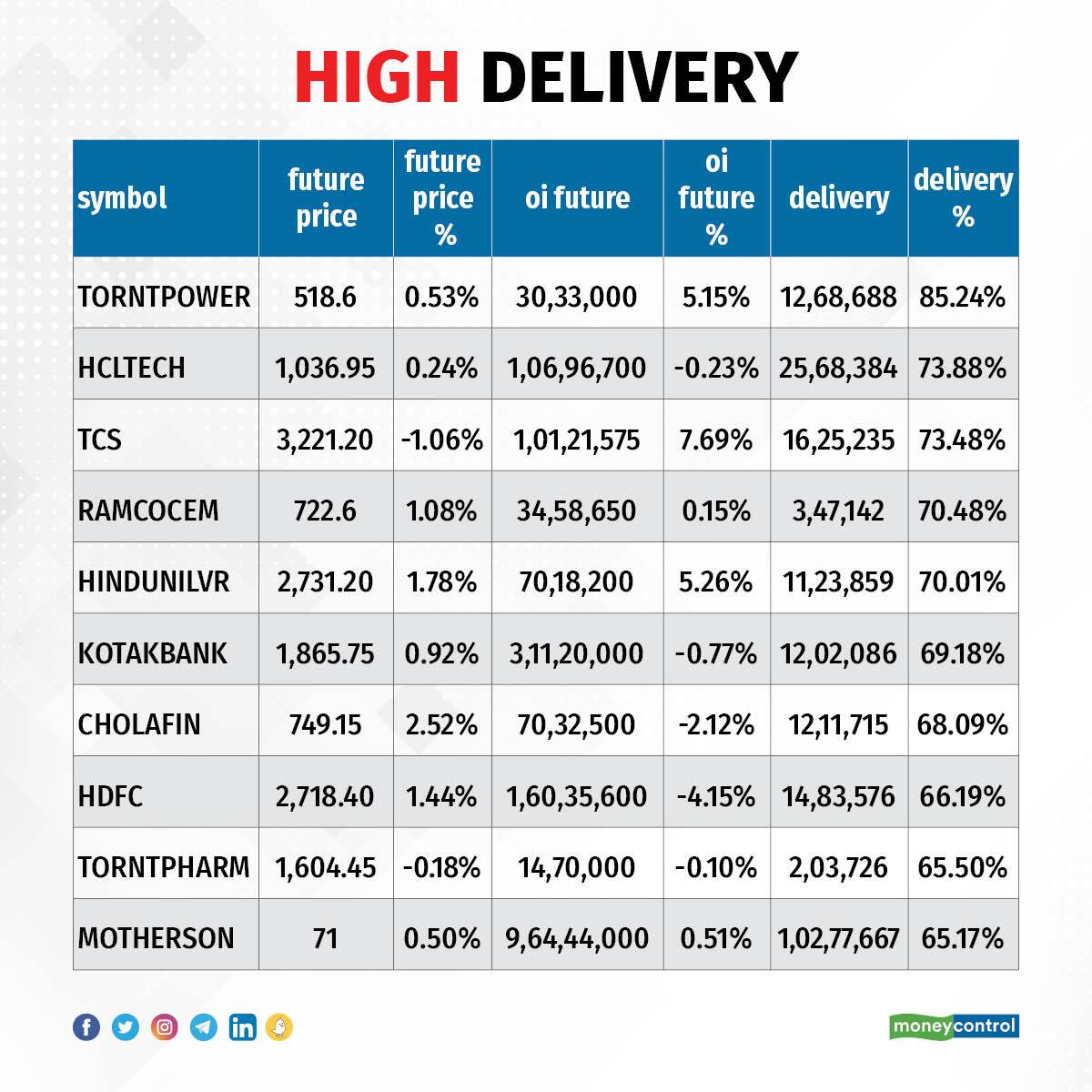

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in Torrent Power, HCL Technologies, TCS, Ramco Cements, and Hindustan Unilever, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, we have seen a long build-up in 90 stocks on Monday, including Nifty Financial, Britannia Industries, Muthoot Finance, Escorts, and Bank Nifty.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, nine stocks have seen a long unwinding on Monday including Balrampur Chini Mills, Punjab National Bank, Coforge, Polycab India, and Tata Chemicals.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, we have seen a short build-up in 27 stocks on Monday including Chambal Fertilizers, Tata Consultancy Services, Aarti Industries, Wipro, and Lupin.

68 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, we have 68 stocks on the short-covering list on Monday including Colgate Palmolive, Eicher Motors, IndiaMART InterMESH, HDFC, and PVR.

(For more bulk deals, click here)

Investors Meetings on December 20

UltraTech Cement: Officials of the company will interact with Fidelity Investments and Franklin Templeton Investments.

VST Tillers Tractors: Officials of the company will meet a group of investors.

Cigniti Technologies: Officials of the company will meet a group of investors.

Tata Chemicals: Officials of the company will interact with Pinpoint Asset Management.

Isgec Heavy Engineering: Officials of the company will interact with Banyan Capital Advisors LLP.

PPAP Automotive: Officials of the company will meet Money Roller, Valentis Advisors, AV Fincorp, and Kriis Portfolio.

Polycab India: Officials of the company will interact with Amiral Gestion.

Maharashtra Seamless: Officials of the company will interact with Ratnabali Securities, ICRA, and Saket Kapoor.

EKI Energy Services: Officials of the company will interact with InCred Asset Management, and SPARX Asia Investment Advisors.

Indian Energy Exchange: Officials of the company will interact with Ardeko (Investment and Wealth Advisor).

Sapphire Foods India: Officials of the company will meet Hara Global Capital Management, Millennium Capital, and Prabhudas Lilladher.

Stocks in News

NBCC India: The company has received contract for the construction of a new multi-storied quarter complex from Odisha Power Transmission Corporation. The company will construct 100 numbers of quarters by demolishing the existing 224 numbers quarters at Bhoinager, Bhubaneswar. The order value is Rs 69.3 crore.

Housing Development Finance Corporation: HDFC increased its retail prime lending rate on housing loans by 35 basis points, with effect from December 20. Its adjustable rate home loans (ARHL) are benchmarked on retail prime lending rate.

IRCTC: Life Insurance Corporation of India has bought an additional 2.27 percent stake in IRCTC between October 17 and December 16 this year via open market transactions. With this, LIC's shareholding in IRCTC increased to 7.278 percent, from 5.005 percent earlier.

Sterling and Wilson Renewable Energy: Promoter Khurshed Yazdi Daruvala will be selling up to 20.28 lakh shares (1.07 percent stake) in the company on December 20-21 via an offer for sale. It also has an option to additionally sell up to 9.71 lakh shares (0.51 percent) in case of oversubscription of OFS issue. Another promoter Shapoorji Pallonji and Company will also sell 47.33 lakh shares (2.50 percent) in Sterling, with an option to additionally sell up to 22.66 lakh shares (1.19 percent) via OFS. The floor price of the offer will be Rs 270 per share.

Ipca Laboratories: The company has acquired an additional 6.53 percent stake in Trophic Wellness (TWPL). TWPL is engaged in manufacturing and marketing several SKUs of neutraceuticals under the brand name Nutricharge. With the above shares, the company now holds 58.88 percent shareholding in TWPL.

Dabur India: Promoters are likely to sell shares worth Rs 800 crore via block deals on December 20, and the block deals are likely at 4 percent discount to the current market price of Rs 589 per share, reports CNBC-Awaaz.

Vikas Lifecare: Material subsidiary Genesis Gas Solutions has received the technical advisory contract from Dornier Group GmbH. Genesis will provide technical advisory for the optimisation of battery storage systems for distribution grid applications for Dornier Group's ongoing project in Mali, Africa.

Fund Flow

Foreign institutional investors (FIIs) have net-sold shares worth Rs 538.10 crore, while domestic institutional investors (DIIs) net-purchased shares worth Rs 687.38 crore on December 19, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has retained Balrampur Chini Mills, IRCTC, Punjab National Bank, Indiabulls Housing Finance, BHEL, Delta Corp, and GNFC under its F&O ban list for December 20. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.